Radar | Aug 06,2022

Nov 3 , 2023

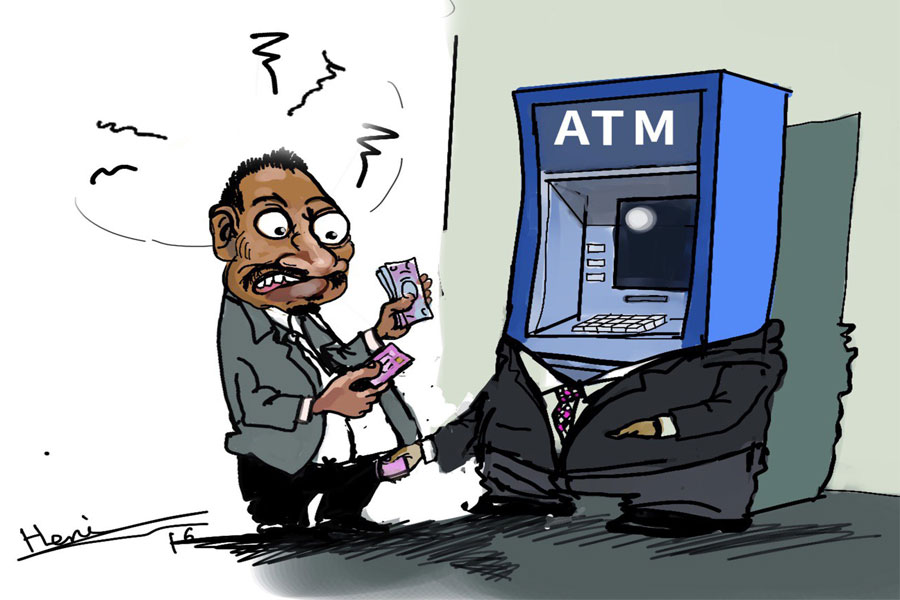

Fitch Ratings has lowered Ethiopia’s credit score further into default territory, casting doubt on its fiscal stability and highlighting the dire liquidity crunch that threatens to push it into default.

Ethiopia’s “long-term foreign-currency issuer default rating” has been cut to ‘CC’ from ‘CCC-’, Fitch announced as it struggles to bridge gaping external financing deficits and battles dwindling foreign exchange reserves. The rating agency has painted a grim picture of Ethiopia’s financial health, warning of the substantial risk of a default event linked to its engagement with the G20 Common Framework for debt treatment.

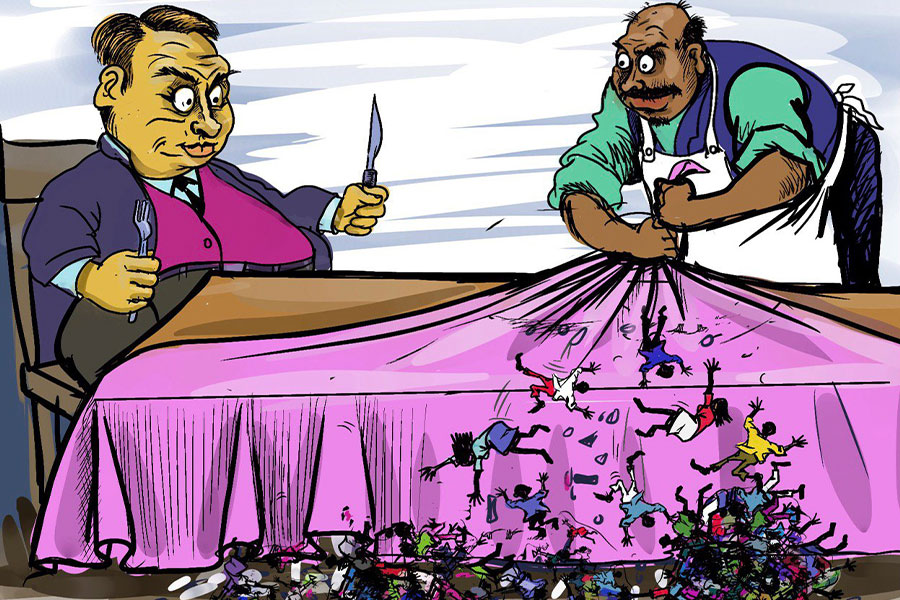

The framework, which aims to provide debt relief and bring transparency to dealings with official and private creditors, has yet to yield substantial progress for Ethiopia. Fitch’s downgrade follows a troubling decline in the country’s external liquidity indicators.

Ethiopia’s international reserves plummeted to a precarious one billion dollars in 2023, barely covering a month of import payments. This sharp contraction brought to light the one billion dollar sovereign debt due this fiscal year and a looming two billion dollar obligation in 2025.

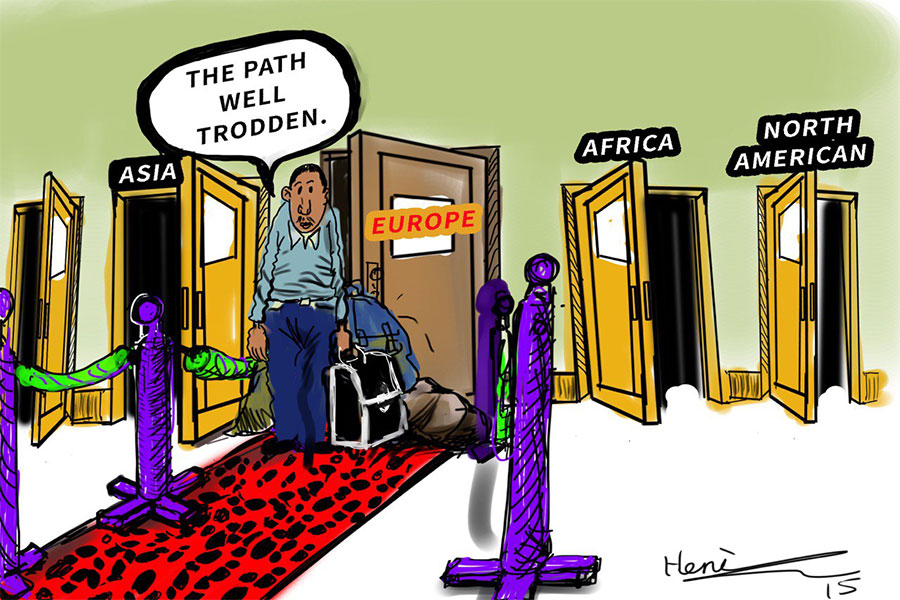

Ethiopia’s current account deficit is expected to have narrowed slightly to 2.9pc of GDP in 2023, according to Fitch. The Agency has indicated that the country’s official exchange rate appears increasingly out of sync with the reality on the ground, suggesting that a significant correction is needed to align with the depreciating rates seen in the parallel market.

The federal government has been leaning heavily on internal financing, primarily through its banking sector, as external capital inflows slowly trickle. Interest repayments on domestic borrowing are set to climb, reaching an estimated 10.5pc of government revenues in 2024.

Inflation, another economic hurdle, has surged, with an average rate of 32.5pc this year. Such levels pose a problem for Ethiopia’s central bank, which faces the difficulty of reining in inflation without aggravating the country’s fragile financial state.

The governance indicators from the World Bank also add to the country’s woes, with Ethiopia scoring poorly on the metrics included in Fitch’s sovereign rating model. These indicators reflect a governance environment that negatively impacts Ethiopia’s credit profile.

Creditor rights are under the microscope as Ethiopia’s capacity to service and repay debt is questioned, given the rising spectre of default. Should Ethiopia embark on a formal debt restructuring or miss a payment to private or public creditors, Fitch warns this could trigger further negative actions on its rating.

Despite the bleak outlook, Fitch acknowledges that a pathway to rating improvement exists. Should Ethiopia shore up its external finances through policy reforms or secure sufficient financing to cover its Eurobond payments, its creditworthiness could see positive revisions.

Radar | Aug 06,2022

Fortune News | Dec 21,2019

Fineline | Jun 22,2019

Fortune News | Sep 30,2023

Editorial | Oct 28,2023

Commentaries | Jan 03,2021

Radar | Aug 08,2020

Editorial | Oct 26,2024

Editorial | Sep 24,2022

Radar | May 21,2022

My Opinion | 130497 Views | Aug 14,2021

My Opinion | 126813 Views | Aug 21,2021

My Opinion | 124818 Views | Sep 10,2021

My Opinion | 122524 Views | Aug 07,2021

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

May 31 , 2025

It is seldom flattering to be bracketed with North Korea and Myanmar. Ironically, Eth...

May 24 , 2025

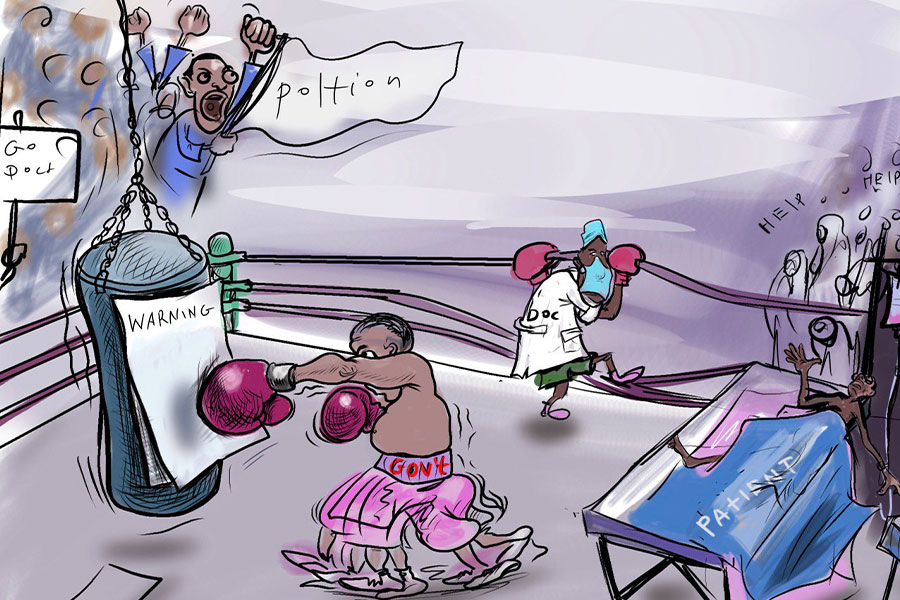

Public hospitals have fallen eerily quiet lately. Corridors once crowded with patient...

May 17 , 2025

Ethiopia pours more than three billion Birr a year into academic research, yet too mu...