Editorial | Aug 28,2021

Jul 2 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Lake Ayalew, minister of Revenues, moved to address complaints about inflationary distortions on capital gains taxes. Last month, the Minister instructed five branches in Addis Abeba and six regional offices to consider inflation when assessing the tax on transactions of shares with companies.

The new rule makes no adjustments to the tax rate, but it reduces the amount of taxable income significantly. It slashes dues owed to the government when shareholders and property owners transfer their assets to buyers. The rule ends the previous practice where officers tax "illusory gains" exaggerated by high inflation.

Taxes on income, profits and capital gains account for nearly a third of federal tax revenues.

Since he took the helm at the Ministry two years ago, Lake has faced mounting pressure from a decline in federal revenues, in contrast to mounting public expenditure. Tax officials collected 309 billion Br over the first 11 months of the fiscal year. Federal authorities expect to mobilise 480 billion Br next year, covering 61pc of the 786.6 billion Br budget bill table to lawmakers last month.

Lake, who once served as deputy president of the Amhara Regional State, is tasked with executing the administration's plan to collect 2.6 trillion Br in taxes over 10 years and boost the tax-to-GDP ratio to around 20pc. It is an ambitious target, as Ethiopia's ratio has been continuously declining for the last decade, dropping to nine percent last year. It is nearly half the 17pc average for Sub-Saharan Africa.

The adjustment on the taxable amounts from capital gains is to be determined based on an index prepared by the Ministry of Finance. In 2019, its officials introduced the capital gains tax on the sale of shares over their par value. Gains from the sale of shares are subject to a 30pc tax, while the rate for earnings from the transfer of properties held by businesses is half this amount.

The directive had sent shockwaves to companies and shareholders alike. They have since been lobbying against capital gains tax, arguing it discourages investment and savings, as well as limits capital flow.

"Growing complaints from start-ups, share companies, and financial institutions led the Ministry to take the measure,” said a tax expert at the Revenues Ministry who requested anonymity.

Experts believe Lake's latest move will respond to inflationary distortions and returns on long-term investments.

Million Kibret is a managing partner at BDO Consulting Plc, an investment advisory services, taxes and accounting. He foresees that the adjustment can encourage capital accumulation by the private sector.

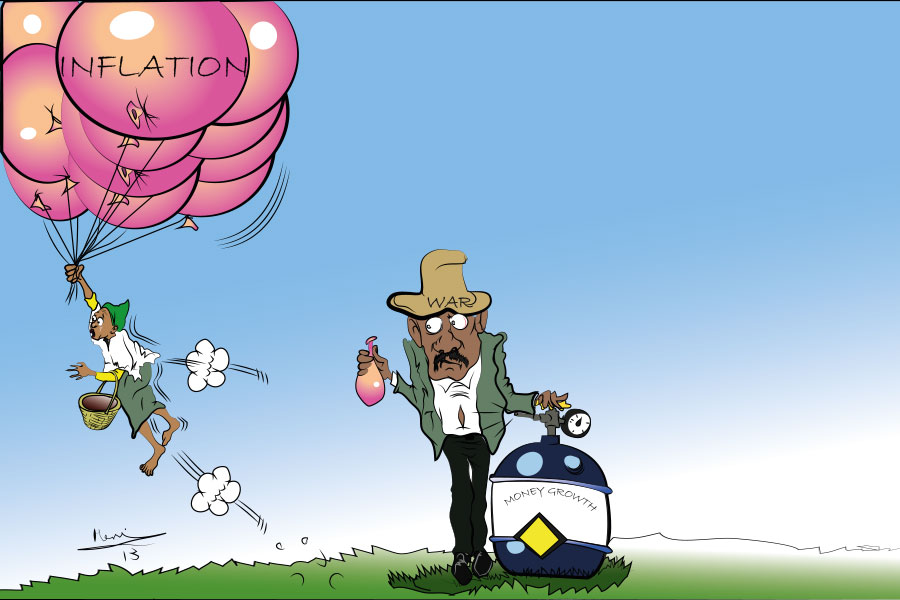

Nonetheless, inflationary pressure in the economy remains a pressing issue. High inflation erodes consumers’ purchasing power and gives rise to distortions that expose asset owners to higher losses while settling capital gains tax. Year-on-year inflation for May was registered at 36.6pc, five-fold to the interest rate banks pay depositors.

Million believes taking inflation into account is crucial to encourage foreign direct investment. It grew rapidly in the five years beginning in 2012 and reached 4.1 billion dollars in 2017. However, it has been shrinking since. According to official figures, Ethiopia attracted 2.4 billion dollars in FDI over the first three quarters of this year.

The administration of Prime Minister Abiy Ahmed (PhD) amended the investment proclamation two years ago in hopes of reversing the decline, opening up more sectors to foreign investors and reducing the minimum capital they were required to register. A common strategy for attracting foreign investment is directly channelling capital into companies in business. Businesspeople buying equity want to see the value of domestic companies increase, injecting capital into buying shares, which they resell after a certain period.

Experts contend the capital gains tax is a contributor to investors' reluctance. It creates a lock-in effect, according to Yehualashet Tamiru, a legal consultant and researcher. He refers to investors' unwillingness to trade their shares because of regulations, taxes, and penalties that reduce earnings.

The financial sector, which sometimes sees shares earn 40 times their par value, is heavily impacted by capital gains tax. Commercial banks have been scrambling to sell additional equity to the public and their shareholders after the central bank raised the minimum capital threshold to five billion Birr last year.

Tilahun Getachew, director of shares and divisions at Awash International Bank (AIB), sees the Minister's move to recalibrate the taxable amount as “a timely decision.”

Awash Bank raised its paid-up capital by 40pc to 8.2 billion Br last year. It has close to 4,400 shareholders.

Abdulmenan Mohammed, accounts manager at the London-based Portobello Group, argues there are no accounting grounds for the capital gains tax.

“Share premiums are neither a gain nor a profit in accounting and tax disciplines,” he said. “It's treated as a contribution by shareholders."

The tax has been a burden on others, too.

The absence of a capital market and difficulties in accessing credit from banks leave start-ups with self-generated capital and private equity funds to play a significant role in filling financing gaps. A growing number of start-ups are emerging with hopes of attracting angel investors and venture capitalists. However, according to Pazion Cherinet, chief executive officer (CEO) of Orbit Health, they have been discouraged by the high capital gains tax rate.

Pazion runs the parent company of Orbit Innovation Hub, an incubation centre. Incorporated in 2020, the Hub focuses on accelerating digital innovations. Last year, it provided 5,000 dollars in financing to 15 start-ups.

Although the adjustment may provide a sense of confidence to investors, Abdulmenan argued Minister Lake's move attempts to correct one mistake by making another. It only gives temporary relief to shareholders and equity investors. As companies continued to operate under an inflationary economy, they will remain trapped by the same issues, says Abdulmenan.

“They should completely scrap the directive," said the expert.

PUBLISHED ON

Jul 02,2022 [ VOL

23 , NO

1157]

Viewpoints | Jul 30,2022

Agenda | Sep 11,2020

Agenda | Jul 18,2021

Viewpoints | Apr 01,2023

Fortune News | Nov 20,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...