Commentaries | Apr 03,2021

Prime Minister Abiy Ahmed (PhD) alighted in the French capital last week, ushering his high-level entourage, Mamo Mihretu, the central bank governor, and Ahmed Shide, his finance minister, into the "New Global Financing Pact" talks. He was met by the world's financial elite, including Ajay Banga, the new chieftain of the World Bank Group; Melinda Gates, the American philanthropist; Janet Yellen, the US Treasury's guardian; and Malfada Duarte, the helmswoman of the Green Climate Fund.

During a spirited panel discussion on the subject of multilateral development financing, Abiy delivered a lucid diagnosis of the daunting crisis cocktail beleaguering the African continent, a mélange of climate financing shortfalls, weighty debt burdens, and potent political instability. Abiy proposed a remedy of sorts, recommending that prior financing promises be upheld, more concessional loans and grants be awarded, and restructuring of IMF`s special drawing rights (SDRs) be instituted.

"Private and public debt has scaled new altitudes," the Prime Minister admonished the gathered financial titans.

The Prime Minister's plea for more favourable financial conditions, in light of Ethiopia's pressing debt burden, is a vivid illustration of the broader economic plight faced by many developing countries, particularly in Africa. The fiscal plan set forth by his Finance Minister to the Ethiopian parliament demonstrates the gravity of this issue. The budget bill proposes a 159 billion Br allocation to debt repayment next year, which only grazes the surface of the looming 27 billion dollars debt Ethiopia`s economy is shouldering. It appears that, despite all the rhetoric, the harsh reality of the country's economic straits cannot be ignored.

PUBLISHED ON

Jun 24,2023 [ VOL

24 , NO

1208]

Commentaries | Apr 03,2021

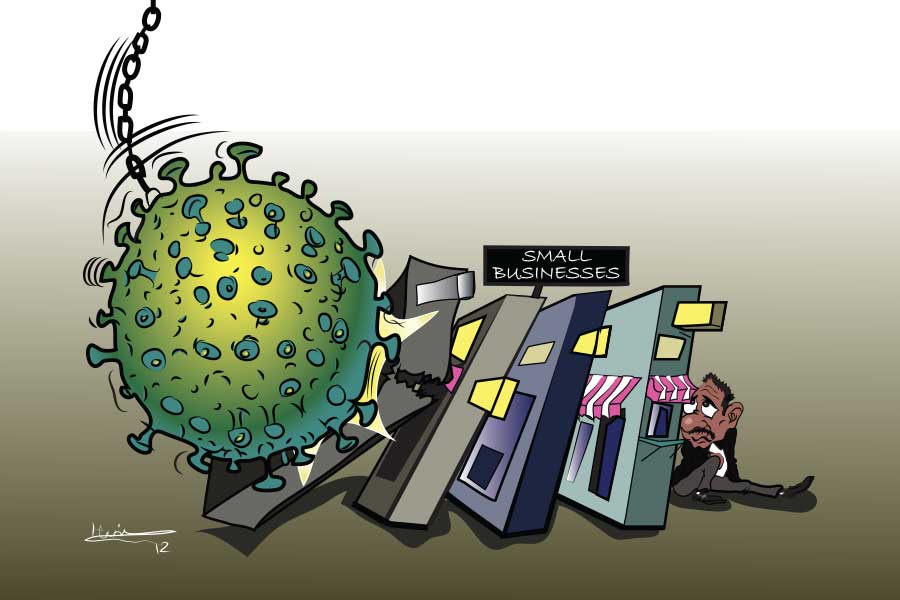

Editorial | Apr 04,2020

Viewpoints | May 16,2020

Life Matters | Mar 06,2021

View From Arada | Jul 17,2022

Covid-19 | Apr 08,2020

Commentaries | Jan 07,2024

Fortune News | Jun 01,2019

Editorial | Sep 30,2023

Fortune News | Mar 09,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...