Jul 28 , 2024

The National Bank of Ethiopia (NBE) is set to revolutionise the country's foreign exchange market with a new directive that grants banks and authorised foreign exchange dealers the autonomy to set their own rates. This historic move, effective Tuesday, July 30, 2024, marks a major departure from the previously rigid determinations that characterised Ethiopia's forex market for the past 50 years.

The NBE is set to issue a comprehensive foreign exchange directive (FXD/01/2024) on Monday, which seeks to enhance efficiency and promote competition in the foreign exchange market. Ethiopian authorities are upbeat about their daring move, predicting that the liberalisation of the forex market will attract substantial foreign exchange inflows from development partners. They hope this, in turn, paves the way for efficient resource allocation and greater transparency in foreign exchange transactions.

The Central Bank Governora, Mamo Mehiretu, met with senior bank executives on Sunday night, outlining a code of conduct for the new market operation. He also disclosed a revised foreign exchange retention and repatriation practices mandating exporters of goods and services to repatriate their foreign exchange gains. They are required to convert 50pc of these profits into Birr at market rates and can maintain the remaining 50pc in foreign exchange retention accounts for future use. This dual strategy seeks to enhance foreign currency reserves while also offering more autonomy to exporters in managing their foreign exchange income.

A crucial provision in the directive is that idle foreign exchange earnings must be sold to the transacting bank within a 30-day period. The regulation focuses on the interbank foreign exchange market and is expected to promote liquidity.

The directive also widens the pool of participants in the foreign exchange market, introducing non-bank entities like independent foreign exchange bureaus to selected segments. The expanded diversity is expected to stimulate competition, improve service delivery, and widen access to foreign exchange services.

Viewpoints | Jun 21,2025

Commentaries | Sep 16,2023

Viewpoints | May 08,2021

Sunday with Eden | Mar 20,2021

Fortune News | Dec 05,2018

Radar | Dec 19,2018

View From Arada | Feb 01,2020

Life Matters | May 24,2025

Radar | Apr 17,2021

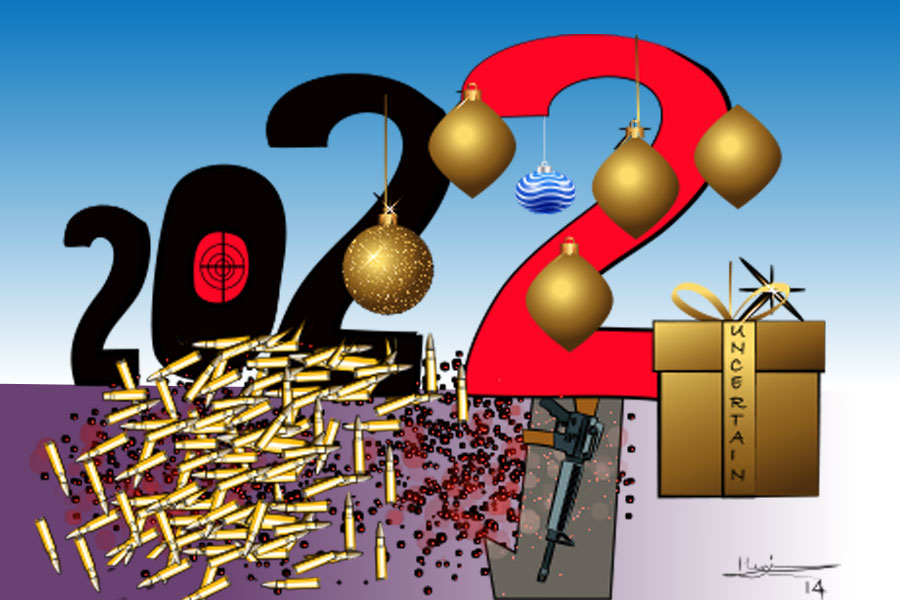

Editorial | Jan 01,2022

Photo Gallery | 180439 Views | May 06,2019

Photo Gallery | 170639 Views | Apr 26,2019

Photo Gallery | 161691 Views | Oct 06,2021

My Opinion | 137279 Views | Aug 14,2021

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...