News Analysis | Mar 04,2023

As October and November rolled in, so did the tax season, when tax officials and businesses began an annual ritual of testing one another’s patience. However, the tax bureaus were not as crowded, stuffy and inflexible as in previous years, although businesses were as belated in their filings and demanding of their accountants.

The introduction of a digital portal has made things more accessible than before. Tax can be declared and filed online, and taxpayers pay digitally only to receive receipts in email attachments. However, businesses have their representatives visit tax bureaus to get copies of clearance to renew licenses. The majority of taxpayers chose to take advantage of this opportunity at the East Addis Abeba branch of the Ministry of Revenues. Many taxpayers prefer to settle their tax obligations when the deadline is closer, choosing to keep the amount they have to pay as working capital for as long as possible, although this tendency is declining. That collateralised loans from commercial banks have been frozen has not helped matters this year.

At around 10pc, Ethiopia's tax-to-GDP ratio is low even by sub-Saharan Africa standards. The federal government has all the incentives to make the process smooth. It plans to cover around two-third of its spending this year from taxes. The performance over the first quarter of the fiscal year, at 124 billion Br, shows that the goal is unlikely to be met. Under the threat of sanctions, the impact of the COVID-19 pandemic and the devastating consequences of war, tax officials could have done much worse than collecting over 90pc of the target to cover a large portion of the over half a trillion Birr in the federal budget this year.

You can read the full story here

PUBLISHED ON

Nov 20,2021 [ VOL

22 , NO

1125]

News Analysis | Mar 04,2023

Fineline | Nov 21,2018

Radar | Jan 25,2020

Agenda | Feb 22,2020

Agenda | Jan 05,2020

Life Matters | May 11,2019

Radar | Jan 11,2020

Fortune News | Nov 16,2019

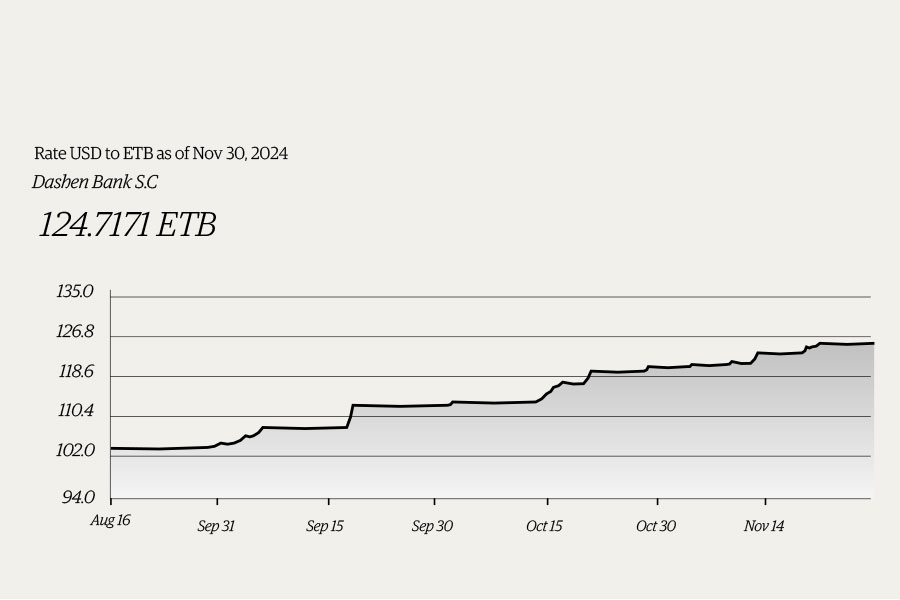

Money Market Watch | Dec 01,2024

Featured | Dec 22,2018

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...