Fortune News | Apr 20,2024

Dec 29 , 2018

By Asseged G. Medhin

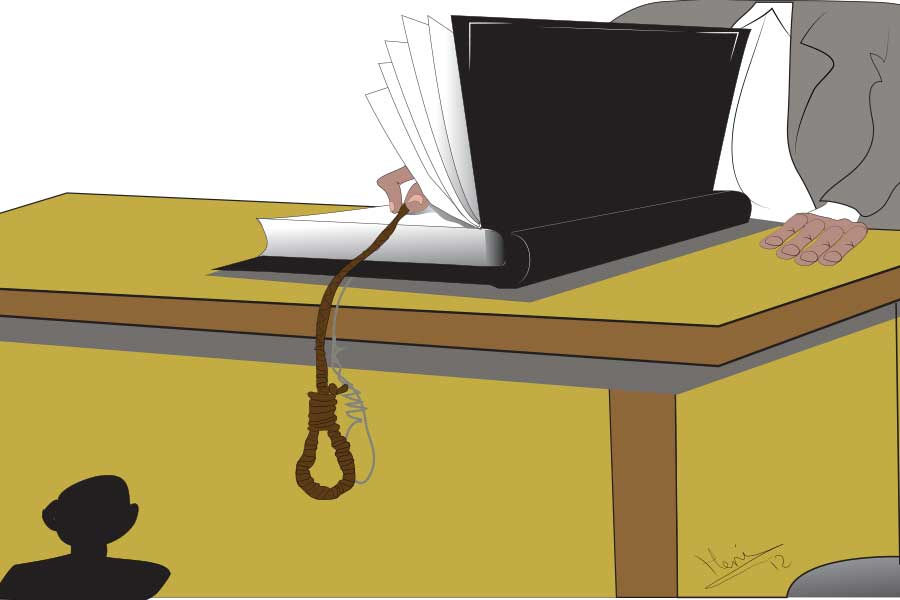

One of the reasons for Ethiopia’s lack of a dynamic and competitive economy is its weak insurance sector. This can change with the introduction of capital markets that allow enough distribution of risk it to thin out, writes Asseged G. Medhin (kolass799728@yahoo.com), deputy CEO of operations at the National Insurance Company of Ethiopia (NICE).

If capital markets can indeed be realised, and there is enough rhetoric to believe that it is a matter of time, then the definition of insurance in Ethiopia would change.

At its most basic, it is the spreading of the risk of loss associated with a particular event among as many participants as possible. The practical business of insurance has often meant marrying the skill set - such as actuaries, underwriters and distributors - necessary to manage that risk with the capital necessary to support it. If this can be done successfully, then the basis for a modern insurance industry will have been laid.

Recent changes may have opened that traditional business model to disruptive innovation. An observer looking for a niche vulnerable to disruption could do worse than focusing on both insurers and the reinsurance sector. There is a great deal of opportunity in the sector given the increased appetite for security.

But the major challenges cannot be disregarded either. From shareholders that demand better returns and demanding customers to a challenging regulatory framework on capital adequacy, solvency and margins of safety, there is enough to dissuade the light-hearted from thinking of investing in the sector. The challenges though are not as significant in light of the growing economy. Change is inevitable in the sector

With technology rapidly increasing both the information available to non-traditional market participants and the ability to manage, analyse and utilise it, there appears to be clear potential for reducing friction.

A capital market will allow insurers to link their capital to securities. It provides them with an opportunity to fish better in troubled water while shareholders’ earnings get boosted. What such a market is good at is seeking diverse means of seeking those willing to accept safety for an acceptable return. This boon can also be extended to reinsurers - if there is more than one by the time there is a capital market - as they inherently converge to offer capital providers a place to invest with a reasonable return that barely correlates to most capital market risks.

The most recent report on the US insurance market noted the growing role of alternative risk-transfer capital in the insurance industry. While this remains a small share of the total capital committed to reinsurance underwriting, its growth continues to put downward pressure on reinsurance premiums.

Alternative capital, broadly defined, continues to enter the reinsurance market. Clearly, this marks a change from the traditional regulated reinsurer model and may lead to a redefinition of market roles. The question is what this means to the marketplace and its participants.

This includes not just insurers and reinsurers, but regulators, consumers and investors. It is hard to contend that alternative capital is the most viable venture that helps insurers as well as reinsurers to move their capital freely in any form of investment.

Shareholders and professionals and other participants in the Ethiopian insurance industry need to keep in mind the words of the great biologist, Charles Darwin.

“It is not the strongest of the species that survives, nor the most intelligent; it is the one most adaptable to change,” he said.

In the short run, change may spell struggle. But in the longer run, it may mean progress.

It is important to answer the question, why the insurance sector is still in its infancy in Ethiopia? Is the rate of return on the investment attractive? Do professionals update themselves on the ongoing change? Are managers vigilant in understanding business dynamics? And are regulators willing and capable to persistently amend their directives?

The lack of a strong insurance industry, in addition to a robust financial one, has contributed to the lack of a strong private sector. Investors, like everyone else, like to shun risk.

All the reasons for introducing change into the industry are there. What remains, as has been the case for long, is the fear that the short-term might be messy. We need to have a more liberal and open market that allows participants to take a bigger slice of their return in their venture through access to capital markets and more dynamically through access to the World Trade Organisation. Those who most effectively adapt may find themselves with a new competitive advantage in this new marketplace

The government must start readying the sector for multinational insurers through capital markets. The inability to bear mega-risks would be addressed through an option for insurers to raise their capital through a capital market. Access to outside markets will as well be important in bringing to the country knowledge and expertise.

PUBLISHED ON

Dec 29,2018 [ VOL

19 , NO

974]

Fortune News | Apr 20,2024

Exclusive Interviews | Jan 05,2020

Commentaries | Jan 12,2019

Radar | May 04,2024

Radar | May 21,2022

Radar | May 13,2023

Editorial | Oct 26,2019

Viewpoints | Mar 18,2023

Radar | Nov 24,2024

Fortune News | Sep 04,2021

My Opinion | 132112 Views | Aug 14,2021

My Opinion | 128515 Views | Aug 21,2021

My Opinion | 126442 Views | Sep 10,2021

My Opinion | 124053 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...