Radar | Mar 02,2024

Jul 2 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

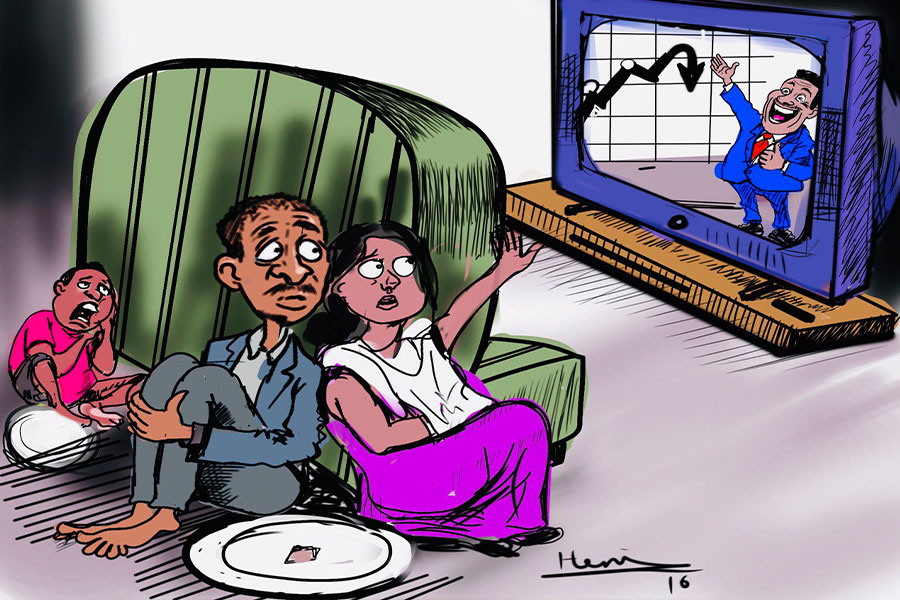

The federal government is set to roll out a single-account treasury system for the coming budget year, consolidating accounts by federal agencies under one.

Federal officials began taking steps toward the single-account system earlier this year. Although the idea initially surfaced a decade ago, it has yet to see its full implementation.

Financial pressures on government coffers have been the main drive as external loan disbursements fall and global prices for commodities such as fuel, fertiliser, and wheat soar. The pressure was evident last December when the administration of Prime Minister Abiy Ahmed (PhD) requested Parliament to approve a 122 billion Br supplementary budget to the 561 billion Br bill Parliament appropriated in June 2021.

Finance Minister Ahmed Shide and his deputies were adamant during federal budget hearings two months ago about the need to cut public spending; at the cost of folding sluggish projects while blocking the approval of new projects. The Minister emphasised the policy when he faced question time in Parliament after tabling the 786.6 billion Br budget bill for a budget year to begin next week.

“The fiscal space that allowed the government to provide financing for development objectives is narrowing,” said Ahmed.

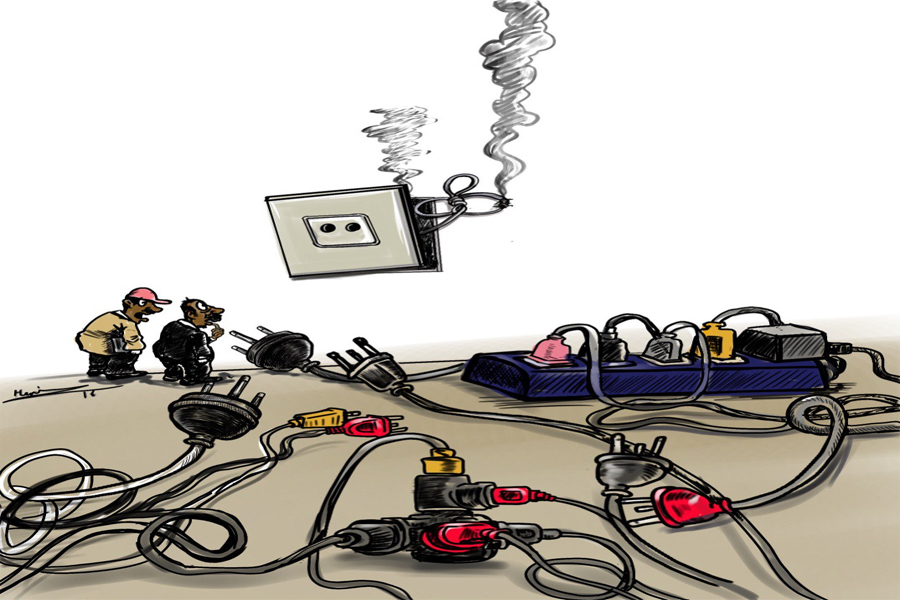

Officials say the single-account system is designed to block revenue leakages and prevent the rampant mismanagement of public funds.

Meseret Damtie, the Federal Auditor General, attested this to legislators last month when she presented audit findings on federal agencies. The Auditor General found that two dozen federal agencies spent 645 million Br above budget. One-fourth of this amount spent by 41 federal agencies was not supported with documentation, revealed the audit findings.

Meseret replaced Gemechu Dubiso, who left the federal audit office this year.

Federal auditors uncovered 107 million Br in overtime payments, per diems and spending without the authorisation of the Civil Service Commission.

Legislated 13 years ago, the proclamation governing public funds granted the National Bank of Ethiopia (NBE) the mandate to decide where the funds are to be deposited. Although regulators have designated the state-owned Commercial Bank of Ethiopia (CBE), various budgetary institutions have transacted through accounts opened at private commercial banks.

"Government agencies do not have accounts at our Bank," said Girum Tsegaye, president of Berhan Bank.

Nonetheless, Eyob Tekalign (PhD), a state minister for Finance, ordered federal agencies two months ago to cease the practice, instructing Gemechu Lulesa, director of the inspection department, to follow up.

Neteru Wendwossen, director of treasury, is responsible for streamlining the single-account system.

Federal agencies that fail to comply were warned they would not receive money next year. They mainly use a zero-balance account (Z Account) system, which was instituted in 2005. The federal agencies receive funds through their accounts at the CBE, where cash is deposited daily by the Ministry from its treasury account held at the central bank. They can withdraw money from their accounts up to the monthly limit. However, they are required to deposit unutilised funds into the central treasury account at the end of each day.

Besides the Z Account system, federal agencies have projects paid by donors into designated accounts. Money is deposited in these accounts, but they are not balanced at the end of each day. Commonly known as "B" accounts, they are used to deposit revenues generated by federal agencies, which will subsequently be transferred to the central treasury.

Temesgen Worku (PhD), a management consultant and an assistant professor of finance at Addis Abeba University, believes a consolidated public fund arrangement will enable efficient oversight over cash flows and allow for the fungibility of financial resources.

“It'll also help to efficiently use the volume of idle balances kept in the banking system, thus reducing borrowing costs,” he said.

Since the early 2000s, the Finance Ministry has depended on an integrated budget and expenditure management (IBEX) system for accounts consolidation, budget control and administration. IBEX gives way to an Integrated Financial Management Information System (IFMIS) beginning in 2019. A single-account system is one of the eight components under IFMIS.

Administrators for federal agencies have doubts about the applicability of the single-account system.

“Merging expenditure and revenues in one account will be difficult,” said Wesen Abebe, head of finance at the Ministry of Urban Development & Infrastructure.

The Ministry is allocated a 5.4 billion Br budget for the coming fiscal year. It oversees 14 federal road projects formerly under the supervision of the Ethiopian Roads Authority.

Wesen cautions donor accounts will be an issue, too.

"Donors' preferences don't allow it," he said.

Tilahun Demisse, director of treasury at the Ministry of Justice, agreed. The Ministry will receive a 468 million Br budget next year if legislators approve the bill this week.

“Since projects funded by donors differ, they require a separate account,” he said.

The introduction of an entirely new system is never without its challenges. But experts warn it is more difficult with the single-account treasury system.

PUBLISHED ON

Jul 02,2022 [ VOL

23 , NO

1157]

Radar | Mar 02,2024

Fortune News | May 09,2020

Fortune News | Oct 09,2021

Fortune News | Aug 26,2023

Radar | Jun 19,2021

Radar | Aug 07,2021

Radar | May 25,2019

Radar | Oct 30,2021

Fortune News | Oct 12,2019

Radar | Jan 05,2019

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...