Commentaries | Sep 02,2023

Feb 20 , 2021.

The late Prime Minister Meles Zenawi was in parliament in 2010, taking questions on his administration’s performance when MPs brought up the issue of living costs. The government’s use of monetary and fiscal policies and how these had impacted inflation were pertinent enough. By that time, for two years in a row, headline inflation had reached over 60pc, only to fall precipitously into de-inflation for a brief period in 2009.

That the central bank had failed to use its monetary policy tools and raise interest rates to combat inflation was a conviction of the political opposition in parliament. In Meles' book, however, taking a cue from the opposition was a downright “neoliberal” prescription. He was convinced that inflation was fueled by growth-induced demand. As far as he was concerned, the primary factor for the persistent rise in living costs was a rapidly expanding economy — with GDP then growing around 10pc.

There was truth to this. For the 24 years beginning in 1980, there were only three years where inflation went above 11pc. But over the subsequent 15 years since 2005, when Ethiopia’s economy expanded at the fastest clip in its history, annual inflation averaged around 16pc. This does not mean that the late Prime Minister considered the ascent in consumer prices an inevitable, acceptable outcome of a growing economy. But he did not want to take any measures that could slow down the growth, despite relentless nudging from Bretton Woods institutions.

Instead, he offered that "developmental" fiscal and monetary policies could be utilised to address rampant inflation. What these entailed were not specified during the parliamentary session. But it was evident. It meant subsidies and regulating prices. In the name of this rapid development, the central bank also continued to print money to cover the administration's budget deficit, thereby worsening inflation. Private banks were bullied into contributing 27pc of their gross loans and advances to purchase bonds issued by the National Bank of Ethiopia (NBE).

It was not an idea that could be called remarkable. The economy continued to expand, but a series of deficits in trade and the balance of payments ballooned. The country has fallen into a debt trap. The Birr was devalued against a basket of major currencies, and inflation reached 40pc in 2011.

The inflation rate may not be as high now, but it has persisted at double digits since 2017. Since January, it has remained around 20pc as the prices of items such as cooking oil and basic non-food items such as fuel have gone up. Teff, a staple crop that cost 20 Br a kilogram three years ago, now sells at well over double that price. Consumers are hard-pressed to find an item whose price has not gone up. Those in the fixed income group are feeling the pinch all the more.

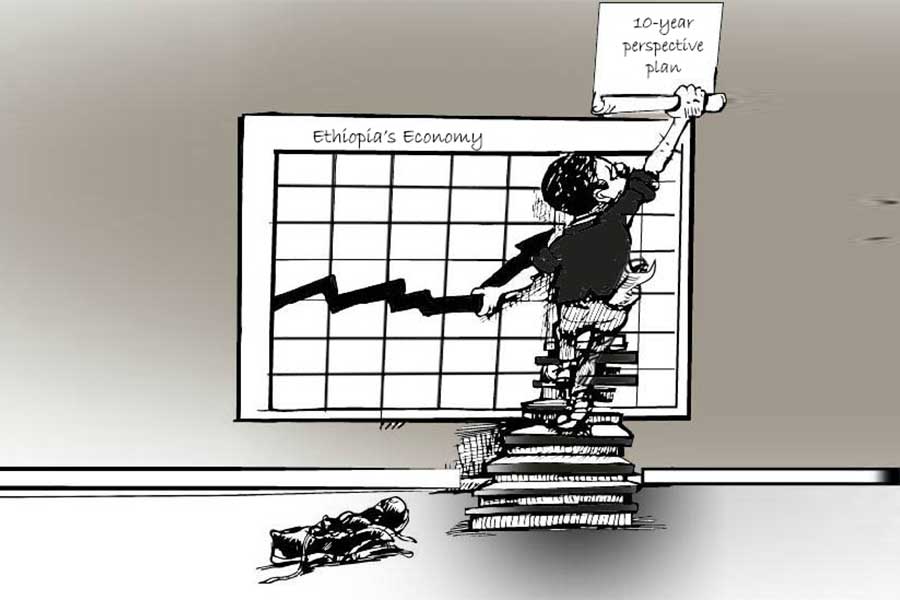

But the circumstances over which this new inflation has cropped up are different from Meles’ time in office. For one thing, it could not be said to be influenced as much by rapid economic expansion. Although Ethiopia would be one of the few countries to grow in 2020, the International Monetary Fund (IMF) predicts it has slowed down to just 1.9pc. This year, the Fund estimates that it will flatten, though the government’s own assessments are a great deal rosier. No surprises there though.

Indeed, this time around inflation is at least partly a consequence of monetary and fiscal policy decisions by the administration of Prime Minister Abiy Ahmed (PhD), the sort that would have led Meles to charge “neoliberal” if he was alive today. One of these reasons is the depreciation of the Birr by a third of its value toward a market-clearing rate. It is a move that the IMF applauds as the value of the currency is not reflected by the demand for it on the ground. Unfortunately, this also ensures that inflation would pick up as Ethiopia is import-dependent.

Another factor making inflation all but sure is the gradual lifting of subsidies on several essential goods and services. This was most recently on fuel oil, which the government has subsidised by 24 billion Br over the past two years. This subsidy was given a 25pc haircut over the past month. The administration has also ended subsidies on sugar and is gradually lifting it from electricity.

Here again, this is a policy that could have made sense. Under normal times and ordinary situations, such policy developments would be commendable. Fuel prices are among the lowest in Ethiopia, where retail prices are nearly twice as much on average globally; and Ethiopia's neighbours have tariffs on electricity three to 14 times as expensive. These changes, whatever their merit, are bound to lead to rises in the cost of living.

They can be painful in the short-term, but they are also the appropriate tools to address the economy's structural imbalances. This is especially true if the administration can maintain budget discipline, unlike its temptations for public investments designed to impress and little to show value for money. A reason for optimism as the budget deficit moderated and debts by state enterprises slowed may not last long.

Treasury bills have also been introduced as an alternative to the central bank's tradition of printing money. Lower subsidies, a more competitive exchange rate, deregulation and budget discipline are essential for the country to have a resilient economy that is adaptive and flexible to challenges and emerging opportunities. If only the prevailing political system is conducive for such an economic reorientation as it once was. The consequences of such policy measures are grave, and they are better taken by a government with a popular mandate, whose ascent to political power is through contested and credible elections.

For the past six years, the country has been rocked by political violence. Since November 2020, it has been the scene of war in Tigray Regional State. While an enabling legal environment and infrastructure are critical to free market-leaning policies geared at incentivising the private sector, the minimum requirement is, nonetheless, stability. None of these policies mean much when there is uncertainty over whether or not the state can protect citizens' lives, safeguard private property, or ensure that business activities are not regularly disrupted.

Facing such economic predicaments then, subsidy cuts and the Birr's gradual depreciation could fuel hyperinflation (inflation, typically, over 50pc). Governments, faced with such inexorable challenges, usually resort to printing money, which will finally shatter the economy.

It is critical to swallow the hard pill on the political front and engage in dialogue to cease active military hostilities. Independent investigations into atrocities that have been committed and the withdrawal of Eritrean forces, whose presence in Tigray is getting less arguable, are implicit in this.

The authorities, advised by policy wonks keen on advocating "neoliberal" prescriptions by Bretton Woods institutions, can confidently execute a programme that could help the economy be more competitive on the international stage. They would have better political buy-in for their objectives. More importantly, they could run the economy with a more concerted focus on the monetary and fiscal policy fronts, which would not be walled up against the consequences of political insecurity.

This won't be easy as the political front's uncertainty is more daunting in the run-up to the national election. Time appears not to be in the administration's favour in the face of mounting economic hardships. The temptation for policymakers would be to print money, having a false hope that they can cross the bridge before the flood catches up. Whether or not they use a policy lexicon as "quantitative easing," taking the most travelled road in flooding the market with freshly printed notes will be the most reckless move. It will only come from a misdiagnosis of the economy's structural imbalances, if not underestimating market forces driving its fundamentals, and ignoring the stormy political environment.

PUBLISHED ON

Feb 20,2021 [ VOL

21 , NO

1086]

Commentaries | Sep 02,2023

My Opinion | Dec 19,2020

My Opinion | May 08,2021

Commentaries | Apr 13, 2025

Viewpoints | Jul 29,2023

Editorial | Mar 28,2020

Fortune News | Sep 09,2024

Editorial | Dec 26,2020

Radar | Aug 13,2022

Viewpoints | Dec 29,2018

My Opinion | 132272 Views | Aug 14,2021

My Opinion | 128692 Views | Aug 21,2021

My Opinion | 126600 Views | Sep 10,2021

My Opinion | 124206 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...