Money Market Watch | Jul 06,2025

Aug 10 , 2024

By Tesfaye B. Lelissa (PhD)

The timeline for stabilising the Birr depends on a comprehensive and well-coordinated policy response that is urgently delivered. Learning from global experiences and insights will be crucial for the authorities as they steer clear of troubled waters, ensuring long-term economic stability and growth. Tesfaye B. Lelissa (PhD) (teskgbi@gmail.com), president of Global Bank, projects that the road ahead could be rough, but with the right strategies, Ethiopia can shine brightly on the economic stage.

Federal policymakers have transitioned the Birr towards a more flexible and market-based exchange rate system, hoping to see the currency stabilise and improve the country's economic competitiveness. For far too long, the Birr was subject to a fixed peg, resulting in an overvaluation that contributed to persistent trade deficits and foreign exchange shortages. The new system seeks to let its value be determined by supply and demand dynamics in the foreign exchange market rather than an artificial peg.

However, this transition has not been without turbulence.

Recently, the Birr experienced a sharp depreciation, plummeting from around 58.6Br for a dollar to over 100 Br within a few weeks. While some expected this acute drop, it represents a setback in the efforts to stabilise it under the new floating regime. The initial depreciation period is formidable for the economy, posing substantial limitations until signs of stability emerge. Despite these difficulties, stabilising the Birr is crucial for addressing the long-standing trade and foreign exchange problems.

A more stable and market-responsive exchange rate can enhance export competitiveness, attract foreign direct investment (FDI), and support overall economic development.

Making definitive judgments on the appropriateness or timing of the Birr's devaluation or speculating on its long-term impact would be premature. The more relevant question should ponder when the Birr will stabilise and at what exchange rate. A combination of economic and policy factors will convolute the process.

Active intervention in the foreign exchange market will be a critical factor in stabilising the Birr. Tools such as foreign exchange auctions, capital controls, and reserve requirements can help manage currency fluctuations. The size and adequacy of the foreign exchange reserves will also play a crucial role in responding to exchange rate volatility. Countries like China and India have successfully managed their exchange rates by building substantial foreign exchange reserves to support their intervention efforts.

Beyond mobilising external resources, Ethiopia should explore ways to accumulate foreign exchange reserves, potentially through managing current account balances and attracting foreign direct investment.

Addressing underlying macroeconomic imbalances, such as high inflation and budget and trade deficits, will stabilise the Birr. Coordinating monetary, fiscal, and exchange rate policies to create a more stable and supportive macroeconomic environment should be indispensable. Structural reforms to enhance the economy's competitiveness, productivity, and export potential, similar to the experiences of Vietnam and Malaysia, would contribute to a more sustainable exchange rate. These countries have achieved more effective exchange rate regimes by aligning their exchange rate management strategies with broader macroeconomic policies, supporting their economic development priorities.

Ethiopia has explored developing a similar comprehensive policy framework through its homegrown economic reform. Effective execution of these policies is vital in the search for long-term equilibrium.

Deepening and broadening the liquidity of the foreign exchange market will be crucial to reduce the impact of speculative activities. Encouraging the participation of diverse market participants, including businesses, investors, and financial institutions, can lead to price discovery and market stability.

Improving the transparency and efficiency of foreign exchange trading platforms, as seen in developing currency futures markets in countries like South Africa and India, can also support Birr's stabilisation. These markets have provided essential price discovery mechanisms and increased the transparency of currency pricing, contributing to more efficient and stable exchange rate dynamics.

Addressing the impact of adverse external shocks, such as volatility in global commodity prices and shifts in international capital flows, and diversifying Ethiopia's trading partners and export markets, as seen in the strategies of countries like Chile and Peru, can reduce the country's vulnerability to external economic disruptions.

Chile, for instance, has proactively sought to expand its trade relationships beyond traditional partners by exploring new Asian markets, particularly China and other emerging economies. This diversification has helped it reduce its vulnerability to fluctuations in demand or prices for its primary export commodities, such as copper.

Ethiopia could emulate these strategies by actively seeking to diversify its trading partners and export markets, reducing its reliance on a few dominant markets or a narrow range of exported goods. This could involve pursuing new trade agreements and partnerships with diverse countries and regions. It could also encourage the development of non-traditional export sectors, such as manufacturing or services, to complement its reliance on primary commodity exports.

Restoring confidence in the government's ability to manage the economy and Birr's exchange rate effectively will be a tasking effort. Transparent and credible communications of the policy framework for exchange rate management, as well as measures to improve the predictability and stability of the Birr's movements, can help reduce uncertainty and speculation. The experiences of countries like Malaysia and Thailand, which have successfully overcome currency crises through effective communications and policy coordination, can provide valuable insights.

The critical question that needs to be addressed is whether the current parallel-market rate of 120 Br for a dollar can be considered the true equilibrium price. Other countries' experience with similar currency crises provides important insights. In many cases, the parallel market exchange rate has not been a reliable indicator of the currency's long-term equilibrium value.

Take Venezuela, for instance. The parallel market exchange rate for its currency, Bolivar, soared to over four million against the dollar at the height of the country's economic crisis in 2019, far exceeding the official exchange rate set by the government. In Zimbabwe during the late 2000s, the parallel market exchange rate for the Zimbabwean Dollar reached astronomical levels, reflecting the country's hyperinflationary environment and the collapse of the formal foreign exchange market. In both cases, the parallel market rates were driven by short-term imbalances between supply and demand for foreign currency, fueled by economic instability, policy distortions, and speculative activities.

These rates did not accurately capture the long-term purchasing power parity or the equilibrium exchange rate based on the countries' underlying economic fundamentals.

Lessons from these experiences suggest that the parallel market rate for the Birr is also unlikely to represent the equilibrium price. Its rate is often distorted by various market imperfections, such as capital controls, foreign currency rationing, and speculative activities, and may not accurately reflect the country's economic conditions.

Proactive policy interventions and market development efforts can help converge the official exchange rate with the equilibrium level over time.

PUBLISHED ON

Aug 10,2024 [ VOL

25 , NO

1267]

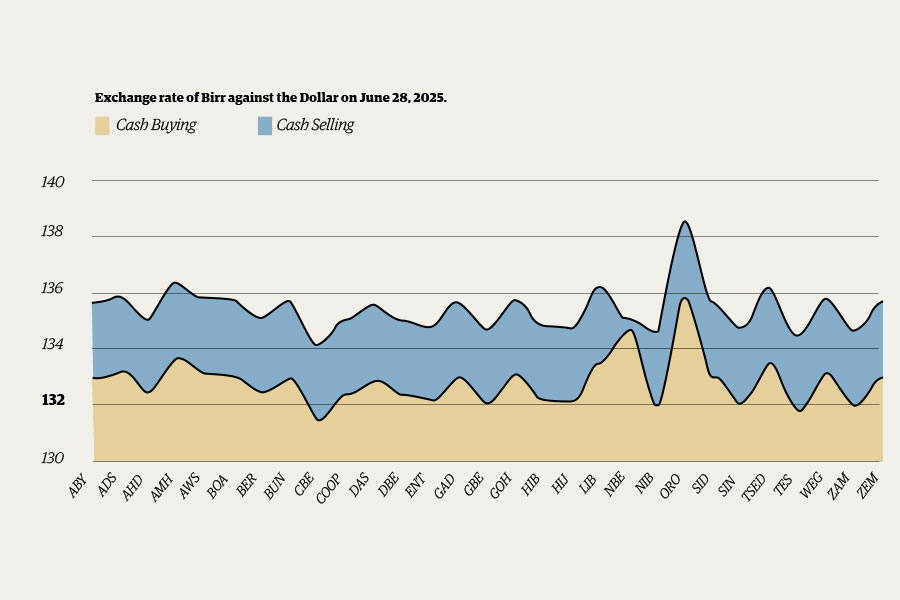

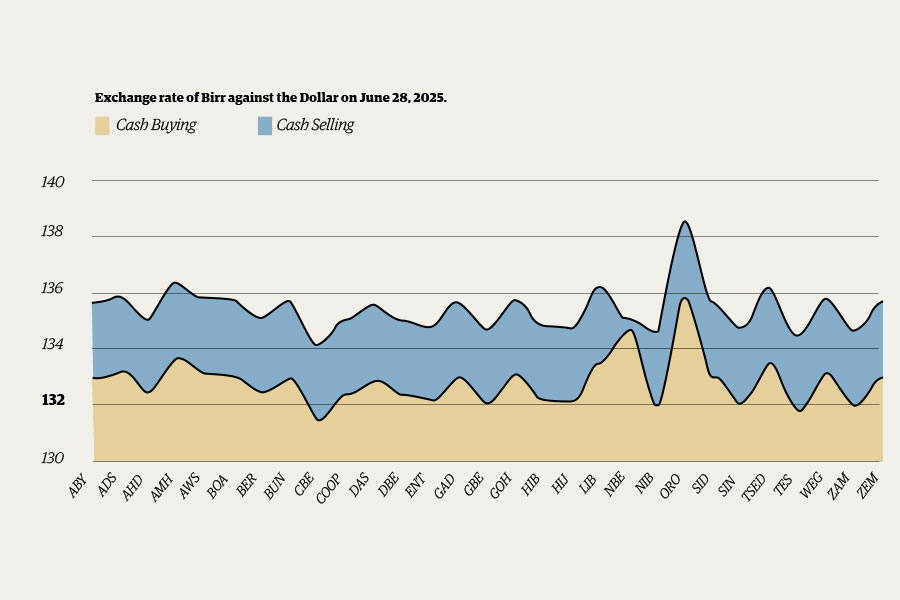

Money Market Watch | Jul 06,2025

Fortune News | Feb 05,2022

Fortune News | May 07,2022

Fortune News | Nov 12,2022

Fortune News | Jul 03,2024

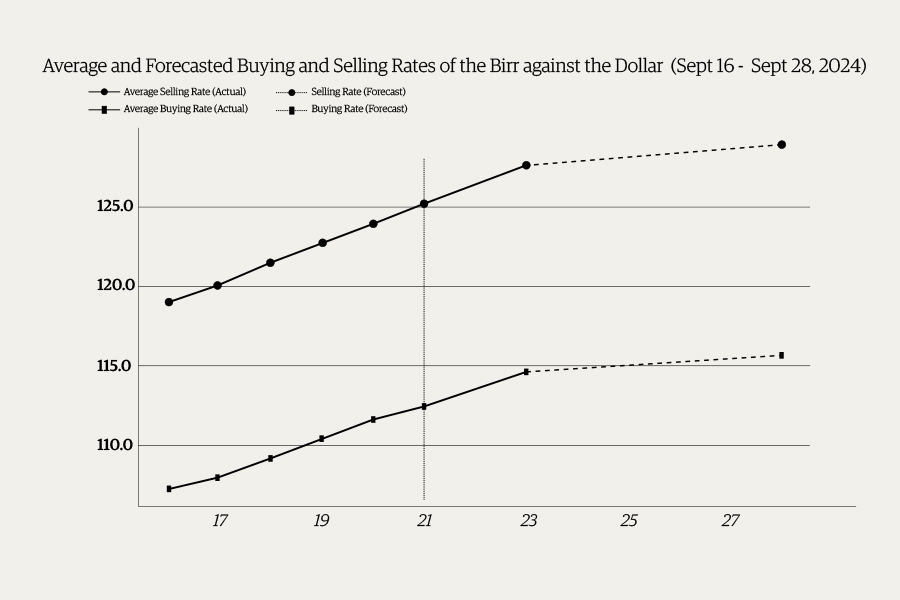

Money Market Watch | Sep 22,2024

Featured | Apr 30,2021

Featured | Oct 30,2021

My Opinion | Mar 01,2024

Photo Gallery | 177303 Views | May 06,2019

Photo Gallery | 167510 Views | Apr 26,2019

Photo Gallery | 158154 Views | Oct 06,2021

My Opinion | 136980 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 26 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...