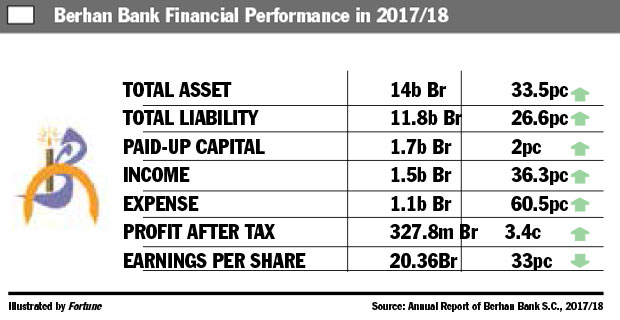

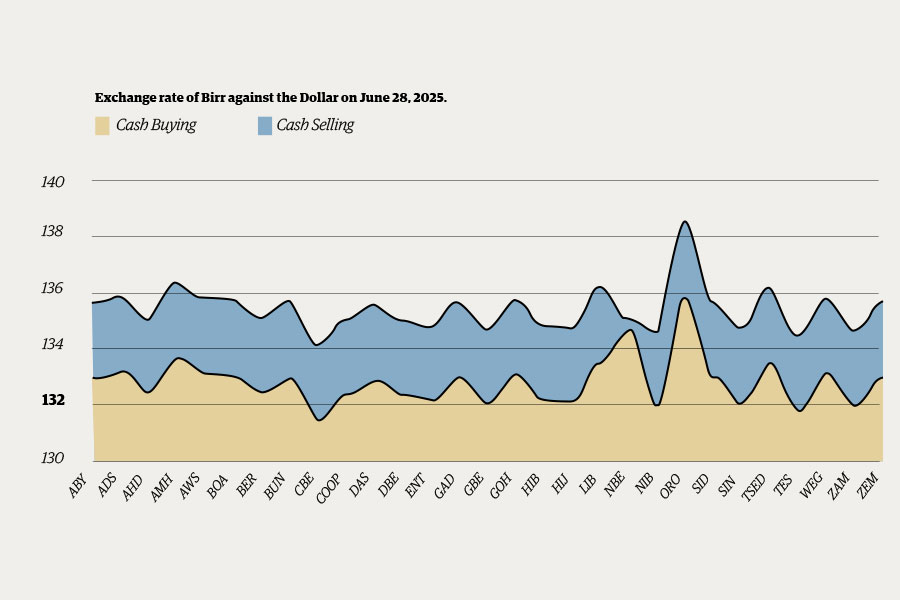

Fortune News | Nov 27,2018

Berhan Bank is steering an increasingly competitive banking landscape marked by modest profitability despite a solid asset size and an equity base. Its fiscal year 2022/23 performance revealed only a slight increase in net profits and a marginal growth in earnings per share (EPS), illustrating the executives' difficulties in income generation and cost management.

The Bank's returns on equity (4.46 billion Br) and assets (33 billion Br) fall short of market leaders, revealing room for better asset utilisation and profitability. However, its asset base is nearly double that of Enat Bank's 17.21 billion Br, significantly higher than Debub Global Bank's 14.09 billion Br and Addis International Bank's 10.79 billion Br. Such a disparity in asset size indicates a potential variance in market reach and operational scale among these banks of similar tiers.

However, a different picture emerges when the lens is shifted to Return on Equity (ROE) and Return on Assets (ROA). Berhan Bank's ROE stands at 11.8pc, and its ROA at 1.6pc, figures while respectable, are eclipsed by its peers. Enat Bank posted a slightly higher ROE of 12.8pc and an ROA of 1.9pc, showing a more efficient utilisation of shareholder equity and asset management. Debub Global Bank's ROE and ROA, at 13.8pc and 2.1pc, respectively, further extend this trend.

However, the most striking contrast would be presented by Addis International Bank, which posts an ROE of 19.2pc and an ROA of 3.9pc despite its smaller asset size, significantly higher than the other banks.

With a capital exceeding three billion Birr, Berhan Bank is a player with the prospect for growth. However, its EPS of 15.6pc pales compared to industry goliaths such as Awash and Abyssinia banks. The disparity in EPS, alongside the ROE and ROA figures, places Berhan in a moderate performance tier.

Over the past fiscal year, the Bank’s tepid performance has sparked concern among shareholders, leading to animated discussions at the annual general assembly held three weeks ago at the Millenium Hall on Africa Avenue (Bole Road). Berhan Bank reported a modest growth in net profits by 6.3pc to 508.63 million Br, a sharp contrast to the 146pc growth rate from the preceding year. This growth is significantly lower than its peers, with Zemen Bank leading at 1.8 billion Br, followed by Abay Bank at 1.5 billion Br and Bunna Bank at 949 million Br.

With shareholder discontent rising and the looming capital threshold requirement of the central bank, Berhan Bank's future hinges on strategic improvements in deposit mobilisation, loan disbursement, and operational efficiency.

Incorporated in 2009 with 97 million Br paid-up capital raised from 12,000 shareholders, Berhan Bank has grown significantly. However, it still falls short of the central bank’s capital threshold requirement by 1.65 billion Br, with a deadline looming in June 2026.

Adding to the concern was the marginal growth in share earnings, which increased by only 0.26 Br to 156.12 Br. This led to significant shareholder unrest, prompting the Board Chairman, Gumachew Kussie, to apologise. His attempt to slake shareholders' worries by unveiling an architectural design for the Bank's new headquarters, planned to lie on 5,400Sqm in the financial district, seemed to have little impact, as the sluggish growth in EPS remained a critical issue.

Berhan Bank’s Acting President, Solomon Assefa, attributed the modest performance partly to the need for capital injection and regulatory risk reserves.

"Regulatory risk reserves also played a role," he told Fortune.

Financial statement analyst Abdulmenan Mohammed (PhD) pointed to the surge in financial intermediary income as a primary reason for the modest growth in net profits.

There was a notable increase in Berhan's assets portfolio, with a 36.3pc rise to 45.05 billion Br. The Bank’s investments in government bills and bonds amounted to 3.8 billion Br, representing 8.5pc of its assets. Despite this, Berhan Bank trails behind Abay and Bunna in assets.

Berhan Bank reported non-distributable reserves of 8.33 billion Br and a capital adequacy ratio (CAR) of 15.4pc, almost twice the regulatory threshold. It generated 4.39 billion Br in income from interest on loans, advances, and central bank bonds, marking a 38pc growth. However, its net fees and commissions revenues dropped by 20.3pc to 435.17 million Br, and other operating income halved to 228.17 million Br. These factors, combined with increased operational expenses, undermined the substantial growth of financial intermediation income.

Berhan Bank's interest expenses increased by 28.5pc to 1.6 billion Br, and wages and benefits rose by 32.8pc to 1.62 billion Br. Its total operating expenses for the year were 4.5 billion Br, ranking third among its peers.

According to Solomon, the Bank’s inability to earn income from fees remains a significant concern, particularly noting the lull in processing new letters of credit due to backlogs.

"We stopped for half of the year," he told Fortune.

The Bank disbursed 27.35 billion Br in loans and advances, a 30.6pc increase from the previous year. However, Berhan incurred more expenses throughout the year than its earnings, raising concerns about its cost management strategies.

Some of the 16,781 shareholders expressed concerns over alleged mismanagement and accountability, citing a 32 million Br donation made to public projects like Ge'beta Le'hager and sudden management reshuffles.

Debebe Mamo, a shareholder who bought shares six years ago worth 118,000 Br, was disappointed over declining dividends and the Bank’s performance, questioning the leadership's strategies in mobilising deposits and disbursing loans.

"The dividends are even lower than the deposit interest rate," he told Fortune.

A branch manager working for the bank since 2019, speaking on the condition of anonymity, attributed some of the Bank’s issues to management failure. He believes in the need for more extensive management reshuffles and credited the Bank's strategy in retaining corporate customers and allocating foreign currency under the former president, Girum Tsegaye.

"His only mistake was not replacing the entire management," he said.

The manager also noted that conflict in recent years had impacted the performance of his branch, with only 70pc of targets met due to business slowdown.

However, Berhan Bank’s deposit mobilisation grew by 29.8pc to 33.78 billion Br, and its loan-to-deposit ratio increased slightly to 81pc. The ratio of cash and bank balances to total assets has also declined, a trend that has persisted over the past few years. Its provision for impairment of loans and other assets dropped by 7.7pc to 311.15 million Br, a figure still considered substantial.

Abdulmenan recommended that the management reduce the provision for asset impairment to an acceptable level.

"It has reached a reasonable limit," Abudulmenan cautioned.

With a background working for the central bank, the now defunct Construction & Business Bank (CBB) and Nib Bank, Solomon faces the challenge of steering Berhan Bank through these turbulent times. The 51-year-old veteran banker who graduated in economics from Addis Abeba University acknowledged the need to focus on resource mobilisation and credit management to maintain healthy liquidity levels.

The banking industry is highly competitive, characterised by a mix of rapidly growing players and established banks. Banks like Berhan, while holding significant market share, do not lead the industry. Their asset quality, liquidity, and profitability are crucial for success, but profitability ratios, capital adequacy, and income balance with expenses reveal their moderate position.

Berhan Bank, along with Enat, Global, and Addis International banks, might be targeting specific market niches or customer segments underserved by larger banks. The regulatory environment and economic conditions, including changes in banking regulations, significantly influence these banks' performance. Their place in the industry reveals a sector where size does not always correlate with profitability or efficiency.

While Berhan Bank leads in assets, it lags slightly behind in profitability metrics. This points to potential areas for strategic refinement, particularly in enhancing asset utilisation and equity returns. Smaller banks like Addis International demonstrated that a focused, efficient approach can yield high returns, despite a smaller operational scale.

PUBLISHED ON

Dec 16,2023 [ VOL

24 , NO

1233]

Fortune News | Nov 27,2018

Radar | Jun 15,2024

Featured | Jul 27,2019

Fortune News | Apr 13,2024

Radar | Oct 23,2023

Fortune News | Mar 12,2022

Radar | Feb 29,2020

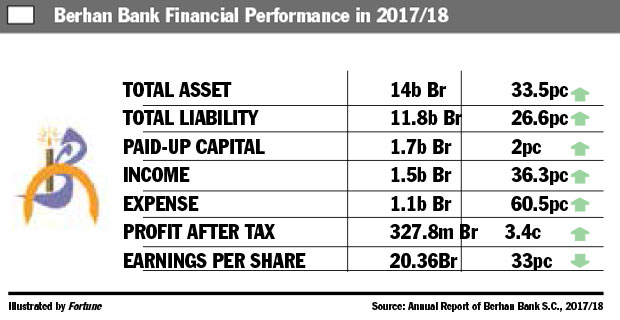

Money Market Watch | Sep 28,2024

Featured | Feb 16,2019

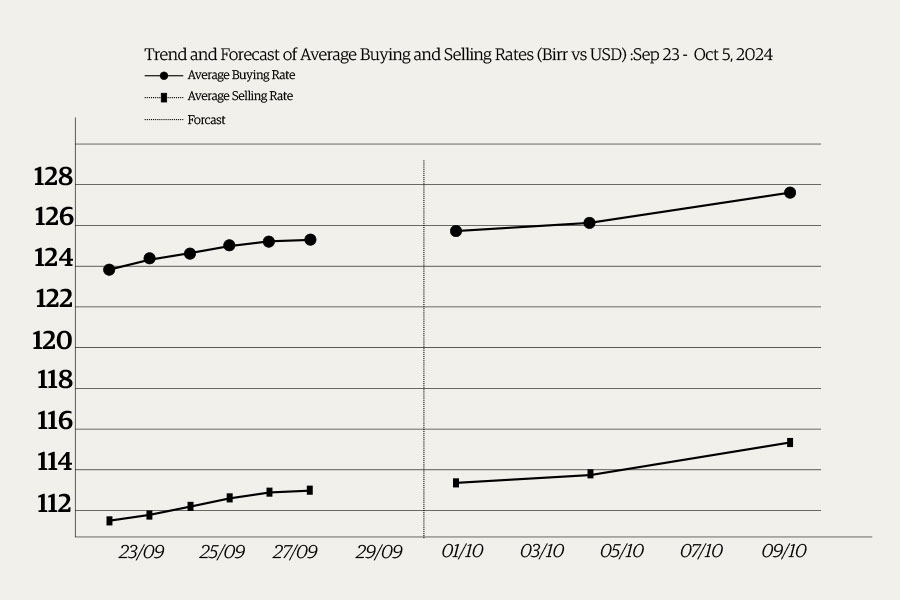

Money Market Watch | Jun 29,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...