Fortune News | Nov 05,2022

Dec 30 , 2023.

Ethiopia has stumbled into a precarious fiscal zone, marked by its first-ever default on external debt. The missed 33 million dollar coupon payment on a one billion dollar Eurobond, issued a decade ago, has sent ripples through the bond market, revealing the fragility of emerging economies in the global financial terrain.

A country with a storied past and a complex present, Ethiopia has come to embody the broader trouble developing countries face in managing external debt facing economic headwinds.

The Eurobond, acquired by a spectrum of investors, including American Beacon Frontier Market (125 million dollars), Templeton Emerging Markets Bond Fund (65 million), Picpit (51 million), and JP Morgan Emerging Markets Fund (31 million), was initially floated in the mid-2010s. Its purpose was to finance Ethiopia's ambitious industrial parks, offering a seemingly attractive 6.5pc interest rate, set to expire in 2024.

However, the unfolding scenario exposes the intricacies between sovereign debtors and international bondholders.

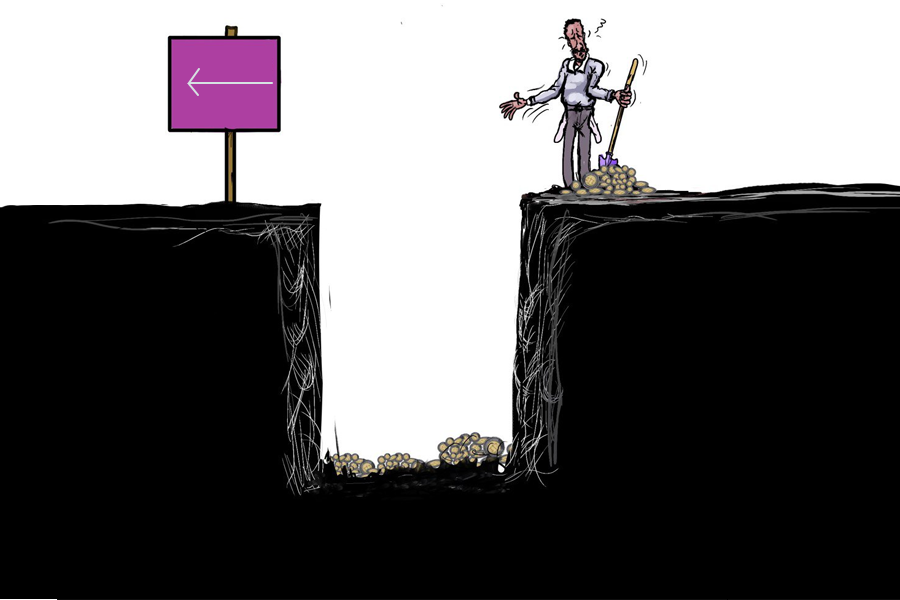

Now, treading the path of a few African countries at the brink of default, Ethiopia is confronted with a trilemma in its debt management strategy. It could repurchase the bonds from the secondary market, albeit at a considerable cost; refinance the debt; or seek a maturity extension from its creditors. The authorities have opted for the latter, proposing a four-year maturity extension and a subsequent four-year grace period, while cutting the interest rate to 5.1pc.

This approach has met with a lukewarm response in initial virtual meetings with bondholders, underlining the inherent problems in negotiating with private creditors first, known for their strong objections towards debt cancellations or 'haircuts' as the lexicon of the aid world prefers to use it.

Private creditors are not known to be as generous as official creditors. However, they have offered 333 million dollars in annual amortisation payments for a three-year extension. Ethiopia’s negotiators face the risk of holdout creditors, including the largest buyers holding its bonds.

The situation is further complicated by the legal jurisdiction of the bond sales in New York, which, while shielding Ethiopia from foreclosure risks, does not shelter it from the significant reputational damages a default could incur. State Minister for Finance Eyob Tekalegn contends that the default is not indicative of insolvency but rather a strategic alignment of debt servicing between bondholders and official creditors under the G20's Common Framework Agreement, which focuses on debt reprofiling from bilateral and private creditors.

It could also be a maverick move taken to compel the big bondholders into the discussion, dragging them out of their present reluctant state. This, however, diverges from the conventional wisdom that prioritises settling terms with official creditors before engaging private bondholders, showing a unique, albeit risky, manoeuvre by Ethiopian policymakers.

Ethiopia's economic recovery hinges on external factors like global economic conditions and donor support. The country is exploring various debt relief options, including a reduction in the stock of debt (HIPC-Lite), which could enhance government fiscal space and macroeconomic stability. The implementation of these debt relief options faces obstacles, especially in securing creditor participation and agreement.

Ethiopia's future depends on its ability to navigate through complex debt restructuring while promoting development and economic growth. However, its relationship with China, its largest external debtholder, is central to its debt predicament.

China's resistance to providing financial assurances under the Common Framework agreement complicates matters, as private bondholders are keen to gauge the extent of bilateral creditor support before making their own concessions. While offering liquidity relief, the Common Framework demands compatibility with the International Monetary Fund (IMF) programs and embodies a process replete with longevity, complexities and diverse creditor interests.

Ethiopia requires around four billion dollars in debt relief from its Paris Club creditors, who hold five per cent of its external debt stock, non-Paris Club (China, India and Turkey) 52pc, Eurobond seven percent, commercial banks 25pc and the remaining from the multilateral institutions.

Its public debt, ballooning to 57.1 billion dollars, about 50.1pc of its GDP, paints a grim picture of an economy under siege. The convergence of high debt levels, macroeconomic instability, and diminishing external support has effectively paralysed its economic progress. The downturn is exacerbated by soaring inflation and a widening fiscal deficit, eroding the purchasing power of its citizens and revealing a failure to maintain a balanced macroeconomy.

The debt service ratio, alarmingly high at 22pc, overshoots the IMF's recommended ceiling of 15pc, with a significant chunk of export earnings being channelled towards debt servicing. This is compounded by a sharp decline in official development assistance (ODA), which fell by over 40pc to 2.7 billion dollars following the outbreak of the civil war in the north in 2020. Such a drastic reduction in external aid undermines Ethiopia's debt servicing capacity and its development financing.

The country's reliance on external financing for development projects further aggravates the situation, which has led to an increasing expenditure allocation towards debt service and defence, overshadowing social services. The imbalance in fiscal priorities strains an already fragile economy, inhibiting its developmental trajectory.

Ethiopia's external debt also impacts its ability to invest in areas critical for economic growth and poverty reduction. The World Bank's International Debt Report shows the severity of the sovereign debt crisis among the world's poorest countries, with external debt service reaching a record high of 88.9 billion dollars in 2022. Ethiopia, alongside Ghana, Chad, and Zambia, is on the brink of a full-blown debt default by 2024.

Historically, Ethiopia's debt service as a percentage of exports was considerably higher at 260pc in the early 1990s. But this anecdotal reference offers little solace in the face of current pressures. The high debt-to-export ratio suggests vulnerability, but the influx of equity in foreign direct investment and the resumption of official aid, as well as a lower debt-to-GNI ratio, offer some hope.

PUBLISHED ON

Dec 30,2023 [ VOL

24 , NO

1235]

Fortune News | Nov 05,2022

Radar | Dec 25,2023

Radar | Mar 18,2023

Commentaries | Mar 18,2023

Commentaries | Jun 08,2019

Radar | Nov 03,2024

Radar | Jul 17,2022

Fortune News | Jun 12,2025

Editorial | Mar 18,2023

Viewpoints | Oct 21,2023

Photo Gallery | 175922 Views | May 06,2019

Photo Gallery | 166137 Views | Apr 26,2019

Photo Gallery | 156549 Views | Oct 06,2021

My Opinion | 136853 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...