Jul 24 , 2021

By Christian Tesfaye

It is the dream of many to own houses. It makes sense. It is one of the few things that make life easier. Primarily, a home is wealth. It can be inherited and is usually a stable keeper of value. Especially in Ethiopia, where property prices appreciate at lightning speed, one can do much worse than own a house.

It is also a very popular policy for governments. They like to push the idea of a nuclear, planned, family, all snug in their homes. To promise people affordable housing is to sell them the idea of stability and security. Billions are poured into the endeavour as a result, without criticism on whether or not it would pay off.

Under its housing program, the Addis Abeba Housing Development & Administration Bureau has thus seen some 300,000 units built for lower and middle-income households since 2013. Not bad. But it had also registered well double that amount, half of which are still waiting. Gradually, delays, politics and the perception of corruption and nepotism has eaten at the interest the houses used to inspire.

The Federal Housing Corporation is better positioned to improve housing in Addis Abeba, albeit not for the lower or even middle classes. In 2019, it announced plans to build 435 housing units for 1.8 billion Br. In another phase, it would be building 11 buildings for 5.2 billion Br. More recently, it launched a project in the Gerji area for around three billion Birr. A unit will sell for an average of six million Birr, not what could be considered affordable housing for an Ethiopian.

It is a great deal more practical than the condominium housing programmes of the City Administration. The Corporation collects rent at market price and plans to sell these houses in the same manner. There is no pretense of scorching billions of Birr for poorly constructed houses in the name of affordable housing.

An even better alternative would be government-backed mortgage loans. There are already private sector players that would like to engage in the sector, from Selam to Goh Betoch banks. Unfortunately, they do not have plans that seem to be practical. It is not advisable to collect short-term deposits to fund long-term lending in housing. Furthermore, lack of formal identification and credit history means that anyone without collateral to offer will be locked out of accessing mortgage deals. These banks may not make a dent in homeownership rates that is any different to the housing loans already provided by conventional banks either.

The government can help by reorienting funding from building houses itself to backing mortgage loans by banks. This is straightforward. Long-term loans are risky; banks are averse to offer them. The government can back these loans, though, in return for banks offering lower interest rates and down payments, and longer grace periods.

It does not stop there. The property market is not rationalised. Brokers exercise too much power, and documentation does not come readily. More importantly, it is nearly impossible to properly assess formal identification for most of the Ethiopian population. The majority does not even have bank accounts, let alone having their incomes and debts accurately accounted for by lenders.

A national identification system will help here by making credit assessment more comprehensive and accurate. It will allow individuals to access loans for houses even if they do not have much collateral. The matter of fluctuating construction sector prices will make interest rates unstable, and low-income households will still lose out. But the public and the private sector working together to help provide affordable housing is a better alternative to condominium housing units financed by the government, as is the case now.

PUBLISHED ON

Jul 24,2021 [ VOL

22 , NO

1108]

Fortune News | Apr 30,2022

Editorial | Jul 18,2020

Sunday with Eden | Apr 06,2024

Fortune News | Jan 09,2021

Agenda | Nov 09,2019

Photo Gallery | 174724 Views | May 06,2019

Photo Gallery | 164946 Views | Apr 26,2019

Photo Gallery | 155182 Views | Oct 06,2021

My Opinion | 136719 Views | Aug 14,2021

Editorial | Oct 11,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Oct 12 , 2025

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

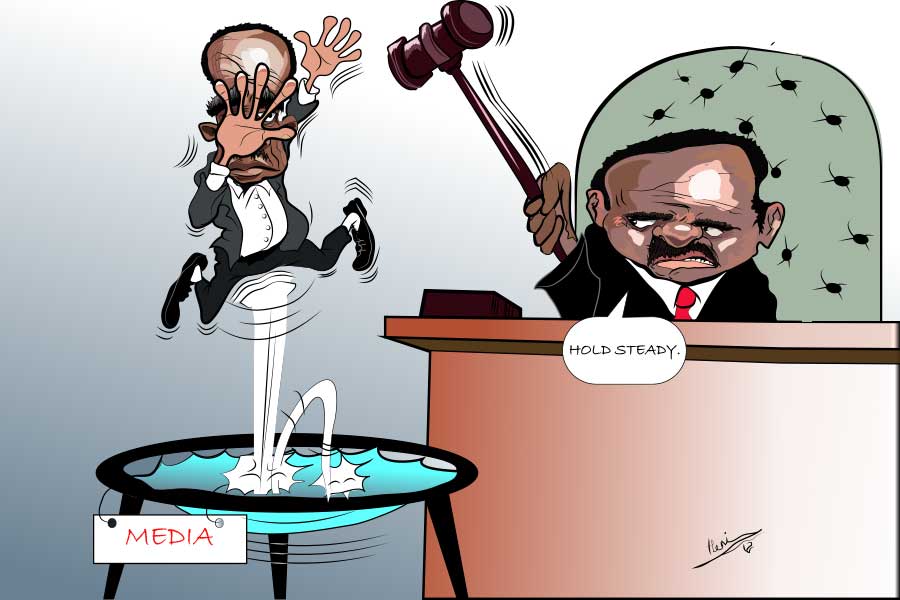

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...