Fortune News | Mar 30,2024

Amrin Ahmed, who is in her early 20s, is a self-described businesswoman. Growing up in the culture of a family-owned business, she started selling cosmetics and women's products while she was still in college.

Soon after graduating from Debre Birhan University in civil engineering three years ago, she set up a business with an initial capital of 50,000 Br. From her shop in Bole on Cameroon Street, Amrin started selling women’s clothes, shoes and cosmetic products.

“Business was good, and we sold out of everything pretty quickly,” Amrin says.

She bought her merchandise from importers or ordered them from Dubai, China or Thailand.

Business has soured since, however, because she has not been able to get products that she used to carry in the past.

“My shop depends directly on imported goods and, consequently, on foreign exchange,” she said. “It is not only a problem with supply but demand as well. I am making less than half of what I used to the previous year.”

With limited items displayed in her shop, she has been forced to increase prices of what little remains to sell.

The foreign exchange crunch is not a problem confined to small businesses but is affecting large companies that are feeling the effect of a situation that is not letting up.

Businesses face forex shortages affecting their operations.

Dan Techno Craft, which assembles elevators and escalators and employs 450 people, is one of many local companies whose businesses are being severely affected by this problem. It has been a year since the company has accessed foreign currency from banks.

“The biggest struggle has been the import of spare parts for machinery that needs maintenance,” said Daniel Mebratu, founder and manager of Dan Techno Craft, which has been forced to cease operations several times in the past. “Even if we need a spare part that costs as little as 1,000 dollars, we are forced to wait.”

These problems are occurring despite the fact that the nation’s forex reserve has grown to cover 2.6 months of imports from only three weeks in the same period the previous fiscal year, according to the National Bank of Ethiopia.

Despite long-held plans to increase forex by bolstering revenue from the export of goods, the external sector has not accounted for this growth.

It is grants and donations that have raised reserve levels, as Yinager Dessie (PhD), governor of the central bank, stated to parliament late last month while presenting the eight-month performance of Ethiopia’s economy.

One of the most important sources of revenue for the government has continued to be remittances, which has reached 3.82 billion dollars in the first eight months of this fiscal year. It increased by 11.9pc compared to the same period the previous year, a rise that the central bank attributes to the diaspora’s positive view of the political changes in the country.

Foreign exchange that amounted to 2.6 billion dollars was secured from loans and grants this fiscal year. During the first six months of this fiscal year, 1.4 billion dollars was disbursed by multilateral institutions in the form of grants and aid, which was almost double the amount obtained during the same period the previous fiscal year.

The government’s treasury also received over half a billion dollars from bilateral sources in the same period. The aggregate sum from both sources stood 14pc higher than the previous year.

Some experts discount the crunch, claiming a reserve of 2.6 months of imports is normal, while the central bank demurs, warning that unless forex flows into its coffers, the nation will limit imports to fuel and medicine.

However, the government’s success in grants and loans were not replicated when it came to one of the key focuses of the government for the past decade - export performance.

Revenue from the export of goods declined by 9.4pc compared with this time last year. Ethiopia earned 1.64 billion dollars in export revenues as compared to the projected 2.69 billion dollars.

While khatand tantalum managed to perform well, the decrease in the price of coffee, oil seeds, gold, cattle, fruits, leather and textiles on the international market has dragged down revenues.

The decline in exports was not met with a decrease in the import of goods, as was the case last year. The nation instead imported goods valued at 10.5 billion dollars, 1.3pc higher than last year. The reason for the increase was a 20.8pc increase in the cost of fuel, which reached 1.73 billion dollars for the period, according to the central bank.

The nation’s historically high trade deficit has persisted, now standing at 8.9 billion dollars. This is on track with the historical level of 20pc of gross domestic product (GDP).

“If the situation stays like this, we will be forced to import only fuel and medicine,” Yinager told parliament.

The central bank has passed directives intended to help boost the foreign currency regime. They included allowing forex transactions inside industrial parks, enabling foreign currency account holders to negotiate with banks on buying rates and raising the indefinite retention account holding rate to 30pc.

Macroeconomists nonetheless believe that the governor is overreacting and that the challenge of foreign currency shortages, while bad, is not unprecedented.

“Ethiopia’s average forex reserve has been around two months worth of imports in the past,” said an expert with vast experience in macroeconomic matters who preferred to stay anonymous. “This is also in contradiction to the Prime Minister’s statement that the nation has earned a record 13 billion dollars through various sources in the past seven months alone.”

The macroeconomist adds that despite increases to foreign currency reserves and positive performances in the economy, it would be a while before this persistent problem would ever be addressed.

Atlaw Alemu (PhD), a lecturer at Addis Abeba University’s Faculty of Business & Economics, sees securing more loans as the most immediate remedy.

“While import substitution and export promotion should be worked on in the long run, it would be impossible to expect such changes to materialise in the short run,” he said.

Despite the relative improvement in foreign currency reserves and what the future may hold, businesses are already finding the problem unbearable.

While big businesses are fighting to survive as hard as they can, given the difficulty of abandoning large investments, small businesses are changing their area of business.

“I can’t in any way engage in the trading of imported items anymore,” says Amrin. “It’s the domestic market for me.”

PUBLISHED ON

Apr 06,2019 [ VOL

19 , NO

988]

Fortune News | Mar 30,2024

View From Arada | Nov 12,2022

Fortune News | Dec 14,2019

Fortune News | Mar 05,2022

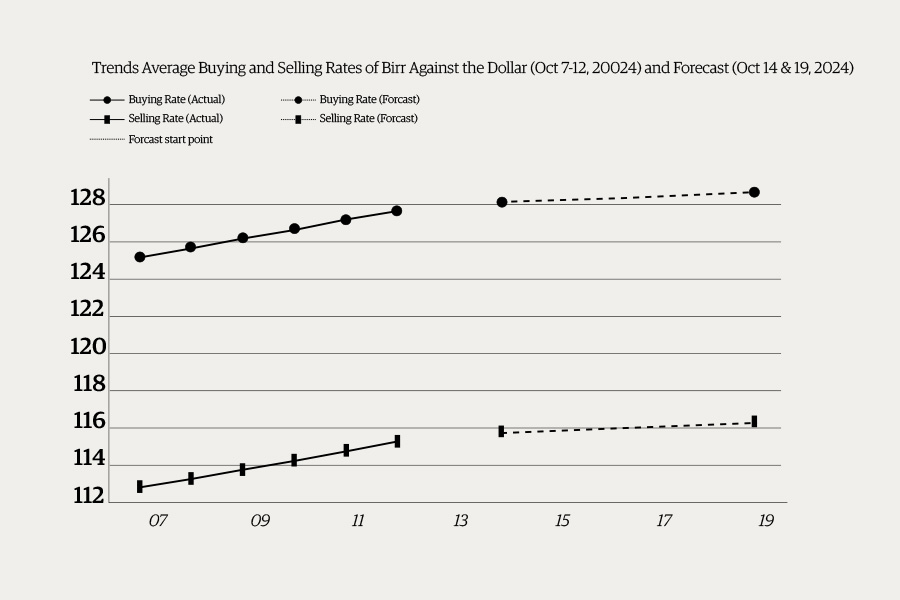

Money Market Watch | Oct 13,2024

Fortune News | Nov 18,2023

Commentaries | Oct 26,2024

Fortune News | Sep 09,2024

Agenda | Jan 11,2020

Radar | Oct 06,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...