Commentaries | Dec 25,2018

On the afternoon of May 21, 2019, Mohammed Dinsefa, 27, was in Merkato, the large open-air marketplace in the capital, searching for dates, a fruit used to break the Muslim daily fast, Iftar, during Ramadan.

Mohammed and his fellow Muslims break Iftarby eating three dates and drinking water.

He usually goes to retailers around Anwar Mosque in Merkato to get his supply of 10Kg of packed dates as he does every year. He recalls paying 450 Br last year for the package, but he was surprised to discover that the price is 850 Br for the same item this year.

“It is unaffordable for me to buy the 10Kg pack,” said Mohammed.

Nonetheless, he cannot do without the dates, for it is required to break each fast with three pieces of the fruit during Ramadan.

Since he cannot afford to buy the bigger package, Mohammed has been buying Eshet dates, a semi-dry variety, for 120 Br a kilogram since the beginning of the fasting season on May 6, 2019. This one kilogram of dates lasts him and his family up to six days when he returns to the market to re-supply.

Mohammed’s complaints are not limited to the high price he has encountered but also concern the quality of the dates he buys.

“The taste of the dates is different, and it is not the same as it used to be,” Mohammed told Fortune.

Ahmed Wabela, one of nearly 30 merchants who carry dates near Anwar Mosque in Merkato, shares Mohammed’s claim. Ahmed sells different types of dates imported mainly from Saudi Arabia: Kimia, Madina, Ajwa and Eshet; and a local variety, Asayita, that grows in the Afar region.

Ajwa, a soft, luscious, fruity date variety with fine texture is the most expensive date and sells for 1,000 Br a kilo, while Eshet is by far the largest volume sold to customers. There are over 400 date varieties globally, and they cover three percent of global farmland.

Folks compare date prices ahead of the Iftar feast, which breaks Muslim’s daily fast during Ramadan.

Last year, Ahmed was selling 600g of Kimia dates imported from Iran for 90 Br, which has now jumped to 130 Br; and 10Kg packages for 450 Br, which have risen to 850 Br. His daily average sales volume during the fasting season is 20 packs of 600g and 10 packs of the 10Kg option.

The price increase started to be seen beginning from the eve of Ramadan, according to Ahmed, who claims that he receives the product from wholesalers who have increased the prices of the product to retailers like him.

“Our suppliers claim that the current increase in price is due to shortages of foreign currency,” Ahmed told Fortune.

There are 150 fruits and vegetable importers registered under the Ministry of Trade & Industry who are the primary suppliers of dates to the market.

Ethiopia imported 9,511tn of dates in 2018 at a cost of 4.1 million dollars, of which 78pc of the dates were obtained from Saudi Arabia. These figures are almost double 2016, which saw the importation of 4,087tn of dates at a cost of 2.2 million dollars. In the first two months of the current year, the country spent 114,000 dollars to import 212tn of dates.

Date palm cultivation goes as far back as 4,000 BC to ancient Mesopotamia, what is now southern Iraq. Currently, date fruit is commercially cultivated in Iran, Saudi Arabia, Algeria, Iraq, Pakistan, Oman, the United Arab Emirates, Tunisia, Libya and Egypt.

In 2017, these countries together produced close to seven million tonnes of dates, which represents 88.9pc of total world production. After the flowering date palm plant, Phoenix dactylifera, is planted in the ground, it takes four to eight years to produce its first fruit, and then it takes another seven to 10 years to be commercially viable.

Bederu Ummer, 35, is one of the fruit and vegetable importers who obtains his dates from the Middle East to supply local wholesalers.

He claims that he used to order four shipping containers of dates during the Ramadan season, but this has not been the case lately due to the forex crunch.

“I did not import a single container this year,” he said.

A vendor sells dates on the streets of Merkato during the Muslim Ramadan fast.

The shortage of foreign currency has also forced him to cut down on other imported goods.

“This year, my monthly import expense is no more than 10,000 dollars, which is four times lower than what it was a year ago,” Bederu laments.

Yinager Dessie (PhD), governor of the National Bank of Ethiopia, has expressed his frustration on the current depletion of the foreign currency reserves in the country.

Two months ago, he told parliament that the nation’s foreign exchange reserves would only cover two months of imports.

“If this shortage continues, it will only enable the country to import pharmaceutical products and fuel,” he said.

Mamush Sadiq, 28, a wholesaler in Merkato, is a new entrant to the date business with only two years’ experience under his belt. He too attests to the drastic price increase of dates.

In preparation for the fasting season, he stocks 700 packages and 1,000 cans of dates at a time. His sales volume, which averaged 10 packs of dates a day prior to Ramadan, spiked to 200 packages a day.

“The price of dates has risen in concert with demand,” he said.

Date consumption is not limited to Muslim consumers alone, as the general public seeks the fruit for dietary reasons.

Webalem Beyen, 30, is a regular consumer of dates and keeps it on her monthly shopping list.

“After reading about the health benefits of dates, I became a regular consumer,” she said.

Different research has shown that dates are high in nutrients, fiber and antioxidants. It is also believed that the fruit provides other health benefits ranging from improved digestion to a reduced risk of heart disease.

Early last week, she was near Anwar Mosque in Merkato to buy the fruit. Last month she bought a kilogram of dates for 70 Br.

This time around, she spent 130 Br to buy 600g of Kimia dates imported from Saudi Arabia.

“Even though I am not fully convinced with their justification for the price increase, I bought the dates since I don’t have any options,” she said.

Henock Semaw, dean of the College of Business & Economics of Haramaya University, believes that the current political uncertainty and the black market contribute to the severity of the forex crunch.

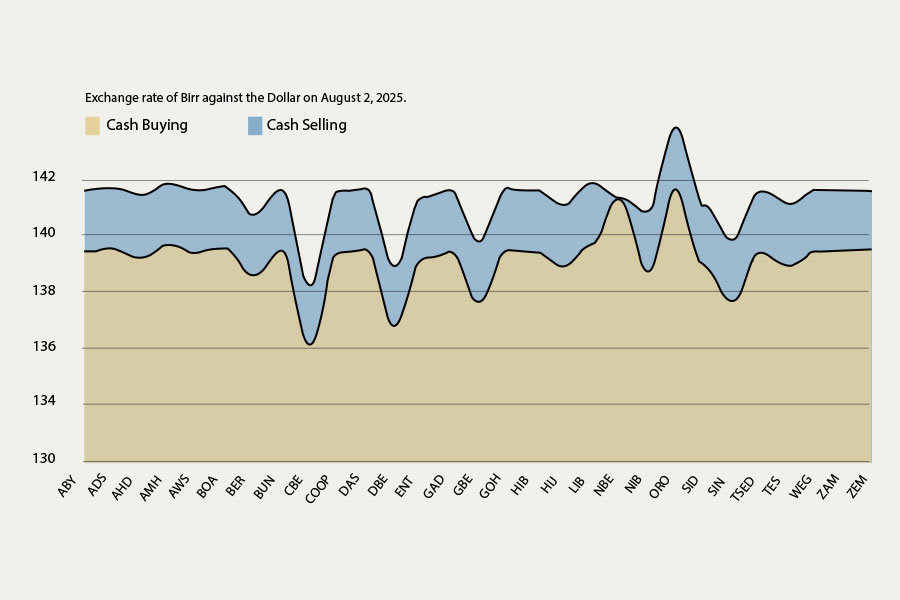

In the black market, traders buy a dollar for 41 Br, while banks buy a dollar for around 28.6 Br, which represents a 43pc premium.

If the current condition continues, it will create worsening political, economic and social problems in the country, he said.

“Now is the time for the government to seriously turn its focus to the economy,” Henock said.

PUBLISHED ON

May 25,2019 [ VOL

20 , NO

995]

Commentaries | Dec 25,2018

Money Market Watch | Aug 17,2025

Fortune News | Jun 29,2025

Fortune News | Mar 07,2020

Verbatim | Oct 20,2024

Radar | Nov 21,2018

Agenda | Jul 29,2023

Fortune News | Feb 23,2019

Viewpoints | Dec 10,2018

Fortune News | Oct 27,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...