Editorial | Dec 14,2024

Jun 1 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

Ethiopia’s oldest bank, DBE was reformed a decade ago to serve as a policy bank, financing mega projects that the EPRDF government had identified as priorities.

Ethiopia’s oldest bank, DBE was reformed a decade ago to serve as a policy bank, financing mega projects that the EPRDF government had identified as priorities. A Turkish businessperson, Mehmet Yesildag, came to Ethiopia five years ago with anticipatory energy and big hopes. He planned to establish a large leather factory with a production capacity of manufacturing 30,000 pairs of shoes a year.

Mehmet recalled things were welcoming then, and he had received a positive reception. The low cost of labour and energy were significant factors that contributed to his and his partners’ decision to invest up to 40 million dollars in Ethiopia through their company, My Shoes Shoe & Leather Manufacturing Plc.

He secured 70,000Sqm of land in Debre Berhan, 130Km north of the capital in the Amhara Regional State, and finalised the process of getting loans from the state policy bank, the Development Bank of Ethiopia (DBE).

Ethiopia’s oldest bank, DBE was reformed a decade ago to serve as a policy bank, financing mega projects that the EPRDF government had identified as priorities. Policymakers attached such important significance to its role that the National Bank of Ethiopia (NBE) passed a directive a few years ago whereby all private commercial banks funnel 27pc of their loans to DBE through bonds.

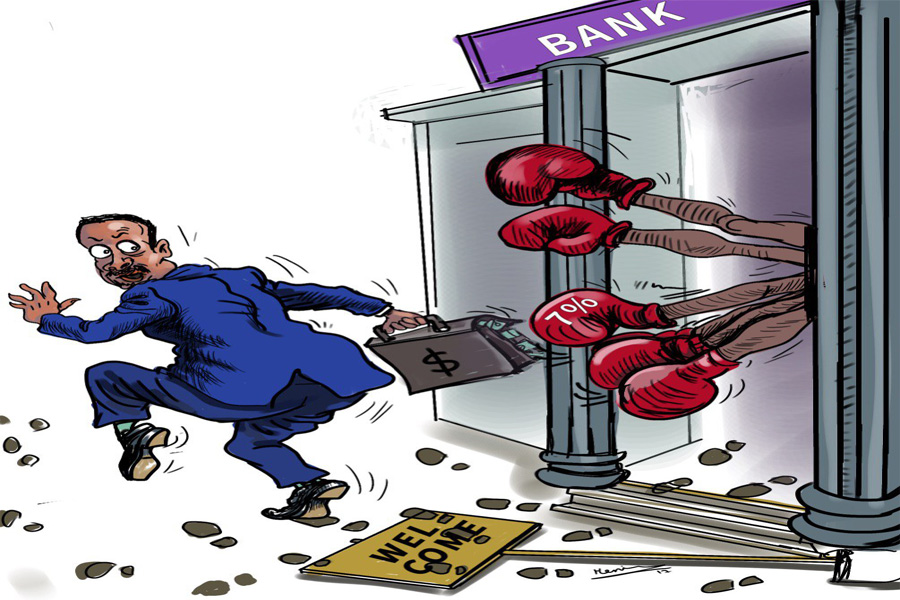

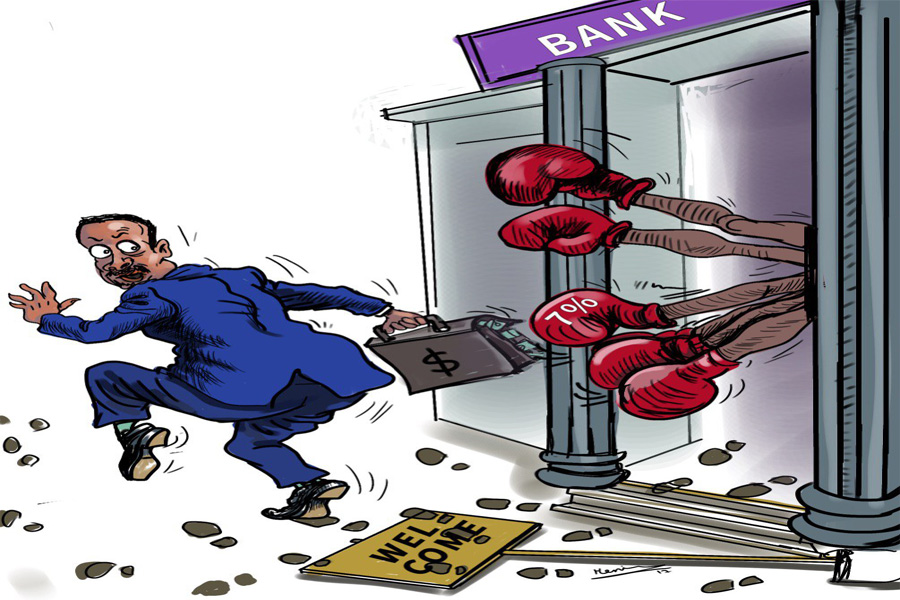

Mehmet’s project was one of the priorities for the government, along with other sectors from agro-processing and mining to extractive industries. My Shoes had hardly any difficulty in securing a 380-million-Br loan from DBE, of which two-thirds were already disbursed.

Mehmet’s project made his company one of the 167 Turkish investments registered in Ethiopia over the last decade alone. These companies obtained licenses to invest in joint ventures with local firms and individuals, some partnered with the government, while many more operated solo as foreign investors. They were hailed as symbols of policy success in attracting investments from overseas with the hope of bringing in capital, technology and marketing know-how. Additionally, their established presence in external markets would help bring in desperately needed foreign currency.

My Shoes was meant to fit into this grand plan. Pledged to employ 1,962 people, its founders had aspired to export products and generate an average of 34 million dollars annually during the first years of its operations. It identified client bases in Spain, England, France, the United States and Middle Eastern countries where it would ship its shoes.

The company began construction of the civil work for the factory’s plant - a steel-structure - five years ago. It took three years to complete with delays attributed to a lack of foreign exchange and the company’s inability to import raw materials. But troubles in servicing the debt with the Bank started even before the company began to bring in the machinery for production.

“Some six months ago, we were told by the executives of the Bank to suspend the project for 10 days,” Mehmet told Fortune.

The executives of the Bank informed Mehmet that they had some concerns about Turkish investments in Ethiopia and were about to initiate investigations of his company along with others. Despite the conclusion of the inquiry, Mehmet’s company was asked to pay interest on its loans during the six months it took the investigation to conclude.

“This led my company to default on the loan,” Mehmet claims.

The company joined the ranks of borrowers listed as carrying bad loans, aka non-performing loans (NPLs). These are loan whose borrowers fail to pay interest for longer than 90 days in a row. Banks are thus compelled to cover possible losses by holding a provision equal to the size of an outstanding loan that is considered non-performing.

DBE carries a massive load of such loans on its books as no other bank does. And its experience with Turkish companies is not one to celebrate. Five Turkish companies are recorded as holding 46pc of its total loans classified as non-performing. The slack has forced its executives to set aside 17 billion Br in provisions in the first three quarters of the current fiscal year. The amount represents 38.5pc of its total loans and advances outstanding, a fact admitted by them as “excessive”.

DBE’s board of directors was chaired by Girma Birru, a former high ranking minister now advising Prime Minister Abiy Ahmed (PhD). Successive leadership of the DBE, from Melaku Fenta to Ahmed Abitew and Shiferaw Shigutie - all former ministers - pursued these policy objectives, despite dangers looming over the health of the Bank.

Some of these loans are lost, not to be recovered in any meaningful way. Close to 300 million Br in loans advanced to companies such as Yirgalem Addis Textile Plc, Hotel De Leopol International and Ruchi Agri Farm are unlikely to be paid back. DBE has identified them as a “loss”.

But these are only three of the top 20 borrowers in the Bank’s NPL books, accounting for 61.1pc of total loans that are either doubtful, sub-standard or a loss. Companies involved in the manufacturing sector, such as Ayka Addis Textile, MNS Textile and BMET, take the lion share of 71.5pc of the bad loans. Those three investments originated from Turkey, and with factory plants in Sebeta and Legetafo between them, they owe DBE close to six billion Birr.

They are followed by those in the agricultural sector, which accounts for about 26pc.

These are, however, sectors the government listed as priority lending areas and directed resources to companies active in them ever since the mid-2000s when DBE’s board of directors was chaired by Girma Birru, a former high ranking minister now advising Prime Minister Abiy Ahmed (PhD). Successive leadership of the DBE, from Melaku Fenta to Ahmed Abitew and Shiferaw Shigutie - all former ministers - pursued these policy objectives, despite dangers looming over the health of the Bank.

Regulators at the central bank have an instrument they use in diagnosing how healthy companies in the financial sector are operating. The banking industry is their primary concern and focus, checking their capital adequacy, the quality of their assets, the competence of their management, and the status of their liquidity and earnings.

Known in the industry parlance as CAMEL, the draft rating report on DBE, issued last year by the central bank, is nothing but alarming. It shows that the Bank has been mired in deep financial woes, for the DBE lacked adequate oversight by the governing board, and its management failed to comply with its directives.

In the reported period, the Bank operated without a board of directors as it was in a transition between the former and the current board, which is now chaired by Tegegneworq Getu (PhD), a retired UNDP staffer. DBE also has had volatile management, with its presidents changing from Issayas Bahre to Getahun Nana and now Haileyesus Bekele, all within three years.

Meanwhile, DBE’s capital adequacy, a ratio of a bank’s capital to its risk, fell to a ‘deficient’ level from ‘satisfactory.’ The ratio, standing at 13.28pc, is lower than the minimum standard established for development financing institutions of 15pc.

Experts see a combination of factors leading to such crises. According to Abdulmenan Mohammed, a financial analyst based in London, DBE might have suffered from declines in its net worth, while at the same time increases in its loan size caused a drop in its capital adequacy ratio.

DBE’s managers may find solace in the fact that the Bank’s accumulated and high liquid assets could be considered a positive achievement. A massive amount of cash maintained in treasury bills while collecting medium-term funding from private banks through the 27pc bond requirement issued by the central bank has helped the Bank remain liquid.

The total assets of the Bank soared to 82.8 billion Br, mainly driven by investment in treasury bills that increased to 30.2 billion Br, whereas loans and advances went up to 42.8 billion Br.

“But its liquid resources were used inefficiently,” said Abdulmenan.

He is referring to the soaring level of sick loans, which led the asset quality of the Bank to severely deteriorate, for it is directly linked to the provisions set aside to cushion the bad loans. The series of defaults seen in the manufacturing sector indicates that there is a severe problem with manufacturing, which the government desperately wants to see flourish.

DBE also has had volatile management, with its presidents changing from Issayas Bahre to Getahun Nana and now Haileyesus Bekele, all within three years.

What failed to work in the manufacturing sector is part of the issue experts believe put DBE in dangerous waters. Another policy objective promoted by the administration of former Prime Minister Hailemariam Desalegn has helped the situation little. Lease financing, where the Bank pays for the procurement of heavy duty construction and agricultural machinery to lease out to users for them to eventually own it, has brought the Bank more difficulties. Loans taken through this scheme that are not performing reached 20.3pc. A former member of senior management staff blames the leasing scheme, alongside working capital financing, for contributing to the woes of DBE.

“The Bank should have focused on project financing, leaving lease financing to commercial banks,” this ex-senior manager told Fortune.

After the Bank launched lease financing, its management increased the number of regional offices to 13, while branch offices reached 107, pushing the total number of staff to 2,360.

“This led the Bank to lose focus and contributed to additional operational costs,” said the former manager.

When first established as the Agricultural & Industrial Development a couple of generations ago, DBE aimed to provide short, medium and long-term development credit. It had served as a financial vehicle for soft loans from development partners such as the World Bank, the African Development Bank and the European Investment Bank to various investments.

DBE, headquartered on Marshal Tito Road (behind Hilton Addis Abeba) in Addis Abeba, has a proud history of accomplishments.

Major state-owned enterprises and private investments such as the Ethiopian Airlines, Abyssinia Flights, MIDROC Lega Dembi Gold Mine, Mughar Cement, Fincha Sugar Factory, Awash Melkassa Aluminum Sulphate & Sulfuric Acid and Derba Cement owe their successes to financing from it. Many of these have paid back their loans, while those still working with it are not on its list of defaulters.

The other success story of the Bank is the conversion of unwashed coffee exports to premium quality coffee through financing secured from the World Bank. It was released in two phases and helped 139 companies to export quality coffee, boosting their export capacity and revenues.

Back then, the Bank’s role in the agricultural sector was vital, and it has disbursed over 800 million Br directly to peasant farmers to buy farming inputs and materials. The Bank played a significant role in the widespread practice of animal husbandry, improved breeds and investment in horticulture. Many of the cut flower companies that flourished over the past two decades would find it extremely difficult to thrive in the absence of such a development financing bank, geared by the state in helping them overcome the shortage in finance.

This record started to deteriorate as the government began to intervene in loan disbursements, undermining independent loan appraisal, review and risk assessments, factors the central bank finds have weakened. Such interventions have continued in the current administration, according to people knowledgeable of the Bank’s operation.

For people like Eyob Tesfaye (PhD), a macroeconomist who once served as director general of the Financial Institutions Supervision Agency, which oversaw the operations of DBE, the troubles with the Bank have been in the making for over a decade now. It is only that the magnitude of the problems has increased in recent years.

“In its current status, the Bank is severely damaged,” Eyob told Fortune.

Some years ago, the Agency identified deeper issues from lack of adequate management and thorough project appraisal to insufficient due diligence, project monitoring and corruption. No less critical was the absence of risk management at the Bank, Eyob recalled.

Known in the industry parlance as CAMEL, the draft rating report on DBE, issued last year by the central bank, is nothing but alarming.

However, all these problems were never addressed due to legacy issues, as well as the government’s belief that it is unimportant for a development bank to make profits or that Bank losses are not significant problems, according to Eyob.

Besides management problems, policy disfunction also led the Bank toward the current predicament. Observers see the direction the government took to expand the manufacturing, agricultural and export sectors as evidence of policy failures.

“Every project should have been evaluated based on its merit,” Eyob said. “Using these policy weaknesses, some borrowers, officials and employees of the Bank have used the opportunity for diversion and corruption.”

Much of DBE’s hardship surfaced in the two years beginning in 2013, according to Tegeneworq, the board chairperson. That was the time when billions of Birr were advanced in loans to companies wanting to get involved in commercial farms, mostly in Gambella Regional State. A number of them have failed such as Ruchi Agri Plc.

Its shareholders took 102.7 million Br from DBE to develop a commercial farm in Gog Wereda of Agnwa Zone, where the company leased a 5,199Sqm plot. It is unlikely for the Bank to recover this loan, as many of the other commercial farms have failed.

“We’re doing our level best to transform and turn things around,” Tegegnework told Fortune. “The board of the Bank is conducting analysis and a comprehensive transformation and reform program.”

The Bank’s leadership, both at the board and management level, say that not all is doom and gloom. The latter believes recent performance in loans disbursement - 6.93 billion Br in the last nine months - and collection of 3.42 billion Br from project and lease financing is evidence that DBE has positive results in its operational performance. The management described this in a letter to this newspaper as a “satisfactory level of performance.”

Consolidating on this gain may require the state to inject additional capital as the board of directors have placed a demand to the government for an infusion of seven billion Birr in capital. Several others see hardly any positive outcome from such a move, except another cycle of disappointment. Not even an injection of 100 billion Br in fresh capital will rescue DBE from its current paralysis, according to Eyob.

The former senior management member of DBE urges the government to do a complete overhaul of the management and form a new structure to resurrect the good name of the Bank.

“The Bank can’t be resuscitated,” Eyob says. “It’s better to close its doors and start a new development bank.”

He is not alone voice in advocating such drastic measures though.

Whatever the decisions the administration of Prime Minister Abiy Ahmed (PhD) may feel compelled to take, investors like Mehmet are waiting to see what happens next. But they see little hope in resuming the working relationship they once had with the Bank. He has already returned to Turkey,

“Very soon, we’ll go to court,” he warns. “We plan to open a case in an international court, because I have around seven million dollars in machinery, which I brought in as equity.”

PUBLISHED ON

Jun 01,2019 [ VOL

20 , NO

996]

Editorial | Dec 14,2024

Fortune News | Dec 19,2020

Editorial | Sep 27,2020

Fortune News | Feb 05,2022

Fortune News | May 04,2024

Radar | Jul 21,2024

Viewpoints | Jul 22,2023

Viewpoints | Apr 29,2023

Fortune News | May 13,2023

Radar | Jun 24,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...