Fortune News | Oct 12,2019

Jul 29 , 2024

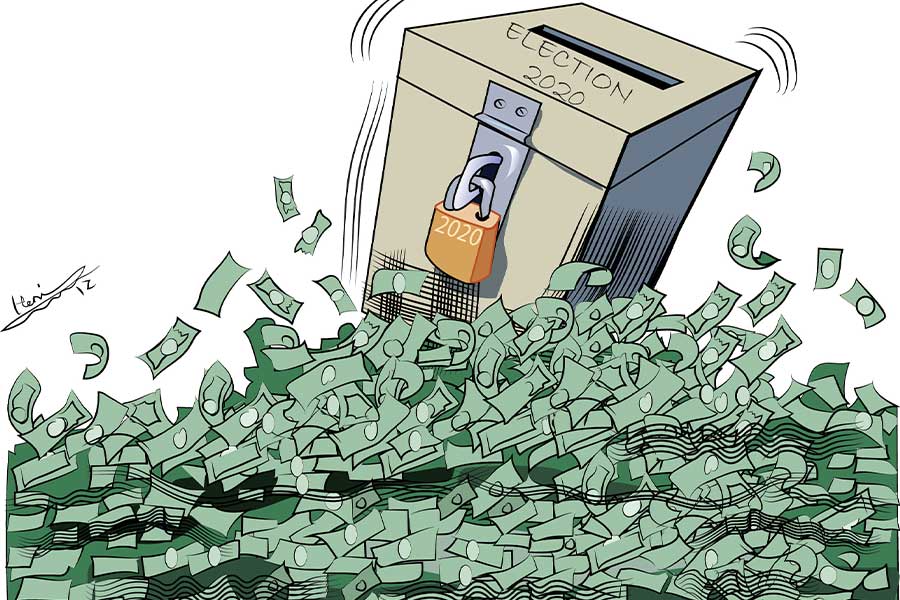

The International Monetary Fund (IMF) has approved a groundbreaking four-year arrangement, granting the country 2.55 billion in special drawing rights (SDR), roughly 3.4 billion dollars, under the Extended Credit Facility (ECF). This landmark decision is set to supercharge the second edition of Ethiopia’s Homegrown Economic Reform (HGER) agenda, responding to macroeconomic imbalances and paving the way for private-sector-driven growth.

Right off the bat, the IMF board of directors who met today in Washington DC approved about one billion dollars to address balance of payments gap and support its national budget. The economic reform program, fueled by the credit facility, is packed with policy measures designed to boost private sector engagement and enhance economic openness, promoting robust and inclusive growth.

A key focus of the reform is strengthening social safety nets to protect vulnerable households affected by the inflationary pressure due to the shift to a market-determined exchange rate. Modernising the monetary policy framework to combat inflation, and creating fiscal room for priority public spending by mobilising domestic revenues are part of the reform agenda of Prime Minister Abiy Ahmed’s (PhD) administration.

IMF’s Managing Director, Kristalina Georgieva, lauded the ECF approval as a clear demonstration of Ethiopia’s government commitment to the reforms. According to Georgieva, the initiative is expected to attract additional external financing from development partners, providing the foundations for successfully negotiating Ethiopia’s ongoing debt restructuring. She expressed optimism about Ethiopia's economic trajectory, pledging the IMF's commitment to supporting the country in its leaders’ aspiration towards a vibrant, stable, and inclusive economy.

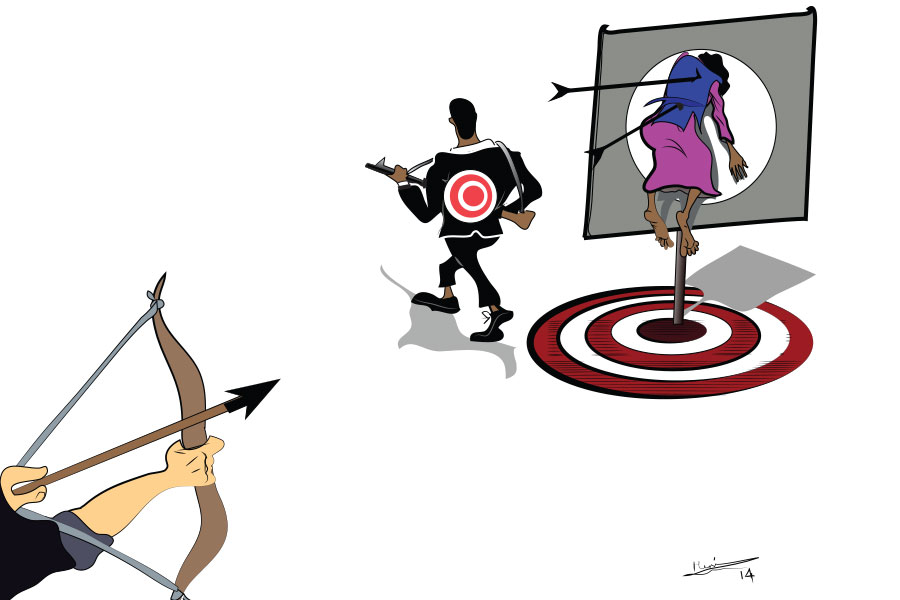

Deputy Managing Director and Acting Chair, Antoinette Sayeh, acknowledged the economic headwinds Ethiopia faces, including soaring inflation, dwindling international reserves, and unsustainable debt levels. She stressed the importance of recent macroeconomic measures, such as adopting a market-determined exchange rate and overhauling the monetary policy framework, as crucial steps toward restoring stability.

Sayeh also stated the need for sound macroeconomic policies, including prudent fiscal management and the phasing out of monetary financing for government deficits to ensure these reforms succeed.

Editorial | Feb 01,2020

Editorial | Oct 23,2021

Fortune News | Jun 15,2019

Radar | May 18,2024

Radar | Sep 21,2019

Photo Gallery | 179588 Views | May 06,2019

Photo Gallery | 169785 Views | Apr 26,2019

Photo Gallery | 160718 Views | Oct 06,2021

My Opinion | 137191 Views | Aug 14,2021

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...