Fortune News | Mar 18,2023

Jul 15 , 2023

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Commercial banks contending with a worsening liquidity crunch initiated a study to delve into the root cause, under the auspices of the Ethiopian Bankers' Association.

Seemingly, the Association that lobbies for 21 banks under Abie Sano wishes to back the liquidity crisis, which took a toll on the financial institutions ever since the pandemic, exacerbated by the two-year conflict, mandatory treasury bonds and developmental projects.

Bank executives gathered for a discussion at the headquarters of the Commercial Bank of Ethiopia (CBE) three weeks ago.

Financial experts have started compiling data related to the disbursed and non-performing loans from each commercial bank, according to Demisew Kassa, secretary general of the Association.

He expects findings from the study to be helpful in figuring out structural weaknesses and applying remedies while serving as input for the regulators.

"We're also looking into the amount of money printed by the central bank," he said.

According to Demissew, the combination of economic slowdown, and non-performing loans in the war-stricken Tigray Regional State piled on by the compulsory purchase of treasury bonds by the central bank has led to the problem.

"It's an undeniable truth that there is a liquidity constraint," Demissew told Fortune.

In an effort to fill a widening budget deficit, the central bank signed off a directive in October of 2022 ordering the commercial banks to purchase treasury bonds with five-year maturity dates.

The total outstanding credit of the banking industry stands at 1.8 trillion Br, according to the second quarter report by the National Bank of Ethiopia (NBE), while 181.8 billion Br in fresh loans was disbursed in the quarter.

The total deposit within the banking industry stands at 2.05 trillion Br, which is nearly double the amount from two years ago.

Girum Tsegaye, president of Berhan Bank disclosed his Bank has significantly cut down on its loan approvals over the past year. He has observed throughout the years that a small but temporary liquidity squeeze occurs between the months of October and February as businesses move to fulfil their tax duties.

"It used to go back to normal after March," he said.

Berhan has piled up half a billion Birr approved loan requests which have not been disbursed. Girum claims to be unsure about the source of the liquidity crunch while he acknowledged that his Bank has started to painstakingly look at deposits before disbursement.

"If we can't manage our loan-to-deposit ratio, we could fail," he cautioned.

This comes amidst a total budget appropriation for next year that would source 30pc of its financing from domestic borrowing, as Minister of Finance Ahmed Shide pointed out to Parliament last month.

The bankers have been pleading with the central bank to rescind its imposition of compulsory T-bond purchases throughout the year.

Worku Lema, vice president of Oromia Bank, believes pinpointing the precise source of the intensified industry-wide liquidity shortage is tricky as a lot of different factors are at play.

He said that Oromia Bank has not been conducting an in-depth study on the liquidity shortage, while he believes the economic slowdown and the compulsory treasury bond purchase could be major contributors.

As one of the largest eight banks in the country, Oromia Bank has frozen mortgage and vehicle loan privileges for its employees. They only get emergency loans, said Worku.

The Bank, which netted 1.2 billion Br in profits last year has prioritized exporters and a few other trusted clientele in its disbursement of loans.

"We should try and protect our bank," Worku told Fortune.

Exporters have been feeling the squeeze the most with a decreased loan portfolio of the banks.

Fikadu HaileMariam, a major shareholder at Home Land Bitta-Woshi Estate Coffee Plc, has been trying to gain credit from three commercial banks this year to no avail.

He had managed to export 250qtl from a farm located in Keffa Zone, South Western Regional State, but is having trouble gaining a 10 million Br credit line to cover harvesting, labour and transport costs. Fikadu fears that the harvest season will pass by without him having access to credit.

"I go to the Banks on a weekly basis," he told Fortune in a defeated tone.

Financial consultants do not believe the liquidity crunch will be resolved anytime soon, advising commercial banks to prioritise short-term loans.

Yosef Getachew, finance and investment consultant and CEO of Rise Addis Advisory believes that the liquidity crunch is a result of the government forcing huge bond purchases to finance its budget deficit.

He observes that unless policymakers change their approach, financing large-scale projects with long-term loans will not be feasible for the banks.

"It won't be solved anytime soon," he said.

Yosef advises banks to promote fixed-time deposits to their customers with higher interest rates which could be considered as an investment rather than a saving. With decreasing purchasing power, most people rather invest their money than save, said Yosef.

PUBLISHED ON

Jul 15,2023 [ VOL

24 , NO

1211]

Featured | Aug 10,2025

Radar | Nov 20,2021

Fortune News | Feb 19,2022

Covid-19 | Mar 28,2020

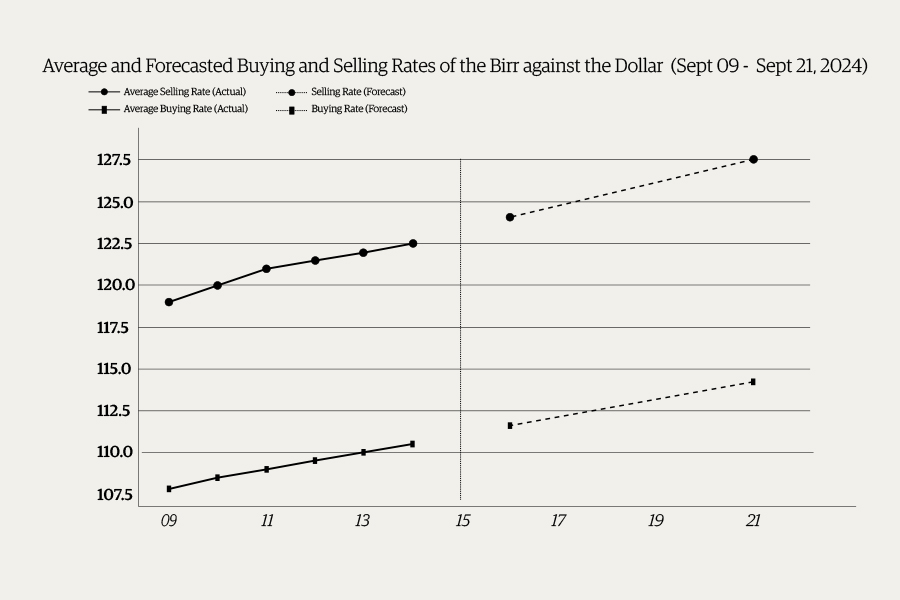

Money Market Watch | Sep 14,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...