Fortune News | Jan 23,2021

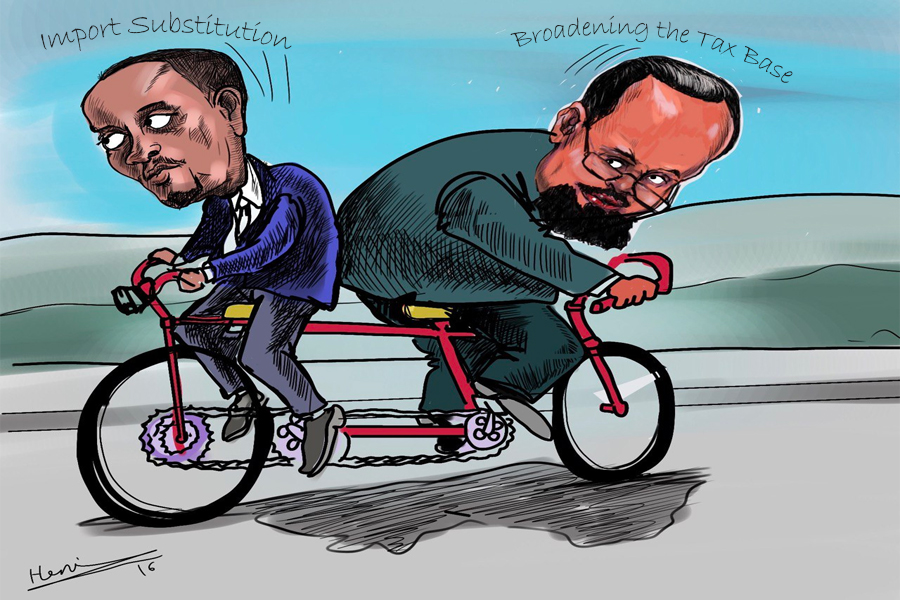

The federal government has finalised the overhaul of its domestic tariff book, a price index for imported goods, by placing a customs duty on each item. The existing book puts duties and tariffs on categories, not on each specific product. The revision also lowered tariffs on spare parts for locally-assembled products and raw materials for manufacturers.

The process was carried out by a committee drawn from members of the ministries of Finance, Trade & Industry, and Revenues along with the Customs Commission. The revision process began three months ago and affects all sectors and imported products, almost 6,000 in number. Before stepping into the revision, the team had conducted a diagnosis study to identify gaps in the book.

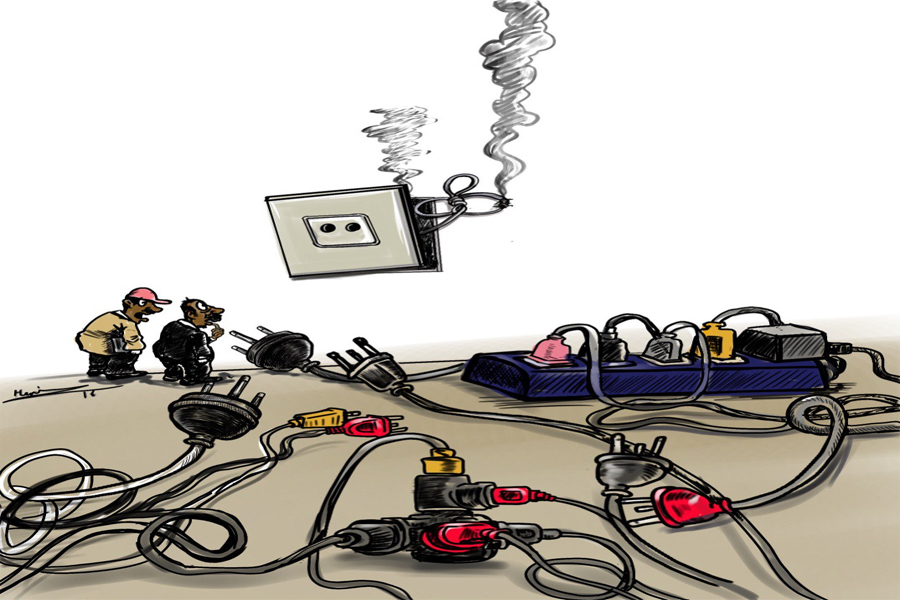

"We found out that the book was encouraging imports rather than local production," said Eyob Tekalign (PhD), state minister for Finance. "It has so many problems, such as levying a heavier duty on cotton than the end product – cloth."

Local assemblers, such as those who put together vehicles, mobile phones and television sets, will leverage a lower duty on the spare parts they import for assembly. Raw materials for local manufacturing will receive a duty cut.

As tariffs are an industrial policy, the government expects the revision to bring a major and significant change in the manufacturing industry and solve many problems, according to Eyob.

The work that is being done now is a revision of the national tariff rates on imported products, which have not been revised with regard to the economic structure of the country for at least three decades, according to Mulay Weldu, director of Tax Policy at the Ministry.

"We're adjusting the overall tariff structure in relation to the current social, economic and policy structure of the country," said Mulay.

The revision is being done in a way that is compatible with the tariff book of the World Customs Organisation (WCO), which revises its tariff book every five years, and each of its 183 member countries has an obligation to implement the changes within a year of the revision.

"One of the purposes of the tariff book is to create permanent tariff codes for products that are in the world market. Thus, following the WCO tariff revision is a must for member countries," said Yunus Tobiaw, tariff classification operation and support expert at the Commission.

The WCO released its last revised tariff book in January 2017, and as a member of the Organisation, Ethiopia implemented the revisions over a year late in 2019. Ethiopia has six duty tax rates ranging from zero percent to 35pc, which are applicable based on the type of good imported. Variation of duty tax rates is made to encourage the import of some goods by imposing the zero tax rate and at the same time discouraging importation of other selected goods by imposing a higher tax rate.

The late implementation was due to the many improvements and work that had to be carried out to solve problems and complaints in the industry sector and policy issues in the country, according to Kassaye Ayele, a tariff policy study and analysis team coordinator at the Customs Commission.

Even though the late implementation did not have major negative impacts, the fact that the national tariff of imported products is being revised prior to the issuance of the 2022 WCO tariff book will help Ethiopia maintain the same standards as other members, according to Kassaye.

"The WCO tariff book won't have major changes, and the fact that the national book is being revised now will aid in making implementation easier," said Kassaye.

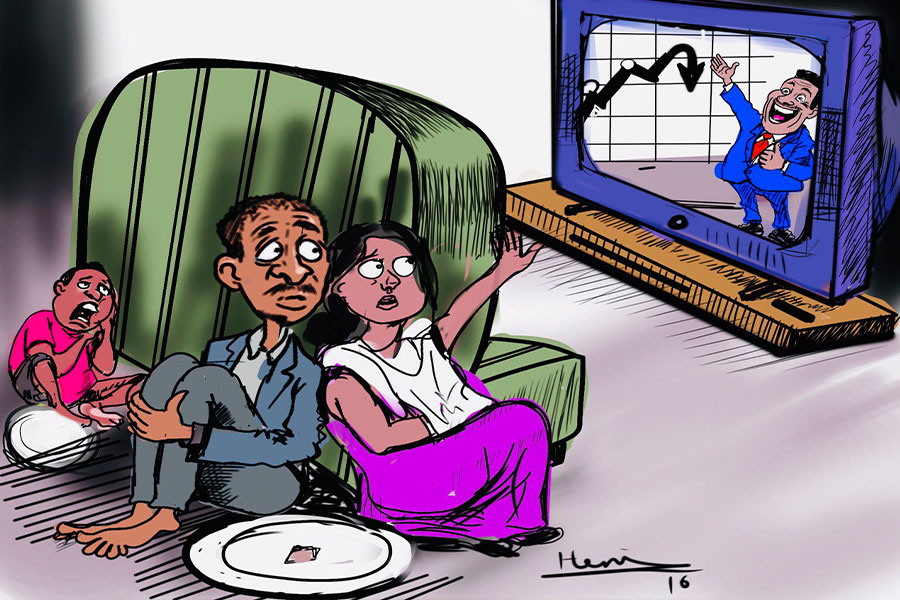

The revision by itself is important, but the fact that the revision focuses on revenue implications, clearing confusion on second schedule taxes and policy issues is more important, according to Andualem Tilaye (PhD), a senior researcher at the Ethiopian Development Research Institute.

Andualem added that doing a study prior to revision is a good step, but the most important thing lies in implementing the lessons learned from the study.

PUBLISHED ON

[ VOL

, NO

]

Fortune News | Jan 23,2021

Commentaries | Dec 19,2021

Fortune News | Aug 08,2020

Radar | Jan 11,2020

Fortune News | Jul 24,2021

Fortune News | May 25,2019

Radar | Jan 09,2024

Commentaries | Nov 05,2022

Radar | Jul 21,2024

Fortune News | Feb 09,2019

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...