Viewpoints | Aug 06,2022

Dec 10 , 2022

By Shewangezaw Seyoum

The civil war in the north has caused considerable losses in human lives, damaged economic and social infrastructure and dislocated many people. The war has also meant the diversion of resources away from development and social spending into war financing. The impact is nothing but consequential.

The federal government's independent economic advisors have not only concurred with the adverse outcomes. They have also put numbers on the facet. The damage caused and the costs incurred were higher than the government's estimates. Major macroeconomic indicators such as GDP, productivity and government expenditure have all suffered.

The gross domestic product (GDP) has shown a three percent deviation from the base, following a downward trajectory. Other indicators like private consumption have also demonstrated significant reduction. The socioeconomic consequences of falling household income and poverty increase are clear examples.

The federal government has now drawn up a three-year recovery plan to revive the economy and get back on the development track. After a surprise breakthrough in peace talks in Pretoria, South Africa, and a cease-fire that seems to be holding despite hurdles, this has given rise to enthusiasm. The hope is that the country will be able to recover faster and better. The plan is optimistic with an accelerated recovery scenario, hoping to see a high growth rate of the economy (GDP) and the different sectors.

More importantly, poverty is to be reduced much faster. Building the productive capacity of the country is the focus of this scenario. Humanitarian support is also involved for the needy. All is well up to this point.

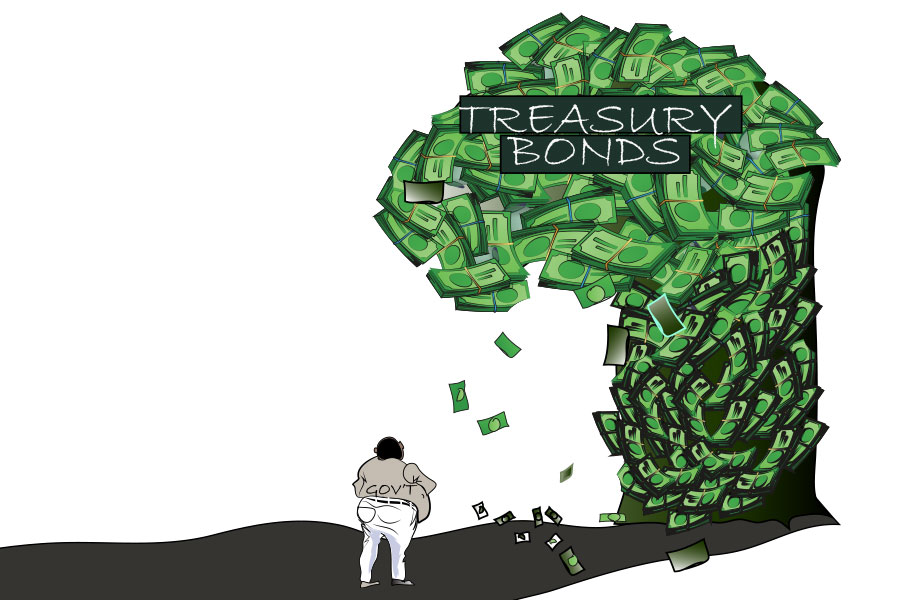

The Achilles' heel of this idea comes with its massive investment requirement. Specifically, the price tag of the scenario is much higher, begging questions about the source of financing. With the kind of money required, the authors of the economic advisors study boldly recommend whole ownership of the recovery by the country. This means Ethiopia and its citizens should bear the entire financing burden. Delving into the details of the public and private sectors, enterprises and exporters are expected to generate the resources needed.

Over the years, the economy has been rocked by multiple and concurrent shocks, weakening its capacity to generate the resources needed reliably. Raising taxes on businesses could be an economic injection. But, usually, companies pass over the added tax to consumers with galloping inflation. This would make already weary citizens worse off. The broader macroeconomic reality will not allow it to implement inflationary financing.

Talk of public-private partnership likewise might not hold water as firms have been operating at a low capacity that, in turn, eroded their revenues and profits. To make matters worse, and with the current global situation, there appears to be little appetite to back up a marshal plan.

The federal government's inability to implement effective countermeasures once it took control of Tigray's capital, Meqele, in the first-round military campaign two years ago seems to have convinced officials it won't be different this time. With a military solution out of the way, the two parties have reached an agreement. The negotiations are yet to be completed, and the peace process has just begun.

The road to peace is likely to be bumpy. A faster and better economic recovery will not only be good on its own, but it can also foster peace and reconciliation. It has added importance. But, we need to craft reliable recovery plans with innovative financing strategies to get around the current bottleneck.

PUBLISHED ON

Dec 10,2022 [ VOL

23 , NO

1180]

Viewpoints | Aug 06,2022

Viewpoints | May 11,2019

Viewpoints | Jun 07,2025

Fortune News | Feb 26,2022

Commentaries | Apr 28,2024

Editorial | Mar 12,2022

Radar | Oct 12,2024

Covid-19 | Apr 01,2020

Fortune News | Aug 03,2019

Radar | Feb 20,2021

My Opinion | 131548 Views | Aug 14,2021

My Opinion | 127903 Views | Aug 21,2021

My Opinion | 125879 Views | Sep 10,2021

My Opinion | 123510 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...