Amidst an impressive recovery from a precarious position marked by alarmingly high levels of non-performing loans (NPLs), the Development Bank of Ethiopia (DBE) is facing criticism from investors over its decision to discontinue funding for rain-fed agricultural projects.

Agro-investors and technology providers gathered at the Ethiopian Agricultural Investment Forum 2024, held last week at Millennium Hall, Airport Rd. Organised by the Ministry of Agriculture, the two-day event featured a panel discussion with representatives from the central bank, DBE, the private sector, and donors.

During the discussion, investors expressed concerns about the full potential of the agricultural sector remaining untapped. Million Bogale, a commercial investor from Oromia Regional State, argued that the sector—from small farmers to large-scale investors—needs more support.

"If DBE is going to focus on profit like other banks, it should drop development from its moniker," Million said.

Million underlined the need for financial backing from a policy bank, particularly for agricultural inputs, stressing that agriculture requires patience and long-term commitment. He noted that key export commodities such as spices and oilseeds, which generate foreign currency, are primarily rain-fed.

Kibrete Alemayehu, another investor operating in the Illubabor and Awi zones of Oromia and Amhara regional states, echoed Million’s sentiments. She expressed disappointment that DBE's favourable interest rates are restricted to irrigation-based projects, arguing that this does not inspire confidence among investors.

DBE President Yohannes Ayalew (PhD) responded by clarifying that while rain-fed agriculture is not entirely excluded from the bank's offerings, service providers can still access lease financing for mechanisation, such as tractors and combiners, at affordable rates, if they are organised in a cluster. However, Yohannes firmly stated that commercial farms can only access DBE’s project financing if their farms are irrigated.

“We invest where there is profitability and a high return on investment,” said Yohannes. "This is the first criterion for lending."

He defended the decision recalling DBE’s non-performing loans (NPL) have since fallen to 6.5pc, with 4.5pc of that comprising lagging loans to rain-fed agriculture made before 2018—primarily in northern Ethiopia.

"Non-irrigated farms are not even insured," he said.

Ethiopia, with approximately 16.3 million hectares of arable land, relies heavily on rain-fed agriculture. Of the 7.2 million hectares with irrigation potential, only 1.2 million hectares are currently under cultivation.

According to Dereje Abebe, investment director at the Ministry of Agriculture, apart from food consumption, the majority of produce, such as sesame and soybeans, are cultivated with rain-fed agriculture schemes. He argues that thorough research into the practice should be conducted by lenders, indicating that not all lands are suitable for irrigation.

"Discontinuing support was not the right decision,” he told Fortune.

Experts also warn of the potential negative impacts of financial restrictions on rain-fed agriculture. Tegegn Debele, a rural development expert from Gonder University, recommended that DBE enhance its risk management practices by assessing which crops are best suited for specific seasons and regions.

DBE's shift in loan portfolio management began around five years ago, the same time as 160 investors in Gambella Regional State defaulted on loans totaling over 2.2 billion Br. The policy bank’s NPL ratio had surged to 57pc, prompting a stringent approach to loan management.

Out of a potential 850,000hct for farming in the region, 530,000hct is suitable for rain-based agriculture, while 320,000hct can be irrigated. Currently, 200,000hct is farmed using rainwater while a mere 12,000hct is under irrigation schemes.

Gambella Investment Commissioner Lou Obup (PhD) underlined the potential consequences of limiting support for rain-fed agriculture, including job losses and reduced crop yields. While he acknowledged the benefits of irrigation in enabling year-round production, he noted the importance of further development of irrigation infrastructure.

Similar challenges exist in Benshangul Gumuz Regional State, where out of 3.5 million hectares of potential farmland, 1.19 million hectares is currently cultivated using rainwater, while irrigated farms cover only 37,000hct. Babekir Halifa, head of the regional Agriculture Bureau, noted that developing the irrigation sector requires significant time and investment, posing additional challenges.

Investors called for the establishment of a specialised agricultural bank to support farmers and agro-investors. However, Yohannes expressed scepticism about the viability of such a bank, doubting that it could offer loans at seven percent interest using depositors’ money.

Access to finance was also spotlighted as a critical issue for agricultural investment. Fikadu Digafe, vice governor of the central bank, noted the need for creating conducive financial access to attract investors. He said that recent macroeconomic reforms would increase cash flow, which could help finance the sector.

"The agricultural sector should be supported with basic technology," Fikadu concluded.

PUBLISHED ON

Aug 18,2024 [ VOL

25 , NO

1268]

Fortune News | Sep 27,2020

In-Picture | Apr 30,2024

Radar | Jun 07,2025

Fortune News | Sep 10,2021

Sunday with Eden | May 24,2025

Fortune News | Feb 16,2019

Radar | Mar 16,2024

Fortune News | May 24,2025

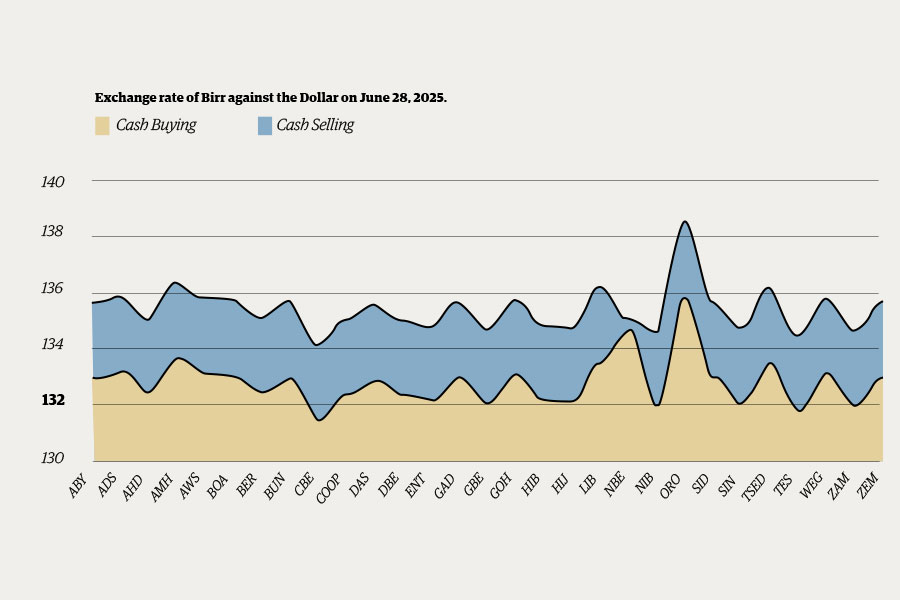

Money Market Watch | Jun 29,2025

Delicate Number | May 31,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...