Agenda | Oct 12,2019

Jan 21 , 2023

Developing countries often use devaluation of currencies to encourage economic growth, yet its repercussions can often be profoundly detrimental. Ethiopia's past few decades have been blighted by numerous financial adversities, and devaluation has become an attractive proposition for many on the policymaking front. However, before deciding, the adverse impacts of doing so should be considered alongside its potential benefits, given the structural issues affecting the export sector, argues this writer, whose identity has been withheld upon request.

The policy decision to devalue the Birr against a basket of major currencies can be perilous, given the current scarcity of foreign exchange and the compounding implications of devaluation. Policymakers must consider whether Ethiopia’s economy has the strength and resilience to bear the risk before moving forward. Devaluing the Birr can bring about a plethora of adverse outcomes, such as raising import costs and, thus, inflationary pressures, dissuading foreign investment, reducing consumers’ purchasing power, and a decline in productivity.

These effects can give rise to various social and political issues, such as diminished human development, exacerbating inequality, and periods of public unrest. Before advocating for devaluation, Ethiopia ought to weigh policy choices to boost its economy, such as creating value-added products, refining agricultural goods through technologically savvy production, expanding exports and market offerings, building investors’ confidence, and developing an import substitution and export-oriented economy.

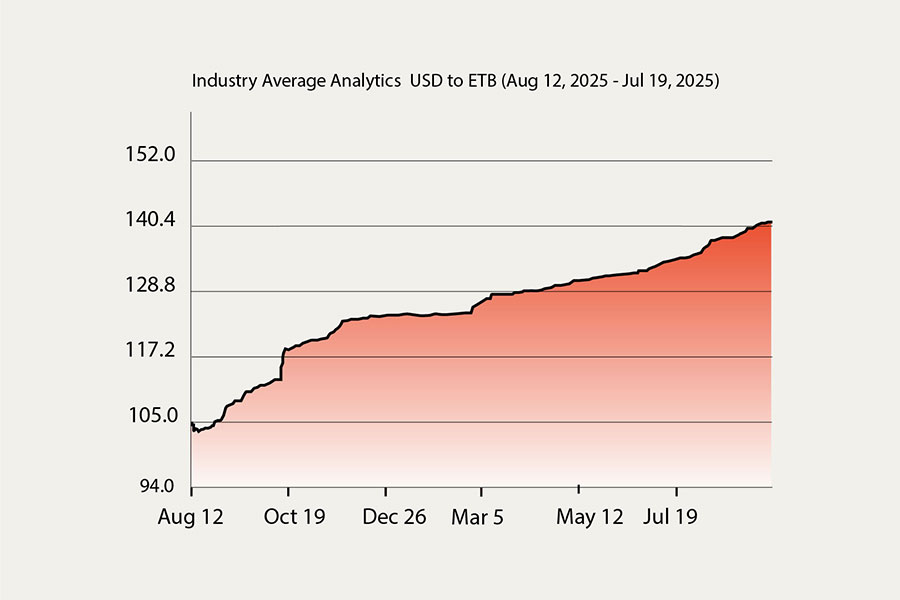

Currency devaluation is when a country’s government reduces the value of its currency, purposefully pegging it down against another currency rather than letting market forces determine its value. A Dollar was exchanged in the official market for 53.37 last week. If the Birr is devalued, we would have to shell out more for the same dollar (the international currency of trade).

Currency devaluation involves taking measures to strategically lower the purchasing power of a country’s own currency. Generally, developing nations resort to this monetary policy tool to gain a competitive edge in global trade, improve the balance of payments and reduce sovereign debt burdens. Industries get a boost to export more as domestically manufactured goods win over imported items in a price war. Government debt becomes more manageable as the outstanding loan value reduces in local currency.

Devaluation, however, can have unintended consequences that are self-defeating. A weak domestic currency makes exports more competitive in global markets; simultaneously, it pushes imports to get expensive. Higher export volumes spur economic growth, while costlier imports also have a similar effect, for consumers opt for alternatives to imported products. Sales of domestically manufactured products increase, thus giving a healthy boost to the national economy.

The cheaper currency also promotes the inflow of capital investment as foreign investors find returns attractive, and international tourism flourishes as it becomes cheaper to travel domestically. This improvement in terms of trade generally translates into a lower current account deficit (or a more significant current account surplus), higher employment, and faster growth in the gross domestic product (GDP). The stimulating monetary policies that usually result in a weak currency also positively impact capital markets, boosting domestic consumption through the wealth effect.

These arguments, however, assume that the supply of exports and demand for imports are very flexible. Ethiopia should export much more (and earn much more hard currency) when export prices rise in local currency, and imports would significantly decline when their prices increase in Birr. In all episodes of significant devaluation in Ethiopia, a substantial increase in export earnings and a decline in imports were never witnessed.

One reason is that there is no sufficient productive capacity (in factories and farms) and no conducive economic environment to increase the volume of exports when prices rise quickly. On the import side, Ethiopia’s economy cannot replenish imports when prices rise. A large proportion of imports are essential items such as petroleum (three billion dollars last year), medicines (906 million dollars), industrial inputs (2.4 billion dollars) and capital goods (2.8 billion dollars). An increase in these prices would not discourage imports.

Devaluation would lead to a rise in the price of imports (in local currency), thereby creating inflationary pressures rather than reducing the quantities of imported goods. A chronic trade deficit economy can only have high-import dependence and meagre hard currency reserves. The exchange rate would have a disastrous impact in the long haul, including uncertainty for those planning long-term investments; wild, unpredictable swing in exchange rates; loss of industrial and trade policy tools for economic transformation; the very likely scenario of high inflation; exacerbated inequality, and worsened capital flight.

Currency devaluation can harm the county’s debt burden, increasing the value of its debit in foreign exchange. This burdens the country more to service its debt, further diminishing its growth rate. Currency devaluation may lower productivity since capital equipment, and machinery imports may become too expensive. Devaluation significantly reduces leverage overseas.

Imports will become more expensive as the Birr stands weaker against the Dollar. As the currency value depletes, with a ripple effect, production costs may also increase without wages increasing. Finished products may become costlier. And to remain competitive, pressure on margins may also be high. With the same wages, the cost of living rises if all of these become expensive. With the same money in the hands of the larger population, purchasing power plummets. Livelihood becomes even more challenging as the essential needs of the poor become expensive.

Devaluation can also have several social and political consequences. It can cause a decline in the country’s human development due to a negative impact on social programs and education. It can also lead to an increase in inequality, as individuals and businesses most vulnerable to the effects of devaluation may be unable to withstand the shock. In the political realm, devaluation can cause a plunge in public support for the government due to the perceived unfairness of its application.

Devaluation also sometimes could lead to a drop in investments. Foreign investors become less keen to invest when a country devalues its currency causing growing uncertainty. They may view devaluation as a sign of economic instability, leading to reduced investments and impeding economic development and growth. While the intentions could be novel, policymakers need to put a thinking hat on and consider the overall impact of devaluation on the economy and the larger population. With the current shortage of foreign exchange and the overall spiralling possible impact of devaluation, there is a significant amount of risk in the devaluation process.

Is Ethiopia’s economy stable enough to take such a risk?

It is time for policymakers to ponder upon this paramount issue.

The other way to boost the economy long-term could be by selling more value-added products and earning more foreign exchange. Building the confidence of foreign investors and providing stability to generate interest in Ethiopia and skills development should be our priorities. Substituting imports by promoting the domestic industry and granting incentives to specific sectors should also be on the agenda, making the country more productive and competitive. This can deliver better growth and give a boost to the economy.

Ethiopia had been one of the fastest-growing economies in recent years, just before the Covid pandemic; it should once again be able to bounce back and not fall prey to external pressures.

PUBLISHED ON

Jan 21,2023 [ VOL

23 , NO

1186]

Agenda | Oct 12,2019

Radar | May 29,2021

Viewpoints | Oct 21,2023

My Opinion | Aug 14,2021

Agenda | Dec 14,2019

Money Market Watch | Sep 27,2025

Radar | Jun 21,2025

Sunday with Eden | Apr 13, 2025

News Analysis | Jan 05,2020

Fortune News | Dec 05,2018

Photo Gallery | 171625 Views | May 06,2019

Photo Gallery | 161864 Views | Apr 26,2019

Photo Gallery | 151604 Views | Oct 06,2021

My Opinion | 136313 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...