Mar 2 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

Tsehay Insurance, one of the youngest insurers, has reported a positive performance for the third year in a row due to robust income growth.

During the last fiscal year, the firm’s after-tax profit rose by 26pc to 29.5 million Br, leading its earnings per share (EPS) to register a two Birr increase to 37 Br.

The management of Tsehay should take credit for the impressive performance, according to Abdulmenan Mohammed, a financial statement analyst.

The success of the company came despite challenges it faced, according to Mandefro Erkou, board chairperson of the insurer that was established in 2012 and currently has 19 branches, representing 3.5pc of 532 branches held by the insurance industry.

“Despite the growing bargaining power of customers, national political unrest that engulfed the nation and economic instability, the firm managed to achieve an encouraging performance,” said Mandefro.

The positive performance of the firm is driven by expansion in all income items. Underwriting surplus increased by 16pc to 25.6 million Br due to an increase in written premiums that reached 285.7 million Br.

Tsehay managed to retain 79.2pc of the premiums, nearly a percentage point increase from the previous fiscal year.

“The level of retention at Tsehay is reasonable,” said Abdulmenan.

There was an increase in claims and other technical provisions against Tsehay where the firm paid out 146.2 million Br, increasing almost by half from the preceding year.

This demonstrates Tsehay underwrote insurance policies for high-risk clients, according to Abdulmenan. “The management of Tsehay should have a system that screens high-risk clients,” he said.

The business environment in the country has led the firm to have high-risk clients, according to Kassa Lisanework, CEO of Tsehay.

“Due to the business slowdown in the country, there was no business coming from non-motor businesses, and even those non-motor businesses we insured had low premium rates,” said Kassa.

In the last fiscal year, 70pc of the insurance portfolio of the firm was motor insurance, according to the CEO.

"As the price of spare parts has increased, our expenses on motor claims have soared," Kassa told Fortune.

Commissions paid to agents have increased to 20.8 million Br, up by 28pc, slightly higher growth than the written premium growth rate.

Tsehay did well in its investment activities. Interest and dividend income soared by 45pc to 26.9 million Br due to increased investments in interest-earning deposits.

Out of the total 497.1 million Br in assets, Tsehay has invested 48.3pc in shares and time deposits.

The surge in income, however, was accompanied by a rise in expenses. Tsehay spent 21.7 million Br on staff and general administration, an increase of 45pc. The direct expenses of Teshay have gone up by 34pc to 20 million Br.

“The growth in expenses of Tsehay is considerable, therefore, the management should set up a cost control mechanism to keep expenses at bay,” said Abdulmenan.

“Considering our growth in branch expansion and staff recruitment, we were good at controlling expenses,” Kassa told Fortune.

The firm’s total assets have soared by 40pc, reaching 497.1 million Br.

Tsehay’s investment in shares and time deposits was 56.5pc of total assets in the preceding year but dwindled to 48.3pc last financial year.

This must have been due to high levels of receivables being held by reinsurers, according to Abdulmenan.

The amount of receivables from reinsurers and shares of technical provisions increased by 126pc to 153.7 million Br.

“Tsehay needs to collect this money and invest it in income generating activities,” Abdulemanan said.

Liquidity analysis indicates that the liquidity level of Tsehay has dropped.

Its cash and bank balances decreased by 88pc to 33.9 million Br. Cash and bank balances to total assets decreased to 6.8pc from 11.6pc.

The ratio of current assets to current liabilities, which is an indicator of Tsehay’s ability to pay short term obligations, decreased to 150pc from 170pc.

Despite the reduction, Tsehay is in a good condition to fulfill its short-term obligations, according to Abdulmenan.

The paid-up capital of Tsehay has also increased by 17pc to 87.3 million Br. The capital and non-distributable reserves of Tsehay account for 19.3pc of total assets, making the firm one of the well-capitalised insurance companies.

The total capital of the insurance industry has reached 5.5 billion Br, of which three-fourths of it was held by private insurance companies.

PUBLISHED ON

Mar 02,2019 [ VOL

19 , NO

983]

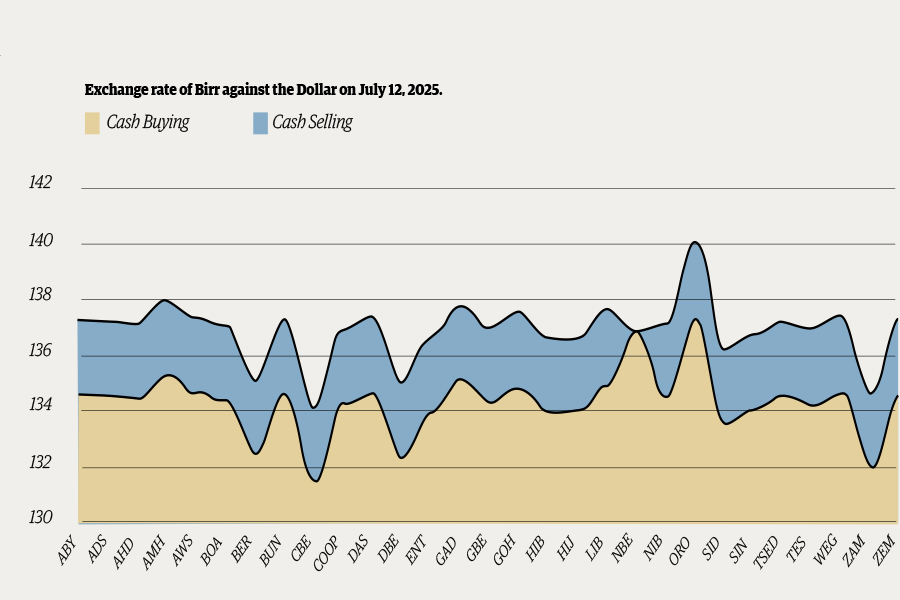

Money Market Watch | Jul 13,2025

Fortune News | Jan 12,2019

Radar | Aug 21,2021

Viewpoints | Apr 24,2021

Fortune News | Aug 13,2022

News Analysis | Nov 25,2023

Fortune News | Mar 06,2021

Radar | Apr 10,2021

Fortune News | Dec 19,2021

Fortune News | Mar 02,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...