Radar | Jan 27,2024

Oct 20 , 2024

By Gelsomina Vigliotti , Maurizio Martina

Although enough food is produced to feed the global population, hunger and malnutrition due to conflict, poverty, economic slowdowns, and climate change still threaten millions of lives. In 2023, around 2.3 billion people faced moderate or severe food insecurity. More than 730 million people suffered from hunger, with undernutrition linked to almost one-half of the deaths of children under age five.

Beyond the profound human toll, hunger costs developing countries billions of dollars in lost productivity and consumption. With such staggering costs, food insecurity is at the top of the agenda at last week's World Food Forum in Rome.

We urgently should address the roots of hunger and malnutrition, and one of the most effective ways to do that is to invest in making our agrifood systems more efficient, fair, and sustainable. That means improving the infrastructure and services that help farmers access markets; mobilising investments to enhance storage and port facilities, irrigation systems, and other sources of productivity; and expanding the use of climate-conscious production techniques. Each would have a huge impact on food security, both now and in the future.

But every component of this agenda requires more financing. According to "The State of Food Security & Nutrition in the World", a regular report produced by the five leading UN agencies working on this issue, trillions of dollars are needed to end hunger and malnutrition. Given the complex links between hunger, poverty, and development, the latest report calls for more efficient use of innovative financing tools, such as green or social bonds, and for reforming how we finance food security more broadly.

We should do more to ensure that marginalised groups – such as women, indigenous peoples, and small-scale farmers and agribusinesses – have access to finance.

The European Investment Bank (EIB), the European Union's bank, has deep experience in financing investments throughout the agriculture and bio-economy value chain. Each year, it lends about five billion euros (5.5 billion dollars) to the sector globally.

For example, the EIB recently invested in infrastructure in Tunisia to strengthen food-storage systems and mitigate the risk of cereal shortages triggered by Russia's invasion of Ukraine. It works with local banks to support smallholder farmers and provide microfinance in countries such as Uganda. It has deployed risk-sharing facilities in Malawi and Zambia, and provided guarantees to financial institutions that lend to companies sourcing raw materials from smallholders. It also supports a social enterprise in Madagascar that would help promote environmental sustainability and food security while ensuring that farmers get decent incomes.

The problem is that countries with the highest levels of food insecurity often have the hardest time accessing financing. Among the biggest obstacles are high transaction costs, fragmented agriculture markets, insecure land rights, poor administrative capacity, weak governance, and political instability.

One key to overcoming these hurdles is to pursue stronger international partnerships. That is why the EIB, the Food & Agriculture Organisation (FAO) of the United Nations, and other international organisations are working together closely to promote food security, environmental sustainability, and climate resilience. By pooling resources and experience, we can overcome the chronic financing challenges, especially in sub-Saharan Africa.

For example, by drawing on the expertise and convening power of the FAO, we can provide more funding for agrifood and bioeconomy activities. In 2023 alone, the FAO Investment Centre helped mobilise 6.6 billion dollars in new investment by designing 38 public investment projects backed by financing partners in 26 countries. This came on top of implementation support to ongoing projects, representing a total of around 46.7 billion dollars.

But, scaling up such financing requires the right kind of tools, not least financial products that reduce risk for the private sector. For example, blended finance – which combines public and private funds – and innovative financing mechanisms like climate bonds can make these investments more attractive to capital that is still sitting on the sidelines.

Feeding the world is not just a moral responsibility; it is a strategic imperative. Hunger is an immediate global crisis that demands massive investments. Fortunately, the potential rewards are well worth it. Sustainable agrifood systems do far more than reduce poverty and hunger. They also create jobs, promote economic growth, reduce gender inequality, improve health, and build stronger communities. The return is enormous, and the cost of doing nothing is even greater.

PUBLISHED ON

Oct 20,2024 [ VOL

25 , NO

1277]

Radar | Jan 27,2024

Viewpoints | Nov 30,2024

Fortune News | Sep 13,2025

Fortune News | Jul 03,2024

My Opinion | May 31,2025

Fortune News | Feb 18,2023

Radar | Jul 17,2022

Fortune News | Jul 06,2025

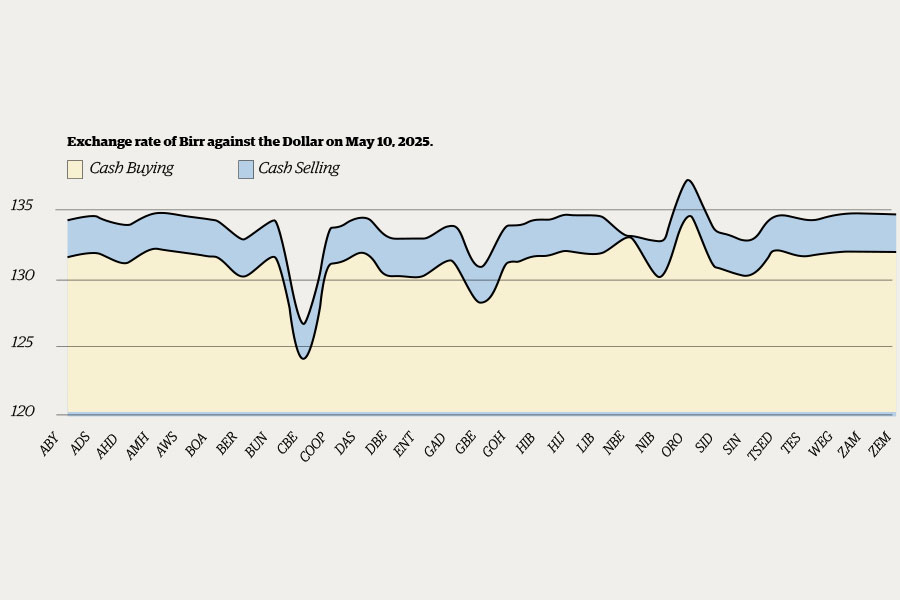

Money Market Watch | May 17,2025

Fortune News | Apr 03,2023

Photo Gallery | 177685 Views | May 06,2019

Photo Gallery | 167899 Views | Apr 26,2019

Photo Gallery | 158578 Views | Oct 06,2021

My Opinion | 136995 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 27 , 2025

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...