Fortune News | Mar 28,2020

Debub Global Bank, one of the youngest banks, has launched two new premium branches at a cost of approximately five million Birr. The two branches that were launched at the end of last week will replace the former three branches that were serving as premium branches.

The first branch is located inside Churchill Hotel on Churchill Avenue, and the second one is located in the new Noah Real Estate building next to Alem Cinema on Africa Avenue. The Bole premium branch occupies around 155Sqm, while the Churchill premium branch rests on 200Sqm of land. Both branches have employed a total of 20 individuals. The branches' soft opening is expected to be held this week.

Debub had previously opened three premium branches located in the Lebu and Bole Medhanialem areas and one in its head office near Stadium.

However, none of these branches operate as a premium banking branch anymore, according to Endalish Woldemichael, director of marketing & resource mobilisation at the Bank, which hired 562 workers over the last fiscal year, bringing its total number of employees to 1,477.

"We weren't able to achieve the customer segmentation we aimed for," said Endalish.

The new branches, which target corporate customers, are equipped with meeting venues for customers and WiFi and an interior layout where customers can receive consultations privately. The interior arrangement, which does not have the usual counters, allows customers to interact with tellers in an open setting while still maintaining their privacy by means of glass partitions.

"We want our customers to feel like they came to a hospitality centre," stated Endalish.

The clients that the Bank classifies as corporate are customers who have large deposits, those who bring in a substantial amount of forex, and those who have a high number of shares.

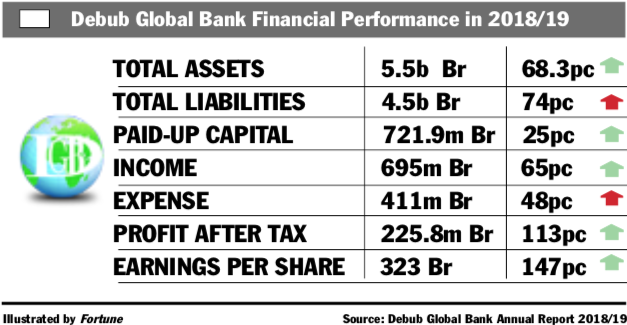

The Bank, which grossed 1.1 billion Birr over the last fiscal year, invested two to three million Birr in each premium branch.

"We've recorded the highest amount of deposits from our Stadium premium branch," said Endalish, elaborating that the reason for that could be because that particular branch is also the Bank's headquarters.

Premium branches are designed to target corporate clients who have exceptional bargaining power and less flexibility, noted Kinfemichel Yibkaw, who has two decades of experience in finance.

The return on investment might not be worthy of the cost of setting up these branches, but it is crucial in remaining competitive in the banking sector, according to Kinfemichel.

"There's a lot of poaching of corporate clients," he said, with the reasoning being that they bring in foreign currency.

So far, Bank of Abyssinia and Dashen Bank have availed premium branches.

In addition to the premium branches, Debub Global has opened two regular branches located near Dejach Wube and Hayat Beshale, increasing its total number of branches to 98.

The opening of these branches and a few more that are in the works is for the Bank to expand its customer base through financial inclusion, according to Endalish.

The Bank also plans to launch interest-free banking branches once it fulfills compliance regulations established by the National Bank of Ethiopia (NBE), according to the marketing director.

PUBLISHED ON

Jan 02,2021 [ VOL

21 , NO

1079]

Fortune News | Mar 28,2020

Viewpoints | Jul 26,2025

Viewpoints | Jul 24,2021

Fortune News | Dec 25,2021

Viewpoints | Jan 13,2024

Fortune News | Jan 26,2019

Fortune News | Oct 05,2025

Viewpoints | Sep 28,2019

Fortune News | Jan 25,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...