My Opinion | 132389 Views | Aug 14,2021

Mar 25 , 2025

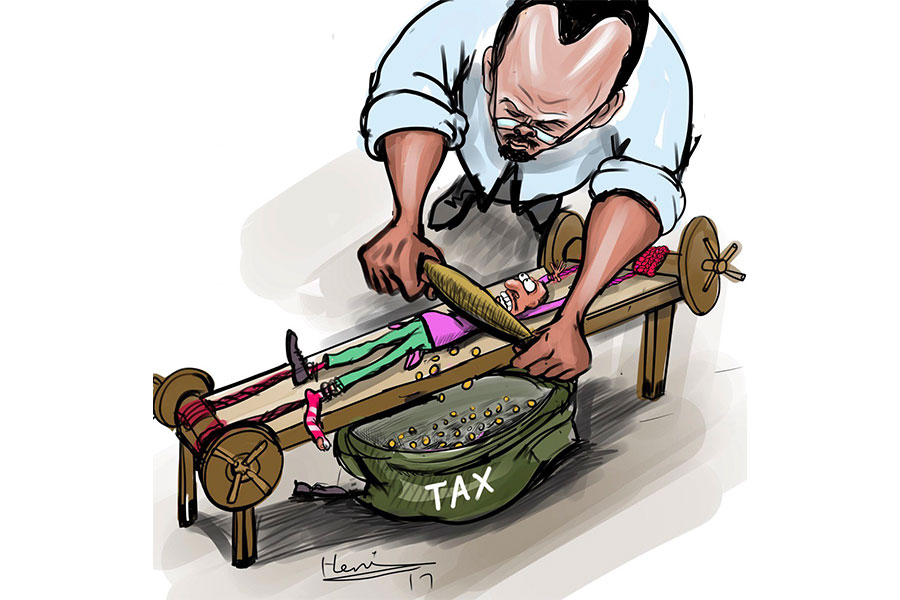

Central bank reaffirmed its decision to maintain a credit growth cap of 18pc, signaling its commitment to tightening monetary policy amid persistent inflationary pressures, high cost of living and uncertainty over the economic outlook.

In a move that signalled the authorities' continued resolve to dampen excessive lending, the monetary policy committee under the National Bank of Ethiopia (NBE) blamed lingering inflation concerns - 19.9pc year-on-year (YoY) - and liquidity imbalances behind extending the cap.

Bank executives and analysts say the decision believe regulators are determined to rein in credit expansion and reduce risks associated with soaring consumer prices. Many observers note that, with inflation remaining in double digits, policymakers have become increasingly cautious about allowing credit growth to loosen, despite slowdown on businesses and the broadereconomy. Businesses, particularly those seeking to fund expansions or invest in new ventures, are expected to feel the pinch as credit remains tightly regulated.

The economy has experienced elevated inflation in recent years, prompting Central Bank Governor Mamo Mihretu to adopt a more stringent monetary position. The renewed focus on controlling money supply and limiting private-sector lending is widely seen as part of a broader macroeconomic reform agenda agreed with the IMF. Financial experts caution, however, that while the credit cap may help counter inflation, it has slowed economic momentum, especially for businesses dependent on borrowed capital.

The policy is expected to affect credit portfolios across commercial banks and microfinance institutions, placing added importance on efficiency in capital allocation.

My Opinion | 132389 Views | Aug 14,2021

My Opinion | 128824 Views | Aug 21,2021

My Opinion | 126715 Views | Sep 10,2021

My Opinion | 124321 Views | Aug 07,2021

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...