My Opinion | Feb 23,2019

Siraj Mohammed, a local butcher in Qera, the hub for abattoirs in Addis Abeba, has been experiencing a surge in demand for beef during the month of Ramadan and the holiday season.

After skinning and assorting the meat for households, he finds himself with a bag of hides from the cattle he dealt with. Despite being an essential input for the leather industry, Siraj considers cattle hides, priced at 200 Br, sheepskin at 80 Br, and goat skin at 10 Br, as an afterthought. These are not a tenable source of income for him.

Although Ethiopia boasts the continent’s largest livestock population, with over 160 million cattle, sheep, and goats, the leather industry has not kept pace. Last year, the country’s leather export earnings dropped by nine percent. Leather and its finished products accounted for only one percent of the 4.1 billion dollars earned in merchandise exports.

Ethiopia’s annual livestock output includes approximately 2.7 million cattle hides, 8.1 million sheepskins, and 7.5 million goatskins. However, the sector’s vast potential remains untapped, with nearly 60pc of the costs in producing finished leather products arising from the hides’ price.

Tanneries in Ethiopia have been grappling with a forex shortage that has hindered them from producing at full capacity.

Addis Abeba Tannery S.C., a 97-year-old company, had to cease production due to the lack of chemicals. Despite its capacity to process 1,500 hides daily, the forex crunch forced its managers to halt operations.

Endris Ibrahim, the manager and major shareholder of Addis Abeba Tannery, blames the unavailability of numerous chemicals required at each stage of the tanning process in the desired quantity.

“The chemicals brought in by importers are subpar and of limited amount,” Endris said.

After ceasing production, the company faced difficulties paying off bank loans of 50 million Br. After resuming from a year and a half hiatus following a flood that damaged machinery at the ASCO Plant in the capital, one of the largest tanneries in Ethiopia was met with bleak market conditions.

According to Endris, maintaining the Plant’s fixed costs alone costs five million Birr monthly, while restarting operations, including importing machinery, cost the company 37 million Br.

“We pay employees without production,” he told Fortune.

Several employees of its 420-strong workforce have voluntarily left the company since, realising that production was unlikely to commence any time soon. While Endris understands that the foreign currency shortage is not unique to their company, he is uncertain about the prospects of the nearly century-old company.

Only four of the 46 inputs necessary to process leather products are locally sourced.

Solomon Getu, secretary of the Ethiopian Leather Industries Association, observed the shortage of chemicals has forced some producers to use plastic as an alternative. He calls for a policy change prioritising foreign currency access to the industry.

The Association he runs is working to trademark Ethiopian Highland Leather (EHL) internationally, with success already in countries like Japan. Formed in 1994 with 189 members, it has faced numerous difficulties with its members going out of business more frequently than in the past.

The foreign currency retention scheme, in which exporters are allowed to utilise only 30pc of their dollars for their own use, also contributed to the industry’s lacklustre performance.

“Capital markets and the entry of foreign banks signal some hope,” Solomon told Fortune.

Solomon is deeply passionate about the industry, with over 36 years of experience in the leather sector. He believes that Ethiopian cattle hides have a fibrous structure that is unparalleled by any other in the world, claiming that the gloves used by famous golfer Tiger Woods are made of Ethiopian leather.

Solomon emphasised the need for a change in the general mindset towards leather, stating that it is seen as a mark of prestige, with tourists usually buying one or two items on their visits. He is excited about the potential of a new generation of designers to revitalise the leather industry.

Several shops selling leather products in the Stadium area showcase bags, jackets, and shoes made by domestic designers. Yoseph Gezahegn, who runs one of these shops after taking over from his father, has observed a significant price increase over the years. While the price of one square meter of sheepskin costs around 50 Br, colouring chemicals, zippers, buttons, and other additions to the raw input inflate costs.

Yoseph mainly buys sheepskin, claiming its texture and strength are best suited for making jackets. He employs two cutters and a sewer to produce jackets based on designs he deems necessary. Yoseph observed low demand for local leather products, as most people prefer to buy synthetic products imported from abroad.

“We barely sale if tourists are not coming,” he told Fortune.

Haymanot Abebe, a saleswoman from Dream Leather Products, shares similar concerns. She says that the shortage of chemicals has forced tanneries to increase prices, leading customers to prefer imported synthetic products over domestically produced ones.

“Sales are down, but costs are higher,” she said.

In 2019, federal government authorities lifted the 150pc tax on semi-finished leather products to boost exports.

“We’re focused on exports,” said Belaynesh, the communications director for the Minister of Trade & Regional Integration (MoTRI).

Leaders of the Association stressed the importance of creating an enabling policy environment that fosters strong industry linkages. Its President, Redman Bedada, urged the authorities to treat leather like other vital exports such as coffee, tea, and rubber to help make Ethiopia the next business hub.

“Business as usual will not work,” Redman said at the launch of this year’s “All African Leather Fair.”

Wendu Legesse was once director-general of the Ethiopian Leather Industry Development Institute, a federal agency tasked to promote the leather industry. He believes linkage between industries is essential as he recommends integrating manufacturers that exclusively produce leather products and those who use it as additional input to make products such as shoes to utilise the vast resource base fully.

“A sustainable value chain is important,” Wendu told Fortune.

Currently a national project coordinator at UNIDO, Wendu believes that the country has vast potential in the sector, which requires the integration of efforts across multiple sectors. He also emphasised the importance of environmental impact considerations and compliance with labour rules in creating a sustainable leather industry.

Tanneries in Mojo town, which currently dump their waste into the local environment, are also set to be relocated if the leather city project is fully realised. In October last year, UNIDO Director-General, Gerd Muller, visited local tanneries as part of an initiative to build a leather city project in Mojo town, where 13 of the 30 tanneries are housed.

Financed by the European Investment Bank, the project has yet to be realised; it sought to build a waste treatment plant, shoe and chemical factories, and a dozen tanneries. While the return of footwear behemoths such as Huaijan holds promise, the future of local leather industry producers remains uncertain.

Ethiopia was selected by UNIDO as one of the pilot beneficiaries of a program aimed at increasing the role of light industries, including leather. A UN agency promoting industries in member countries, UNIDO has been conducting several projects to boost Ethiopia’s leather industry, including restructuring the Ethio-International Footwear Cluster Cooperative Society and training on the importance of clusters for the leather industry.

Ethiopia’s leather industry’s future hinges on overcoming multiple challenges, including the forex crunch, chemical shortages, and a lack of prioritisation from policymakers. Industry insiders and experts urge the government to create an enabling policy environment to foster strong inter-industry linkages and prioritise access to foreign currency for the sector.

PUBLISHED ON

Apr 22,2023 [ VOL

24 , NO

1199]

My Opinion | Feb 23,2019

Editorial | Dec 11,2020

Money Market Watch | Apr 13,2025

Radar | Oct 31,2020

Fortune News | Aug 18,2024

Commentaries | Dec 14,2024

My Opinion | Sep 21,2019

Agenda | Aug 31,2019

Viewpoints | Sep 21,2024

Fortune News | Sep 10,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

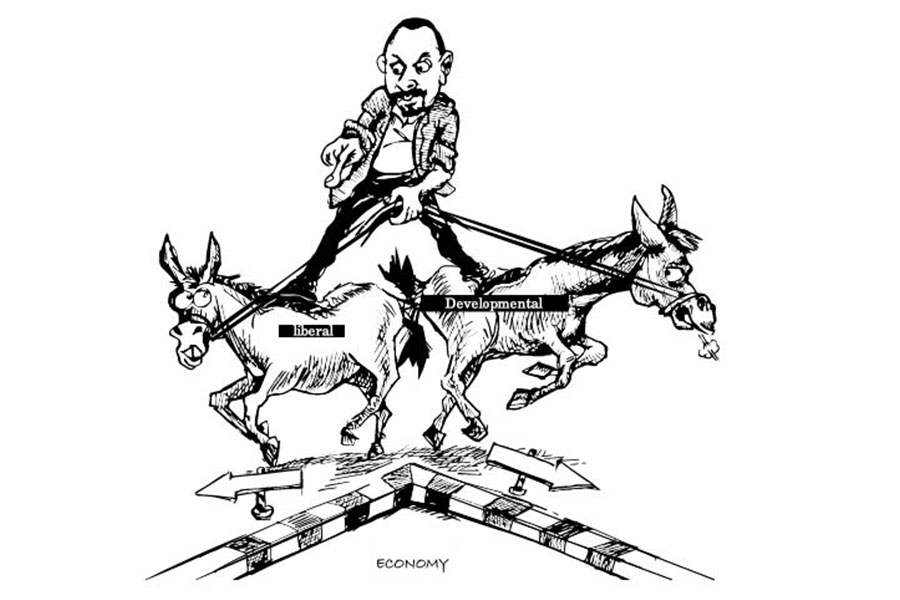

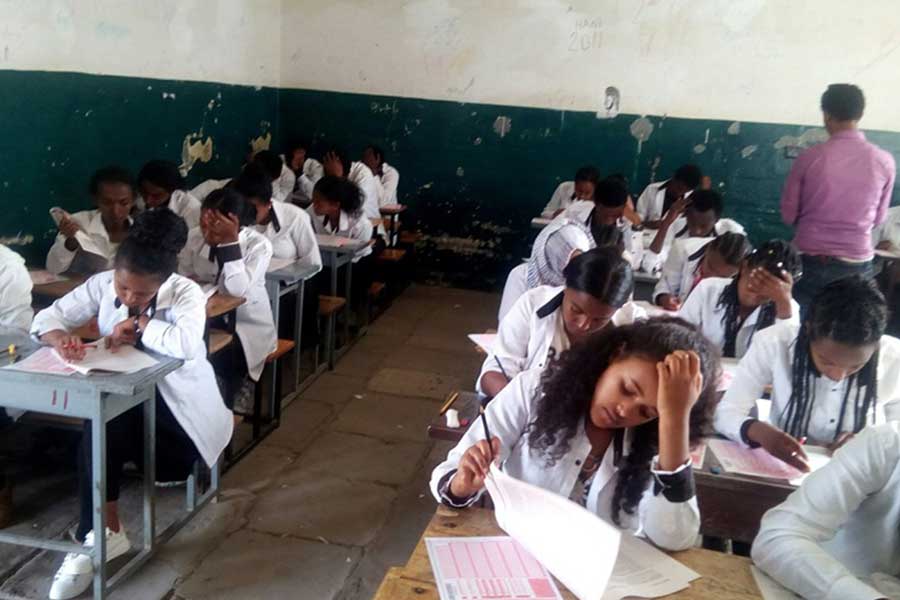

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...