Radar | Jun 15,2025

Jul 9 , 2022

By Asseged G. Medhin

No one living miles from the nearest river seriously expects to be hit by floods. But heavy rain can bring the flood to anyone – and with little or no warning. As structural measures offer little protection, the best precaution people can take is suitable natural hazards insurance.

Worldwide, about a third of overall losses resulting from natural catastrophes are attributable to floods, while the focus is on storm surges and flooding goes underreported. Flash floods tend to hit the headlines only in the worst cases that have large fatalities, such as in Dire Dawa a few years ago, while they are becoming a common phenomenon in Addis Abeba.

Flash floods usually occur as independent, localised and random events. It has a destructive power that is often under-appreciated. In the less serious cases, water accumulates in cellars and underground car parks. In the worst of circumstances, it can cause buildings to collapse and increase losses enormously. Given climate change, the risk of flash flooding is growing, increasing the hazard to areas that have not seen this type of natural disaster.

It is thus important to discuss risk management to prepare proactively and reduce the frequency of flooding while reducing its impact.

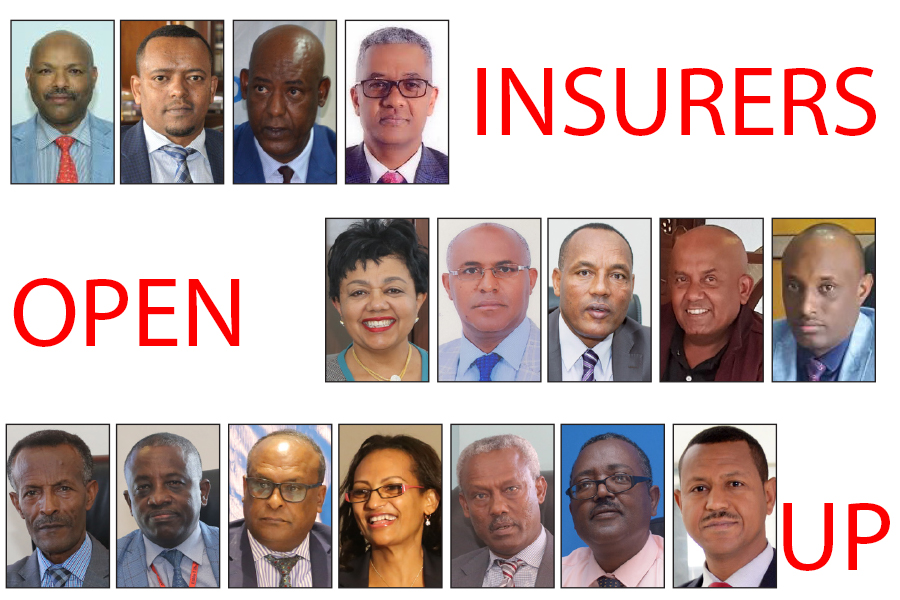

The government should ultimately reform its traditional way of management and craft a strategy with insurers who could also be stakeholders. The international practice of ensuring climate risks like floods should be practised in Ethiopia as a strategic course correction to adequately distribute risk, protect wealth and reduce the negative consequences to the economy.

City administrations are another responsible stakeholder who seek critical advice in mapping out potential risk areas and should step up to allocate resources to institutions and programmes that promote risk prevention. History should serve as guide in preparing for rainy seasons and tragedies that occur should be carefully audited to ensure that they do not happen again.

No less important are meteorologists who are expected to be above reporting the climate. They should integrate their report with the other stakeholders so that a meaningful risk management strategy on flooding can be developed and constantly updated.

Once the risk is transferred to them, insurers should create awareness from existing and potential clients through continuous seminars and selective panel discussions to spell out climate risk. The insured has the right to have it as and when needed. Not only should insurers suggest practical experiences and exposures for policymakers about mitigating climate risk, they should also underline the critical importance of the industry in addressing the effects and minimising economic impact.

Today, all over the world, risk management is a very crucial point of discussion. Artificial and natural hazards are transforming world resources. COVID-19, war, cyber-security risk, and inflation are creating imbalances between and among nations. We know how some of these, such as inflation, are affecting us and can only estimate the challenges climate change will bring if left to its devices. Time is not on our side.

Undoubtedly, we will have to contend with more extreme weather events in the future. A warmer climate and a higher concentration of water vapour in the atmosphere will increase the amount of rainfall and the likelihood of localised storms, especially in the summer. This does not contradict the general trend toward drier summers in certain regions but indicates greater volatility of precipitation events, particularly over dense urban sectors.

A strategic insight to integrate all stakeholders to mitigate the risk ahead and save future resources should thus be a priority. We need to walk the talk on climate risk so as not to see the loss of life, destruction of property or economic crisis.

PUBLISHED ON

Jul 09,2022 [ VOL

23 , NO

1158]

Radar | Jun 15,2025

Exclusive Interviews | Jan 04,2020

Fortune News | Jul 18,2020

Viewpoints | Oct 03,2020

Fortune News | Nov 16,2019

Commentaries | Jan 01,2022

Radar | Oct 15,2022

Viewpoints | Sep 19,2020

Exclusive Interviews | Jan 05,2020

My Opinion | 132038 Views | Aug 14,2021

My Opinion | 128435 Views | Aug 21,2021

My Opinion | 126362 Views | Sep 10,2021

My Opinion | 123981 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...