Apr 8 , 2022.

By the government's own admission, the macroeconomic reality for Ethiopia is distressing. Consumers battered by inflation find the answer to their bind in life in the first-quarter report recently released by the central bank. It gives clarity on why inflation is pushing consumers to a breaking point, with all of the socio-political crisis this entails.

Start with the federal government’s dismal revenues mobilisation. It declined by a tenth, to 73 billion Br compared to the same period in the previous fiscal year. This is bad in itself. It gets worse when factoring in the expenditures in the same period, which ballooned by just over a quarter, to 111.3 billion Br. Its fiscal deficit this year was thus five times higher than at a similar period in the previous year.

Neither is there good news on the external sector front. Despite the relentless depreciation of the Birr making imports expensive - and hoping against hope that exports become competitive - the import bills keep growing. While few would expect the trade balance to go into surplus even in a generation, it is telling that the import bills still ballooned by nearly a fifth, reaching 4.1 billion dollars, over four times the amount received in export revenues at the same time. The main offenders were fuel, which surged by a whopping 80pc, and consumer goods such as edible oil and wheat.

Taken together, the balance of payments, transfers with other countries, now has a deficit of 972 million dollars, five times as high as in the same period in the previous fiscal year. Standing between the economy and outright insolvency is growth in goods exported, precisely coffee, service proceeds and remittance, having increased at an average of around 20pc.

These numbers may sound distant to the daily lives of average citizens. But they explain why every good and service they consume gets harder and harder to afford. The external sector crisis translates into a fiscal debacle that the federal government has to make up for somehow. Currently, it is on a money-printing binge to shore up its finances. The addiction to deficit financing is powerful.

Here too, the direction the economy is heading should be terrifying.

Central bank direct advances are a mainstay in federal budgets, but it was hoped that the administration of Prime Minister Abiy Ahmed (PhD) would turn to the floated bond market by selling government-backed securities (treasury bills) instead – a way of raising money with limited impacts on the overall money supply. The administration has done this, but its spending needs have also proven gargantuan. The central bank has continued to finance the federal government. It has shelled out 113.5 billion Br in the first quarter of this year, 266.1pc more than the same period last year. The broad money supply in the economy, from saving deposits to currency outside of banks, has climbed by more than a quarter, 10 percentage points higher than what the International Monetary Fund (IMF) urges Ethiopia's authorities as prudent behaviour.

No wonder then that headline inflation has been stubbornly high. In February, it was 33.6pc, a 10-year record. Food inflation was 42pc.

It is a macroeconomic storm hailing on citizens' income and savings, throwing many into poverty by the day. Consumed by official rhetoric of "prosperity", Ethiopia appears to have given up on the decades-old battle to overcome poverty.

In better times on the global and domestic fronts, such economic predicaments could have created what economists refer to as an “upward slopping” movement in short-term supply. When prices increase – following an increase in the money supply – it incentivises producers to supply to the market more before contracts and wages also catch up.

Ethiopia is unlikely to benefit from this silver lining as it suffers from a structural supply shock. The civil war in the north damages agricultural productivity, causing it to shrink by over three million tonnes. The escalation in import prices, including inputs, eats on profit for suppliers. Most critically, supply chain disruptions and Russia's invasion of Ukraine have sent global prices for commodities such as fertilisers, fuel, and edible oil into an upward spiral. It is nearly impossible to increase productivity and improve employment rates under such circumstances.

Ethiopia has entered a stagflationary trap, a phenomenon where prices escalate, wages remain depressed, and the unemployment rate hits the roof.

The good news is that it can be addressed. But it needs strategic leadership in both the fiscal and monetary policy frontiers that are not only determined. It takes policymakers willing to put the economy's health ahead of political expediency.

Start with fiscal policy. Austerity is in order. The federal government’s spending is getting out of hand, and if it does not stop, it will likely bankrupt the country. It may not even be fitting to call it austerity because it is the prosecution of a war that is driving spending. Putting an end to the civil war in the north and resolving the growing insurgency in the south-west can reduce fiscal deficits by no small fraction. The need for arms imports, wages for an expanded army and expenditure on humanitarian responses will go down.

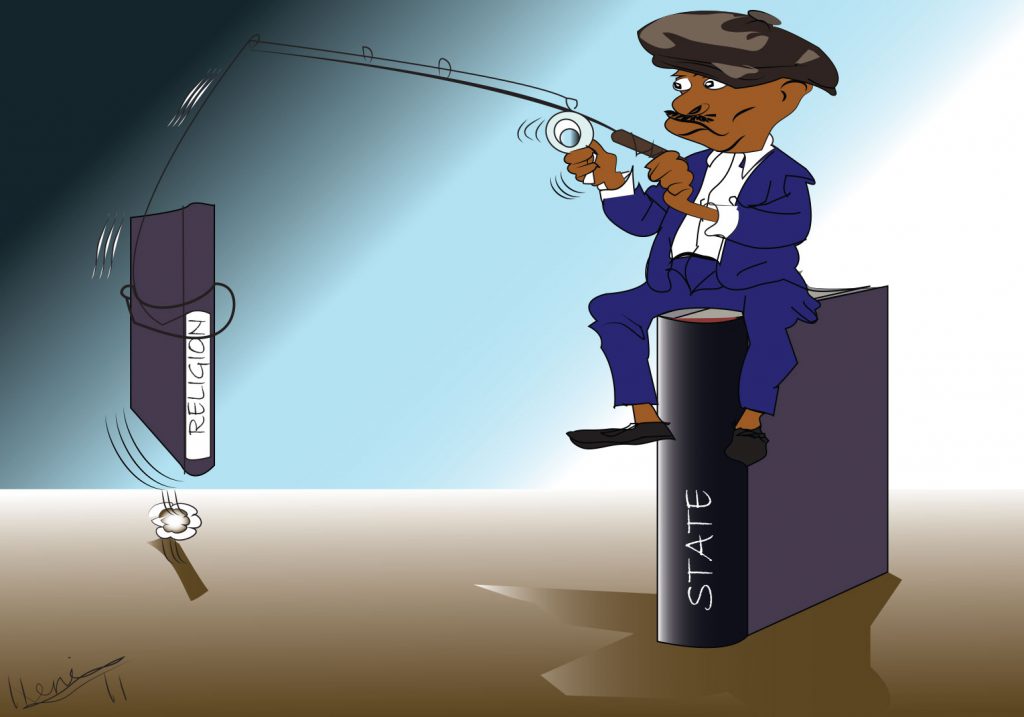

The central bank will also need to do its part. Politicians are usually not trusted with fiscal prudence; sometimes, it is not in their interest. The central bank was expected to be autonomous from the politicians – to watch over the money supply. Under Yinager Dessie (PhD), the central bank's passivity has been nothing less than a dereliction of duty. No central bank worth its salt can keep peppering the federal government with this much freshly minted money in the face of such inflationary pressure.

The central bank needs to have a battle of its own. In this case, it should be on inflation. It can take a page out of the late Paul Volcker’s inflation-busting book. As the head of the Federal Reserve, Volcker ruthlessly attacked the sources of inflation in the United States in the 1980s despite the extreme political pressure he was subjected to as his policies set off a recession and unemployment climbed. Today, Volcker is credited for taking the US out of the 1970s and 80s inflation and building the groundwork for four decades of stable price rises.

Ethiopia’s central bank lacks such a commitment in its leadership. Understandable. Nonetheless, necessity makes an honest man a knave, so they say.

Policymakers must move to pull the massive amount of money in the economy back to the treasury. The interbank and deposit interest rates can be raised, encouraging savings. Direct advances to the federal government need to be ceased; in practical terms, this is to discontinue ordering the printers in Europe for more notes.

Undoubtedly, all this would risk a full-blown recession. But if inflation is left to its own devices, it too would wreck the economy for years to come. The former path is the lesser evil.

PUBLISHED ON

Apr 08,2022 [ VOL

23 , NO

1145]

Radar | Oct 30,2021

Radar | Aug 14,2021

Advertorials | Sep 13,2021

Radar | Jun 21,2021

Films Review | Apr 17,2020

Editorial | Feb 12,2022

Commentaries | Nov 13,2021

Fortune News | Apr 16,2022

Fortune News | May 23,2021

View From Arada | May 25,2019

My Opinion | 131584 Views | Aug 14,2021

My Opinion | 127940 Views | Aug 21,2021

My Opinion | 125915 Views | Sep 10,2021

My Opinion | 123539 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...