Fortune News | Mar 18,2023

Sep 10 , 2023

By Mahmoud Mohieldin , Bogolo Kenewendo and Reuben Wambui

Climate finance is inefficient, insufficient, and unfair. With debt levels and borrowing costs soaring, climate action must be funded through more equity investments and concessional financing. That means focusing on the needs of African countries, which are disproportionately vulnerable to climate change, despite contributing the least to creating the problem, in creating and implementing green-finance tools.

The sooner leaders of advanced economies and international organizations understand what Africa needs to achieve a just energy transition and provide the required financing and technology transfers, the greater the chance that the world will reach net-zero emissions by 2050. This week, Kenya is hosting the inaugural Africa Climate Summit and Africa Climate Week to increase commitments and pledges to support climate adaptation efforts and scale up renewable energy on the continent. That makes this an opportune time for governments, the private sector, and multilateral lenders to begin removing the systemic barriers to investment and development in African countries.

To meet the Paris Climate Agreement’s emissions targets, Africa will need 2.8 trillion dollars by 2030 – roughly equal to 93pc of the continent’s GDP. But, with the continent’s combined public debt reaching 1.8 trillion dollars in 2022, many African countries lack the fiscal space to mobilise domestic resources. International investors should fill this gap by providing financing and technology transfers that will help build capacity and develop local industry, rather than merely continuing to exploit the continent’s natural resources.

To that end, starting in Kenya this week and leading up to the United Nations Climate Change Conference (COP28) in Dubai in November and December, governments and financiers must begin implementing five critical reforms to ensure that Africa’s funding needs are met.

Lenders must offer more concessional finance to emerging markets and developing economies (EMDEs). The World Bank and regional multilateral development banks (MDBs), supported by the climate-finance contributions of advanced economies, should provide loans to low- and low-middle-income countries at an interest rate of one per cent and with a 10-year grace period and a 20-year repayment term for initiatives that boost climate resilience. Lending mechanisms such as the World Bank’s International Development Association, traditionally available only to low-income countries, should be extended to low-middle-income countries, and adopted by various multilateral institutions.

Governments and development agencies should also establish large and flexible pools of concessional capital earmarked for climate projects. And they should explore new avenues for international taxation to provide grants, rather than loans, when traditional private or public funding falls short.

Multilateral financial institutions can implement credit enhancement and guarantee schemes to incentivize private-sector participation. Such assurances would mitigate project risks and bolster investor confidence, attracting much-needed private capital to Africa.

Creditors, including in the G20, must provide debt relief to low- and middle-income countries. Given that around 60pc of low-income countries are in or at high risk of debt distress, suspending debt payments or, even better, cancelling debts would significantly improve their ability to respond to the damaging effects of global warming. These institutions need to implement Climate Resilient Clauses in loan contracts for poorer countries, which the World Bank announced this year. Moreover, debt-for-nature and debt-for-climate swaps could enable recipient countries to repay their debts by investing in biodiversity protection and climate action.

Building on its recent efforts to provide 100 billion dollars in special drawing rights (SDRs) to climate-vulnerable countries, the International Monetary Fund (IMF) should allocate an additional 100 billion dollars in paid-in capital and redirect SDRs to MDBs, starting with the African Development Bank this month. This would be in line with the Marrakech Declaration, an initiative to reform the global financial architecture which is being developed at the request of African finance ministers.

A multi-partner fund must be established to help mitigate foreign exchange risks for private investors by providing cost-effective currency and country hedges for climate investments in Africa. Such a fund would significantly reduce the perceived risks of investing in EMDEs, even in the face of currency fluctuations.

Lastly, lenders should support the creation of a facility that accelerates existing projects and programs on the continent, especially those that preserve nature and help communities adapt to extreme weather events such as droughts, floods, and heatwaves. Multiple funders and investment instruments already operating in Africa could set up such a facility, avoiding the cumbersome process of establishing a new fund.

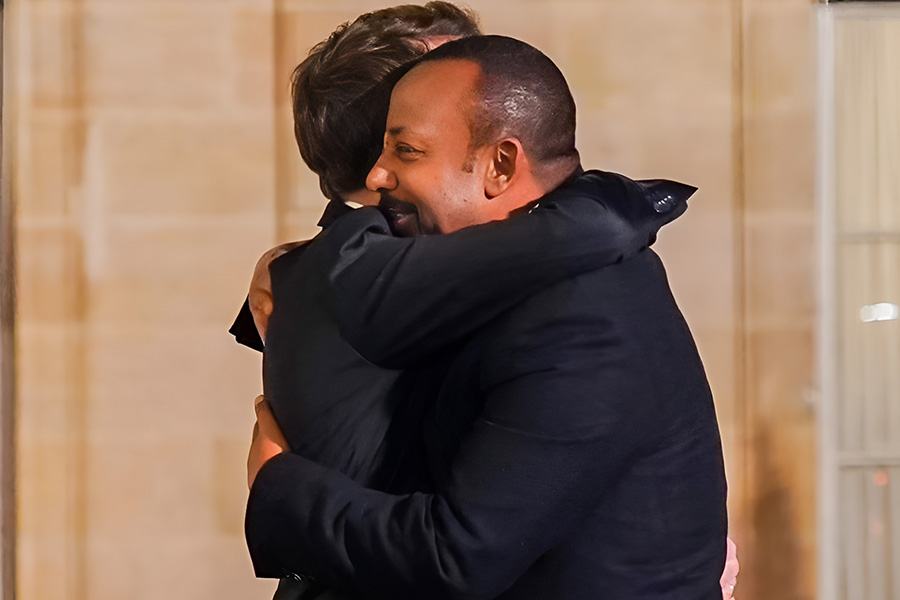

Progress on these five reforms has already been made. At the Summit for a New Global Financing Pact in Paris in June, Senegal secured 2.7 billion dollars from developed countries to invest in renewable energy, and Zambia struck a deal to restructure 6.3 billion dollars in debt. Meanwhile, the African Risk Capacity Group, which offers parametric insurance against natural disasters, has provided 720 million dollars in coverage for 72 million people since 2014.

We can substantially increase such assistance by quickly putting money into the Loss and Damage Fund established at last year’s COP27 climate summit in Egypt. Innovative financing measures will help African countries recover from climate disasters, build resilience to future shocks, and complete the transition to cleaner energy – all of which can bring sustainable development gains.

But the continent needs a dramatic increase in funding to reap the full benefits of climate action.

This article first appears in the Project Syndicate (PS).

PUBLISHED ON

Sep 10,2023 [ VOL

24 , NO

1219]

Fortune News | Mar 18,2023

Fortune News | Feb 11,2023

Fortune News | Apr 20,2019

Fortune News | Feb 10,2024

My Opinion | 131548 Views | Aug 14,2021

My Opinion | 127903 Views | Aug 21,2021

My Opinion | 125879 Views | Sep 10,2021

My Opinion | 123510 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...