In-Picture | Jul 06,2025

May 27 , 2023

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Meqelle is in an animated bid to reclaim control of the management of companies under the Endowment Fund for Rehabilitation of Tigray (EFFORT), a conglomerate housing 31 companies.

EFFORT’s Board seeks dominion from the state-owned Commercial Nominees, its imposed custodian after war broke out in Tigray Regional State. The move, directors say, is driven by mounting fees and the strain of managing its operations under the caretaker’s supervision.

For legal experts, the case represents a significant example of the tensions that can arise when political and business interests intersect, especially in situations involving war and conflicts as well as their subsequent resolutions. They see the story of EFFORT unfolds as it offers lessons in managing large-scale, state-involved corporate entities amid political turmoil.

Beyene Mikeru, CEO of EFFORT, dispatched a formal petition last month to the Ministry of Justice, urging the Ministry to reinstate the company’s status. He cited the recent peace accord signed between the federal government and the TPLF as a spur for normalized relations, which, he believes, should provide the impetus for EFFORT to manage companies under its portfolio.

A ruling in April of the previous year by the Federal High Court presided over by judges Genenew Assefa, Abdu Ibrahim, and Hawi Osana, had designated caretaker responsibilities to Commercial Nominees. This came during a bloody civil war in the Northern region of Ethiopia in November 2020.

Beyene has pleased officials of the Ministry to dispatch a reinstatement letter to the High Court, providing EFFORT with the right to access its accounts and handle its financial matters without hindrance. His plea comes a month after the Ministry put on hold pending lawsuits against the civil and military leaders in Tigray, marking the progressive implementation of the Pretoria peace deal signed in November 2022.

EFFORT came into being in 1995 as a public endowment company, aspiring to revitalize the regional state’s war-torn economy and promote the region’s industrialisation. Initially, a 25-members council chaired by Tewolde Weldemariam, then vice chairman of the TPLF, installed a board of directors led by Seyee Abraha and included Sebhat Nega and Abadi Zemo. Launched with a 2.7 billion Br investment, the conglomerate entered into a mix of interests from mining, construction and agriculture to transportation and textile sectors.

Its pioneering companies were clustered in five sectors of mining (under Tedros Hagos), industry (Abadi Zemo), finance and trade (Sebhat Nega), construction and transport (Arkebe Oqubay) as well as agriculture (Tsegaye Taimyallew). However, some companies predate EFFORT’s formation, such as Mesebo Building Materials Construction Plc, incorporated with 60 million Br capital registered under five senior members of the TPLF.

It was restructured two years later with 240 million Br capital where EFFORT took control of the majority shares, along with minority shareholders such as Meskerem Investment Plc, Sur Construction S.C., Trasn-Ethiopia (Transport) S.C. and Abadi Zemo.

So were Mesfin Industrial Engineering, Meskrem Investment, Almeda Textile, Sur Construction, Sheba Tannery, Addis Pharmaceuticals, Guna Trading, Trans-Ethiopia, and Hiwot Agricultural Mechanisation went into similar restructuring in the mid-1990s, their individual founding shareholders giving way a network of companies. In the late 2010s, its corporate governance was transferred to the regional state's regulatory bodies as the companies and their assets were made publically owned.

EFFORT’s portfolio houses several industry titans. One such company is Sur Construction, a first-grade contractor entrusted with multiple significant projects before the war.

When it was first incorporated with a 100 million Br registered capital, its founding shareholders in 1992 were Yelem Seyoum, Kahsay Weldemichael, Yemane Tewelde, Tadesse Debelu and Medhin Kiros. In August 1995, they transferred 96pc of the share to EFFORT, with the remaining distributed among Berehan Building Construction, Mesebo and Meskerem Investment. Arekebe had received one share with a 1,000 Br par value to serve the board as a chairman.

Zenfu Asfaw, its current managing director, said that the protracted war has resulted in the company losing 85pc of its machinery to looting, damage, or abandonment. He told Fortune that the management caretaker company has become a barrier to accessing Sur’s accounts. Zenfu alleged that the caretaker company has become a tie-up for their operations and claimed the service fees by Commercial Nominees are exorbitant.

The now-defunct Construction & Business Bank established Commercial Nominees three decades before EFFORT’s inception. The company was formed to provide various services, including management services, employee benefit funds, real estate administration, and representing international money transfer services. Today, the company boasts over 43,000 employees across 33 branches.

Its CEO, Tilahun Tesagye, asserts that the concerns raised by EFFORT’s management about high management fees and reclaiming management are issues that lie beyond their purview, as standing Judges order binds them. The fees charged are significantly lower than the initially proposed, Tilahun said in response to the allegations of high service fees.

Commercial Nominees’ responsibilities include settling EFFORT companies’ liabilities, renewing their licenses, authorising pending payments, and managing debt. Only a few of the companies were within reach for effective management due to the war, Tilahun told Fortune.

Managers of Guna Trading, another enterprise within EFFORT’s fold, alleged that the caretaker company has hindered the company’s recovery efforts.

Guna Trading HouseS.C. was first incorporated in 1992 with a 4.5 million Br capital registered under Girmay Gebremedihin, Gidey Gebremichael, Hibur Gebrekidan, Solomon Gebrehiwot, and Tsegaye Taimyallew, all TPLF leaders at the time. Three years later, the company increased its capital to 10 million Br, with EFFORT acquiring 97pc of the shares, with Almeda Textile, Trans-Ethiopia and Mesebo taking the remaining from the founding shareholders. Sebehat Nega was appointed board chairman, although he had owned one share worth 1,000 Br.

Hagos Kidan, its current CEO, revealed that the company has suffered a colossal loss of 600 million Br due to the war. The company could not pay its 540 employees during the two-year wartime, Kidan revealed.

“We’re rationing basic goods in our inventory to our employees during the war,” he told Fortune.

Managers of Sur Construction and Guna Trading have independently lodged their petitions with the Ministry of Justice seeking the reinstitution of their respective management, showing a strong desire to reclaim the companies` governance.

Fikadu Tesaga, the state minister for Justice, while unaware of the specific letter sent by Beyene, did not dismiss the probability of EFFORT regaining its status.

“It’s actually inevitable,” he told Fortune.

Arba Beyene, a legal expert, concures. He believes the initial decision to assign a caretaker management to EFFORT was essentially political, with little bearing on the practicalities of the situation. He argued that Commercial Nominees were tasked with caretaking duties without acquiring the conglomerate’s assets; the reinstatement of EFFORT’s rights was a foregone conclusion. According to him, the caretaker company has the legitimate right to invoice for any additional fees incurred while performing its court-ordered duties.

PUBLISHED ON

May 27,2023 [ VOL

24 , NO

1204]

In-Picture | Jul 06,2025

View From Arada | Mar 01,2024

Radar | Aug 13,2022

Radar | Feb 24,2024

Fortune News | Mar 02,2024

Agenda | Nov 20,2021

Editorial | May 24,2025

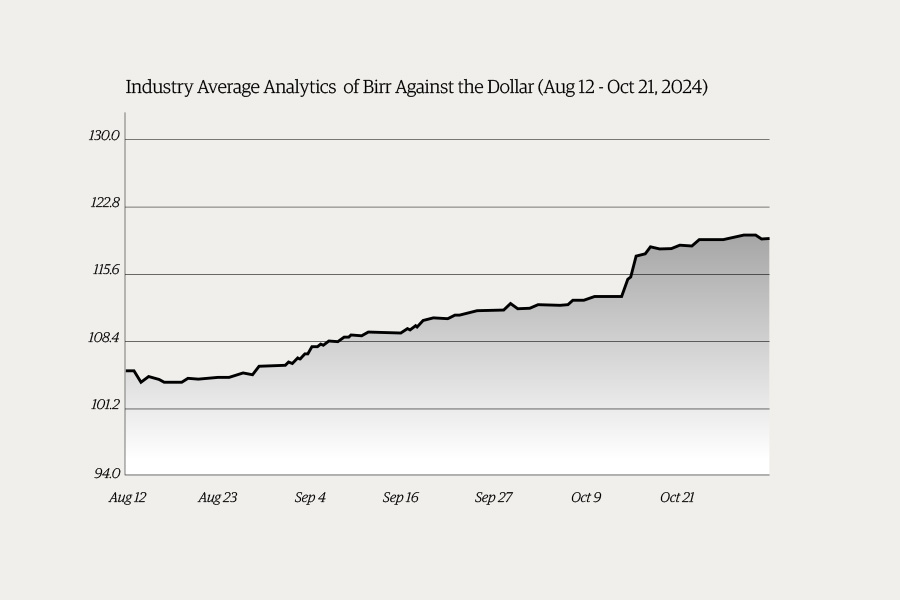

Money Market Watch | Nov 03,2024

Viewpoints | Apr 10,2023

Fortune News | Nov 03,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...