Aug 26 , 2023

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

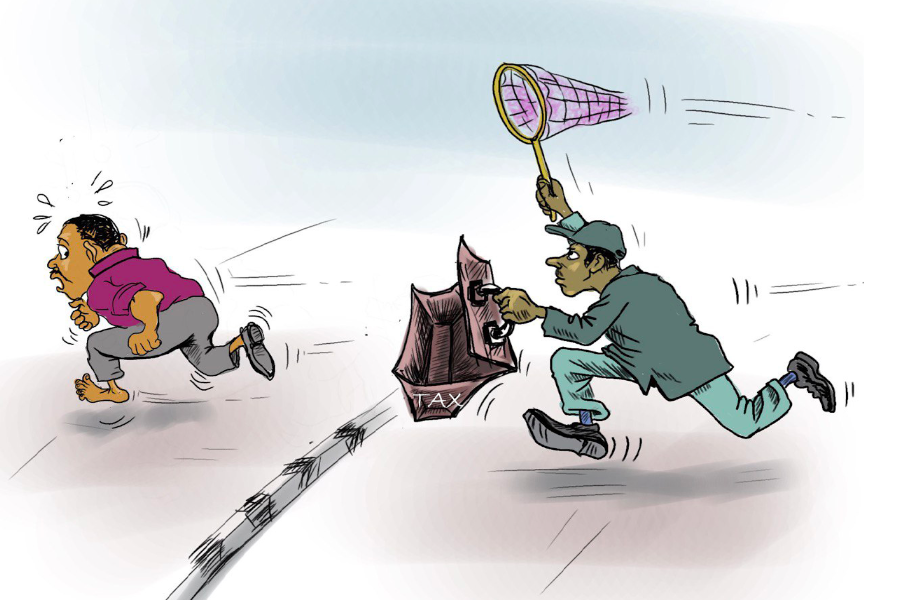

Lawyers are receiving the budget year with a sigh of relief as they are met with a notice that recognises their expenses incurred for generating income to be curtailed from income tax as they submit their annual accounting costs to tax authorities.

The letter signed by the State Minister for Finance Eyob Tekalign (PhD) allows them to present the miscellaneous costs while they are on duty to be deducted from the probable income tax.

It is a response to the Ethiopian Federal Advocates' Association's plea that had been a concern for several years.

A year ago, the Association submitted the 87-page recommendation while a couple of workshops with policymakers unfolded before the decision.

"We've pleaded with officials at the Ministry several times to end the decade-long controversy," said Tewodros Getachew, acting president of the Association.

Although he is hopeful, Tewodros disclosed the reverberations will be highlighted in the coming tax period.

Under the City Administration Revenue Bureau, over 400,000 taxpayers with categories A, B, and C based on their annual turnover, declare taxes from July to October.

With 5,200 members under its fleet, the Association requested a meeting after the decision to go over its implementation. But the Bureau Communications Head Endale Kebede confirmed that they have started to apply the rule.

Lawyers are apprehensive over the accounting costs as they claim to have high costs for fuel, telephone, parking and travel due to the nature of their work which requires a commute to several places.

Fikadu Petros, co-founder of Fikadu Petros & Partners LLP has mixed feelings about the decision.

He applauded the officials for recognising a significant problem for taxpaying lawyers. However, he believes the unique features of law firms co-founded by multiple partners and how their income tax is treated remain unaddressed.

"Partners are both employers and employees," he told Fortune.

He established the firm on one million Birr capital with two partners two months ago. Fikadu indicated that the letter falls short in addressing the ended-year taxes where several lawyers were met with rejection while submitting their costs.

"They may not have kept their records," he said, suggesting treatment on presumptive cost calculation for the ended year and beginning the implementation for the next tax season.

The Association has been working jointly with the Ministry of Finance to draft regulations and directives for sustainable changes during the tax declaration period.

According to Habtamu Mensha, a legal advisor at the Ministry, the lawyer's overhead costs were not considered as expenses for lack of a trade license. He said that Category A and B taxpayers are legally required to keep their costs which now apply to lawyers.

However, he observed that in the last couple of years, they were not keeping their accounts properly.

"A sizeable portion was left undeclared," said Habtamu.

With the intention of vying for the law as an absolute rule, lawyers were not treated as business entities and operated with a license issued by the Ministry of Justice.

This does not roll off the tongue for Araba Beyene who formerly served as a tax law expert at the Ministry of Revenues. He indicated that people who make money out of a business should be treated similarly while avoiding confusion on the tax declaration.

"It's the feasible approach," he said.

PUBLISHED ON

Aug 26,2023 [ VOL

24 , NO

1217]

Commentaries | Oct 16,2024

Editorial | Nov 23,2024

Fortune News | Oct 12,2025

Fortune News | Jan 05,2019

Radar | Oct 08,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...