News Analysis | Dec 09,2023

As the central bank slashes foreign currency retention rates by half to 20pc, exporters are decrying the move as detrimental to their businesses and warn a fall in foreign exchange revenues is inevitable.

The majority (70pc) of forex earnings from exports, remittance and transfers to non-governmental organisations (NGOs) should be surrendered to the central bank, declared one of the two directives Central Bank Governor Yinager Dessie (PhD) signed off on January 6, 2022. Foreign account holders can only retain 20pc of their transfers in foreign currencies, and they should cede 10pc to the commercial banks.

Policymakers argue the amendment was prompted by their desire to encourage exporters and recipients of inward remittance. The exporters are fuming over the latest bout from the central bank, seeing it as further erosion of their earnings from 50pc. There was a time when exporters retained 70pc of their forex earnings to finance imports with widely high-profit margins. The recent adjustment is the third in about a year as the central bank continues to tinker with the foreign currency retention ratio between exporters, commercial banks and itself.

In March last year, the first significant change came about when regulators told exporters to surrender close to 70pc of their earnings to commercial banks and the central bank, repealing a directive issued two years ago. This, too, was a reverse to exporters' relatively unrestricted access to their foreign currency earnings. Nearly a third of their earnings was available indefinitely, and the balance was available for use within 28 days of deposit.

The authorities at the central bank saw this scheme manifesting in exporters using much of the available foreign currency, leaving none for banks to allocate to other sectors. They introduced a new rationing regime and allowed exporters to use retained forex to import their chosen items as long as they had the necessary permits.

Exporters are displeased.

The Ethiopian Horticultural Producer Exporters Association (EHPEA) is one of the lobby groups from export-focused industries that is apprehensive about the decision. Its leaders wrote a letter to the central bank voicing the misgivings of their members. They pleaded to the authorities to treat "producer-exporters" differently from other traders.

The Association represents over 100 members, many of them cut-flower growers and exporters demanding foreign currency to import inputs such as fertilisers, chemicals and packaging. Rarely available in the local market, these products represent 90pc of the inputs the cut-flower industry uses. Some also make periodical royalty fee payments in foreign currency for using patented flower breeds.

Sentayehu Kebede, general manager of Afriflora, a horticulture farm in Holeta town, Oromia Regional State, says the latest round of restrictions will make importing difficult and affect their business.

"The situation was at least manageable when the retention rate stood at 40pc," he said.

So are coffee exporters discontented with the latest set of rules from the central bank. It is an industry known to have its exporters sell on a thin margin – or even at a loss – to earn forex they use to import merchandise and recoup their losses from exports. Export revenues have surpassed 1.8 billion dollars over the first half of the fiscal year, with coffee accounting for nearly a third of the amount.

Fikadu Hailemariam, general manager of Homeland Organic Coffee Agro-Industry Plc, observed that many coffee exporters are in the business to benefit from the foreign currency earnings and not from the profit of the exported coffee.

"It [the ratio] should have increased," he said.

Coffee exporters have consultations with leaders of their respective lobby groups to voice their concerns collectively. Other lobby groups, such as the Ethiopian Meat Producer-Exporters Association and the Ethiopian Pulses, Oilseeds & Spices Processors Exporters Association, are to follow suit, according to people familiar with these groups.

Others involved in the forex chain are more optimistic about the new ratio. This includes commercial banks.

The central bank's decision should be understandable considering the country's import needs, argues Melaku Kebede, president of Hibret Bank.

“Considering the country’s huge deficit and scarcity of foreign currency, the measure is understandable,” he said.

Loans from external creditors have dwindled as grants from development partners are at an all-time low. Over the second quarter of the current fiscal year, Ethiopia received 250 million dollars in disbursement from loans and external aid, compared to 715 million dollars over the same period of the preceding year. A country that imports an average value of 16 billion dollars of merchandise sells no more than three billion dollars' worth of goods to the world. Foreign direct investment languishes at less than two billion dollars, the lowest in a decade. The annual average of four billion dollars in inward remittance is nowhere near filling the five billion dollar deficit in the balance of payments.

Adjusting the ratio of forex the central bank gets was necessary with the growing import bills for essential items such as petroleum, edible oil and wheat, according to Fikadu Digafe, vice governor and chief economist of the central bank.

The federal government spent half a billion dollars in the last quarter of the previous fiscal year importing petroleum products. It an expenditure representing over 130pc increase from the same period of the preceding year. The global oil price has gone up over the past few months, subjecting the government to higher foreign currency allocation.

"We understand the adjustment will have a negative impact on some sectors," Fikadu told Fortune. "But, it's the only option we have for now."

PUBLISHED ON

Jan 15,2022 [ VOL

22 , NO

1133]

News Analysis | Dec 09,2023

Agenda | Aug 14,2021

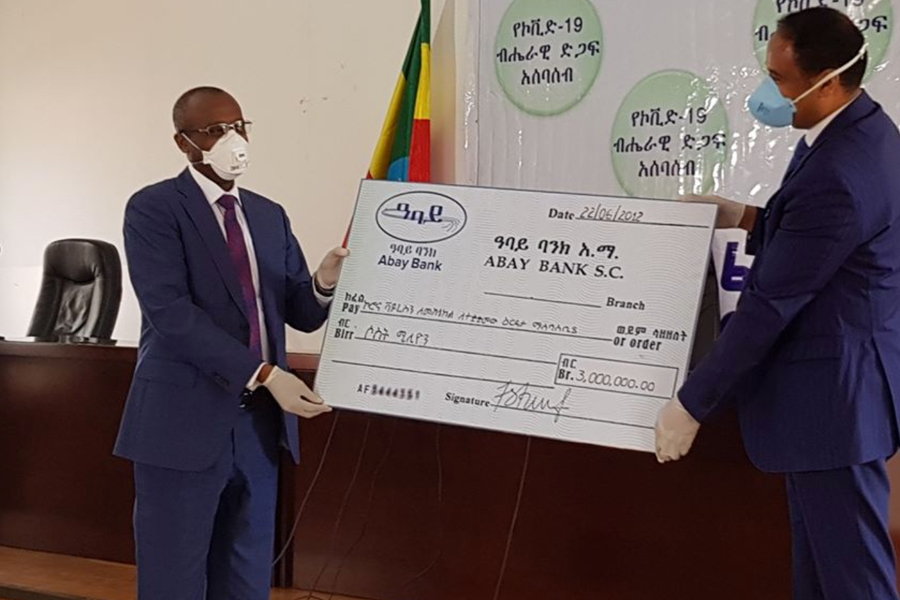

Covid-19 | Mar 31,2020

Fortune News | May 20,2023

Fortune News | Mar 13,2021

Radar | Aug 17,2019

Radar | Feb 24,2024

My Opinion | Jul 30,2022

Fortune News | Dec 25,2021

Fortune News | Sep 08,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...