Featured | Apr 06,2024

Nov 27 , 2024

The International Monetary Fund (IMF) is close to approving a 251-million-dollar loan to Ethiopia, applauding "progress in the economic reforms," which saw the exchange rate shift toward a market-determined regime.

IMF staff which visited Addis Abeba last week reached an agreement with the authorities to conclude the second review of Ethiopia's four-year, 3.4-billion-dollar Extended Credit Facility arrangement. The Fund’s Executive Board is expected to review and approve the agreement in the coming weeks.

"Ethiopia's economic reform program, including the transition to a market-determined exchange rate, continues to advance well," said Alvaro Piris, head of the IMF mission to Ethiopia. "With macroeconomic stability supported by prudent policy and a so far muted foreign-exchange reform impact on inflation, conditions for economic growth in the period ahead appear promising."

Piris believes that the adoption of a market-driven exchange rate has begun to address long-standing foreign-exchange shortages with the spread between the official and parallel currency markets narrowed to below 10pc, after briefly widening in October. The authorities attributed the easing of foreign-exchange surrender requirements and increased activity in the nascent interbank foreign-exchange market to this improvement.

The National Bank of Ethiopia (NBE) has also launched a domestic interbank money market, integrating the country's financial systems and enhancing liquidity management. However, it remains to be fully functional where trading has been paused after one transaction.

"To ensure progress toward low and stable inflation in the medium term, it will be important to maintain overall tight monetary and financial conditions during the transition to interest rate-based monetary policy," said Piris in a statement he issued today.

His team met with officials, including Finance Minister Ahmed Shide and National Bank Governor Mamo Mihretu.

The federal government implemented a supplementary budget last week, approved by the Council of Ministers, hoping to ease tight liquidity conditions while keeping fiscal targets meet the IMF program's objectives.

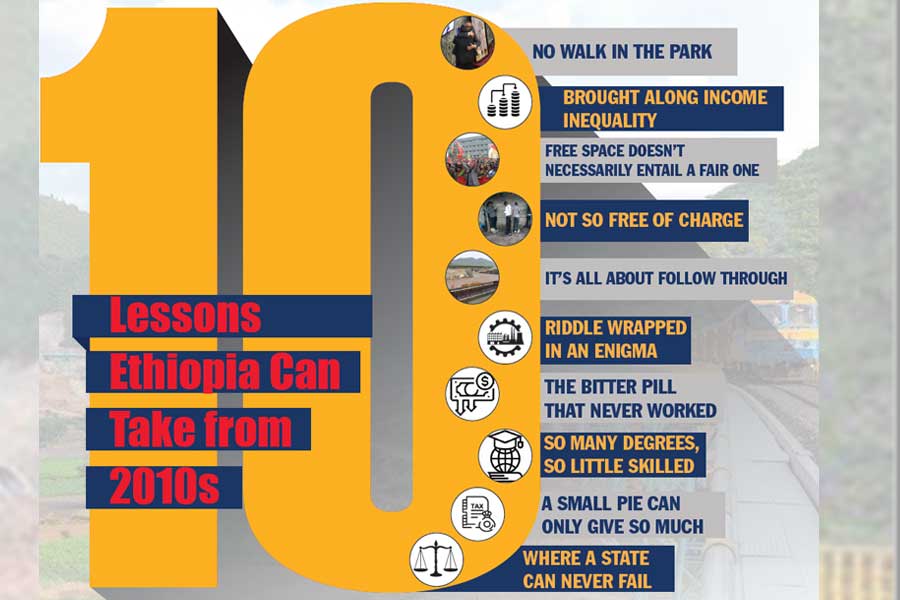

Featured | Apr 06,2024

My Opinion | Jul 17,2022

Fortune News | Apr 10,2021

Radar | Sep 04,2022

Fortune News | Apr 09,2023

Radar | Jan 01,2023

Radar | Dec 08,2024

Commentaries | Jul 25,2020

Radar | Nov 02,2019

Fortune News | Jan 05,2020

Photo Gallery | 178736 Views | May 06,2019

Photo Gallery | 168932 Views | Apr 26,2019

Photo Gallery | 159774 Views | Oct 06,2021

My Opinion | 137107 Views | Aug 14,2021

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...