Fortune News | Aug 22,2020

Apr 8 , 2023

By Yonnas Kifle (PhD)

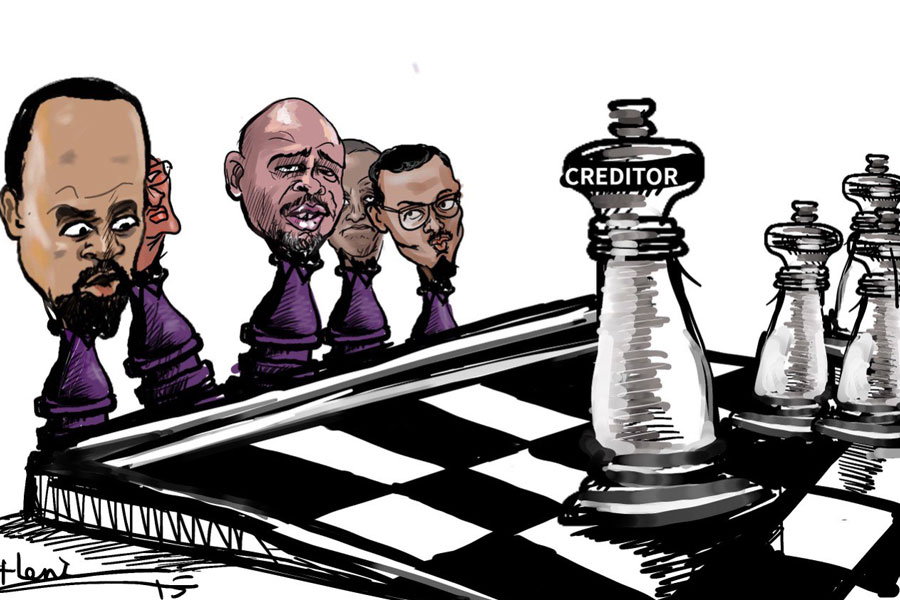

Ethiopia, a country with a diverse cultural and natural heritage, is grappling with a growing external debt burden that stood at 27 billion dollars in 2022, constituting over 23pc of its gross domestic product (GDP). Projections show that between 2023 and 2027, its national debt will rise by a staggering 82.4 billion dollars, reaching an estimated 134.65 billion dollars within five years.

This dire situation calls for a strategic response from the Ethiopian government, which must navigate the complexities of debt relief negotiations with its creditors, including the International Monetary Fund (IMF).

However, securing debt relief from the IMF often entails agreeing to policy recommendations that may prove to be double-edged swords.

The IMF might insist on fiscal consolidation measures, structural reforms, and changes to monetary policy, including interest and exchange rates. It may demand that the Ethiopian government implements spending cuts to social programs and adopts stringent austerity measures, asserting that such steps foster macroeconomic balances and long-term economic stability.

Notwithstanding these challenges, Ethiopia's negotiating strategy must prioritise the welfare of its citizens.

As the renowned economist John Maynard Keynes once observed, "in the long run, we are all dead." Consequently, the government's primary obligation should be to provide robust social safety nets, ensure public safety, protect individual rights, and expand access to education for all its people. Balancing these immediate imperatives with long-term sustainable economic development and addressing the external debt burden is crucial.

Ethiopia's negotiating team must ground its arguments in the country's unique needs and challenges to build a compelling case for debt relief. In addition to securing debt relief, the government must guarantee that borrowed funds are allocated to targeted projects without being misappropriated or used to support the lavish lifestyles of high-ranking officials, thereby ensuring tangible benefits for the populace.

Alongside fiscal responsibility, maintaining political stability and internal security is essential for safeguarding the rights of Ethiopians to live and work anywhere within the country without fear of displacement.

Ethiopia's rich human and natural resources can be harnessed to propel economic growth. The country boasts fertile arable land, minerals and precious metals, natural forests, and abundant water resources. By investing in education and training, Ethiopia can develop a skilled workforce capable of contributing to more advanced industries and products, fostering long-term sustainable economic growth.

The government can mobilise skilled Ethiopians to construct renewable power plants, transportation networks, and irrigation systems. These infrastructural developments can improve Ethiopians' quality of life and attract foreign investment, generating the export earnings necessary for servicing and repaying the country's external debt.

As Ethiopia's negotiating team seeks debt relief, it must formulate clear negotiation positions and goals. If need be, the team should not shy away from threatening to default on debt payments rather than subjecting its citizens to the extreme poverty that IMF-prescribed austerity measures could entail. Building alliances with other countries and organisations to bolster Ethiopia's negotiating stance is equally vital.

Given the country's wealth of resources and dynamic population, the Ethiopian government must prioritise the well-being of its people over the demands of IMF economists. Economic reform and sustainable growth should be pursued while preserving the safety and security of the populace and harnessing the country's resources. By adopting this approach, Ethiopia can overcome its external debt challenges and chart a course toward a brighter, more prosperous future for its citizens.

PUBLISHED ON

Apr 08,2023 [ VOL

24 , NO

1197]

Fortune News | Aug 22,2020

International Stories | Apr 16,2020

Commentaries | Sep 20,2025

Editorial | Apr 15,2023

My Opinion | Apr 17,2021

Fortune News | Jun 08,2019

Viewpoints | Apr 13,2019

Radar | Feb 22,2020

Fortune News | May 20,2023

Sunday with Eden | May 13,2023

Photo Gallery | 174093 Views | May 06,2019

Photo Gallery | 164314 Views | Apr 26,2019

Photo Gallery | 154432 Views | Oct 06,2021

My Opinion | 136621 Views | Aug 14,2021

Editorial | Oct 11,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Oct 12 , 2025

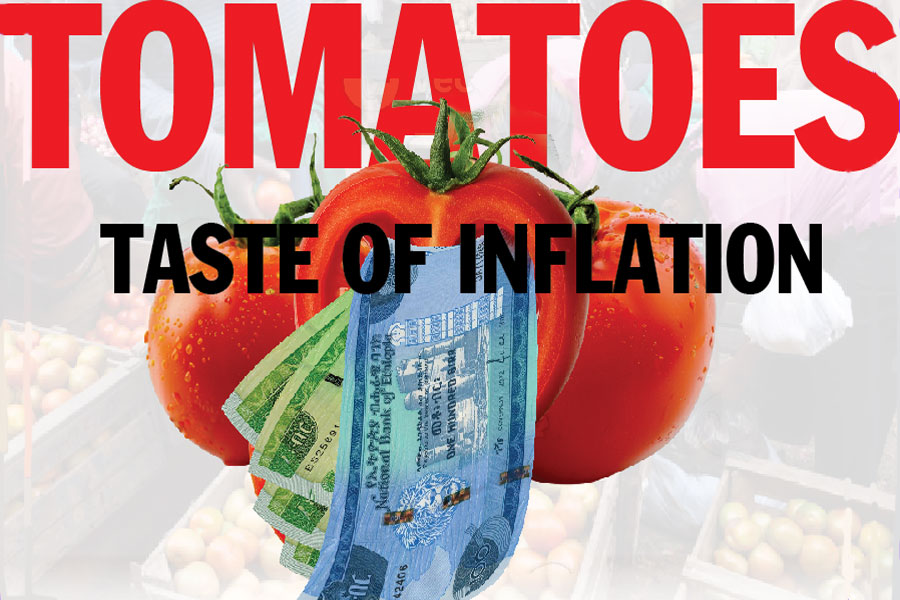

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

Oct 12 , 2025 . By NAHOM AYELE

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...