Nov 12 , 2022

By Abdulmenan M. Hamza

A couple of weeks ago, the National Bank of Ethiopia (NBE) issued a directive compelling commercial banks to acquire treasury bonds maturing in five years. Accounting for 20pc of loan disbursements at an interest rate of two percent, these bonds yield more than the minimum savings rate, making it much lower than the lending interest rates. Sadly, this requirement is imposed on commercial banks while a significant amount of their money is still held by the central bank under a previous directive that tied 27pc of loans and advances.

This signals that Ethiopia's banking industry, characterized by resource allocation and pricing distortions, has further staggered.

It is bizarre to see the new rule introduced while the industry is undergoing market-based reforms. It also lacks economic justification. The previous directive, a.k.a "the 27pc rule", remained controversial for years before it was lifted a few years ago as part of the ongoing financial reform. However, it had a theoretical underpinning that encouraged state intervention in the financial sector. It came from a policy prescription to correct market failures in banking feared to deprive resources towards strategic and socially beneficial public projects.

However, policies shaping the financial sector are riddled with inconsistencies and contradictions. Ill-thought-out rules often dominate the policy sphere instead of principles. The new directive has no persuasive rationale except expediency. It is a response to a growing budget deficit. Its repercussions are considerable and adverse. It will have a crowding out effect on the private sector as a sizeable amount of resources go to the public coffer.

It will also force commercial banks to follow pricing strategies to earn a constant interest rate margin. As they make much less interest on treasury bonds, they will raise interest rates on loans and push savings rates down to maintain the interest rate spread. The primary losers will be savers who are already losing the value of their savings to runaway inflation. This will cause financial disintermediation, a process that leads to the decline of intermediaries between producers and consumers.

The Ethiopian banking industry has been struggling with liquidity shortages in recent years. With the introduction of the current rule, an enormous amount of resources will be squeezed out of the banking system, which might further strain the banks.

It is a policy that will severely impact the treasury bills (T-bills) market, which thrived following the reform a few years ago with the active participation of the banks. Out of the outstanding balance of 288.62 billion Br, nearly 64pc is held by the banks. However, the T-bills market is still in its early stage; supply has consistently outstripped demand. Notably, the gap began widening beginning July last year. The need for T-bill over the past four months was 59pc of the supply, indicating a significant shortfall in appetite.

The drawback of T-bills as a financing source is related to the short-term maturity date; the longest issued is for 364 days. A substantial share of proceeds from newly issued bills is used to redeem the outstanding T-bills. During the third quarter of the preceding fiscal year, 152.56 billion Br worth of T-bills were sold. Two-thirds of these were used to settle outstanding bills.

Bonds with long maturity periods are suitable for long-term needs, and market rules should govern them. But the mandatory bonds the central bank forces commercial banks to buy will ultimately discourage them from participating in the treasury bills market as they will not have disposable resources. This will considerably undermine the development of market-based T-bills. Without a well-developed money market, the government will have to rely on heterodox ways of funding its budget deficits, such as printing money.

Forcing banks to buy treasury bonds at an interest rate much lower than the lending rate encourages the government to ignore tightening its belt. The forced sales of treasury bonds will complicate the use of monetary instruments. Increasing the minimum savings rate will be unwise as it will affect the government's interest payment on treasury bonds.

The interventionist rule will also scare foreign banks off. Instead of forcing the banks to acquire these bonds, market mechanisms should be employed to raise funds the federal government needs. This will help the treasury bonds and bills market thrive, avoid resource allocation distortions, encourage competition, and discipline the government.

PUBLISHED ON

Nov 12,2022 [ VOL

23 , NO

1176]

Editorial | Dec 07,2019

Radar | Aug 01,2020

Life Matters | Sep 27,2025

Fineline | Jan 05,2019

Fortune News | Jan 13,2020

Commentaries | Jul 31,2021

Fortune News | Oct 30,2022

Radar | Feb 20,2021

Radar | Apr 22,2022

Featured | Aug 29,2020

Photo Gallery | 170252 Views | May 06,2019

Photo Gallery | 160492 Views | Apr 26,2019

Photo Gallery | 150120 Views | Oct 06,2021

My Opinion | 136236 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

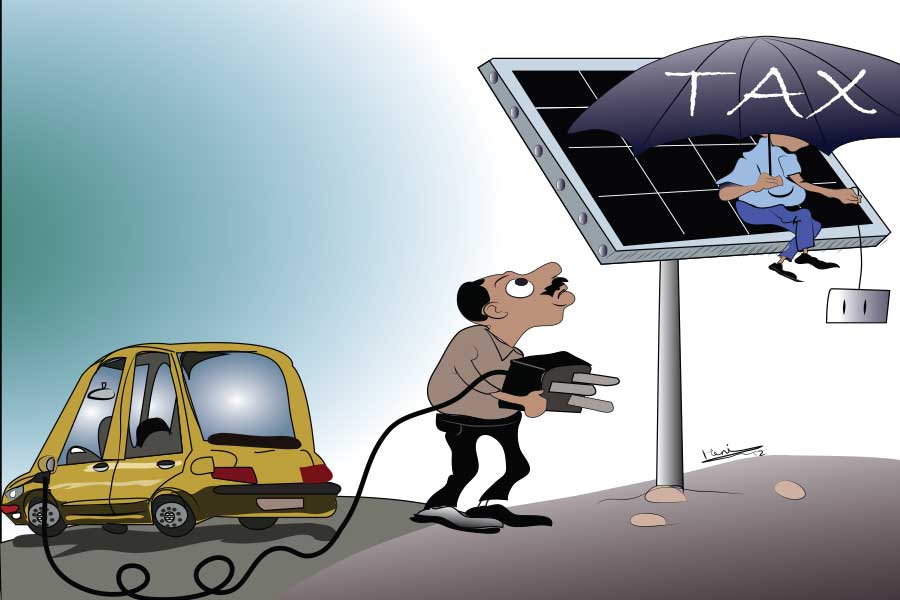

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...