Radar | Apr 03,2023

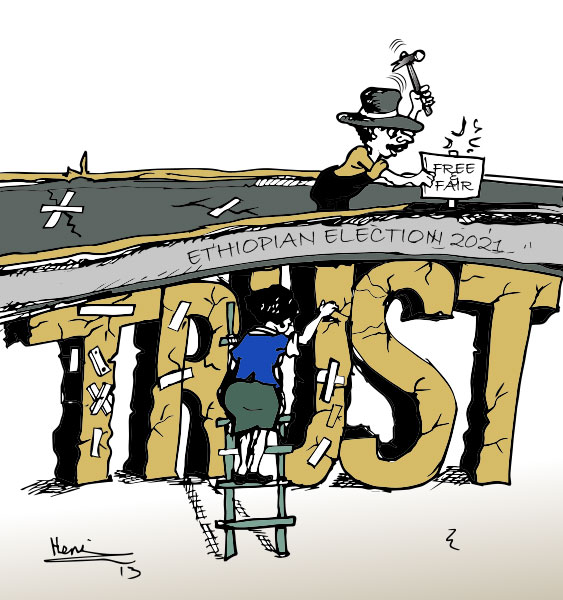

Nov 6 , 2021

By HAWI DADHI

Three companies in the information technology sector will soon launch online payment systems without partnering with financial institutions, ushering in a new era of financial services outside banks.

ArifPay, Sunpay and Chapa are close to receiving permits from the National Bank of Ethiopia (NBE) after months of waiting. Officials at the central bank confirmed that these companies have fulfilled the requirements.

The NBE permitted private firms to operate as fintech service providers last year, issuing two directives governing the licensing and operation of payments system operators and payment instrument issuers. Companies in the digital payment industry can do business as switch, ATM, point of sale (POS) operators, or payment gateway service providers. These operators, which provide systems to facilitate payments and online transactions, are useful for e-commerce businesses looking to accept payments online. The central bank requires them to have a threshold of three million Birr in registered capital.

Over a dozen companies have applied for licenses over the past few months.

Established last year, Chapa Financial Technologies is among these companies. It has been providing crowdfunding systems to the Ethiopian Electric Power (EEP) and Ethiopian Diaspora Agency. Dubbed "My GERD," the crowdfunding application aggregates donations from diaspora members to the Grand Ethiopian Renaissance Dam (GERD). The platform has raised close to 250,000 dollars thus far. Launched last week, a platform called "Eyezon," commissioned by the Ethiopian Diaspora Agency and the Ministry of Foreign Affairs is geared towards crowdfunding activities for national causes such as Dine for Nation, COVID-19 relief and raising funds for internally displaced people.

"We've worked as technology providers before," said Nael Hailemariam, general manager of Chapa.

He disclosed that the company is considering offering more shares to the public.

Chapa's crowdfunding system is one of several launched recently, including the Commercial Bank of Ethiopia's (CBE) "itsmydam" platform.

These services are proliferating because of their simplicity in use and resonance with national agendas, according to Tewodros Tassew, a fintech expert.

Another fintech company, Sunpay Solutions, a subsidiary of Sunshine Investment Group, is awaiting a license to join the financial sector as a payment gateway and POS operator. The company was formed this year with a registered capital of 100 million Br.

Despite nearing the end of the process, the fintech companies have had their work cut out for them. A year following the liberalisation of the digital payment market, the central bank has introduced a new set of rules governing how these companies should be formed. Foreign nationals of Ethiopian origin are permitted to acquire shares, but they must pay in foreign currency. They can only receive dividends in Birr, however.

The new rules require the companies to surrender 30pc of the forex invested by Ethiopian-born foreign nationals from their escrow accounts held at commercial banks.

The regulations have compelled one of the applicants to have a shareholder'` meeting to pass resolutions for share buying in foreign currencies. Founders of ArifPay said the rules could discourage investments from Ethiopians abroad. Established with a capital of 140 million Br, several ArifPay shareholders are from the Diaspora.

ArifPay signed an agreement with Abay Bank two weeks ago to issue mobile POS services, which allow customers to use their debit cards to make payments and for merchants to accept payments without having a POS machine.

Over a dozen might have rushed to enter the market as payment operators, but only two have opted to apply for payment instrument issuer licenses.

The state-owned Ethio telecom became the first non-financial institution to apply earlier this year when it was granted a license to launch its Telebirr mobile money platform.

Players in the mobile money market, such as E-birr, have chosen to remain as technology providers for now. Established in 2016, E-birr works with commercial banks to streamline its mobile money technology.

"We're thinking about it, but it won't happen immediately," says Abebe Mulu, general manager of E-birr.

The payment instrument issuer license has stringent requirements, with companies required to submit proof of having 50 million Br capital.

The intense competition in the mobile money and wallet space and the high customer acquisition cost could be behind why so few companies are interested in applying for instrument issuer permits, according to Tewodros.

"The entry to the market of Telebirr makes it hard to compete," he said.

Ethio telecom has capitalised on its existing customer base and well-recognised brand when launching Telebirr. It has mobilised over 10 million users since its launch last May.

"Companies which have operated for years don't have as many customers as Telebirr," said Tewodros.

Unlike serving as system operators, where the companies provide payment facilitation services building upon the existing customer bases of financial institutions, fintech companies need to win over the market. They have to go through the difficult process of customers acquisition.

The past couple of months have seen the launch of several remittance service providers and the issuance of international payment cards. Tewodros expects the next step for the market is the introduction of micro-credit services. Amole and Telebirr have announced their plans to do that.

PUBLISHED ON

Nov 06,2021 [ VOL

22 , NO

1123]

Radar | Apr 03,2023

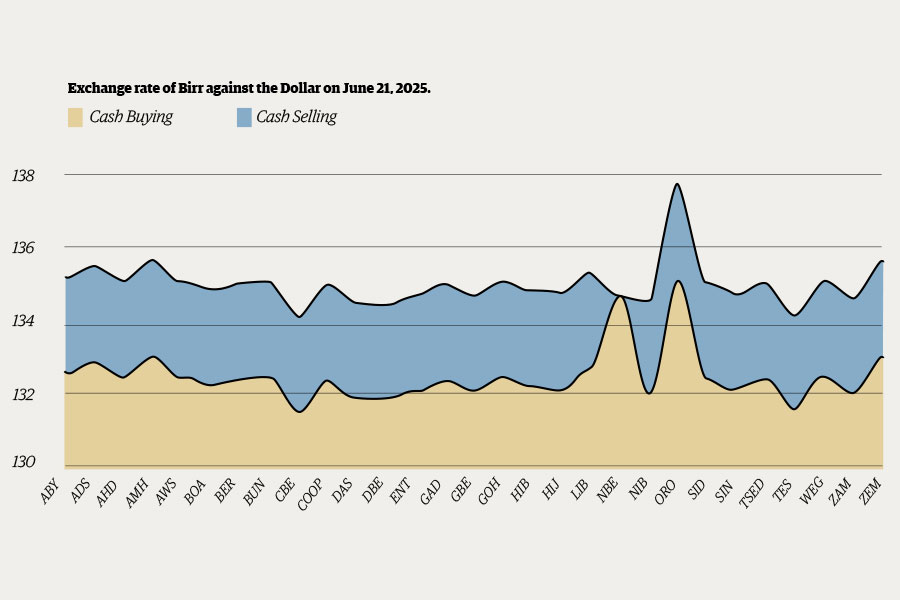

Money Market Watch | Jun 21,2025

Verbatim | Oct 16,2021

Films Review | Jul 25,2020

Exclusive Interviews | Jan 05,2020

Editorial | Jan 09,2021

Viewpoints | Oct 31,2020

Radar | Aug 28,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...