Commentaries | Sep 27,2025

Oct 4 , 2024

The Central Bank has injected 175 million dollars into the foreign exchange market responding to a severe forex shortage that threatens fuel imports and economic stability.

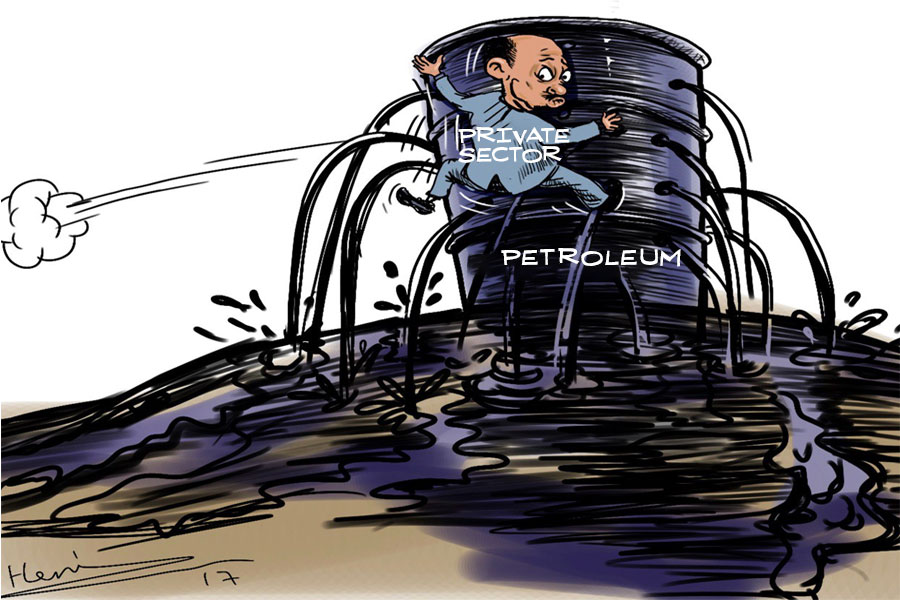

The National Bank of Ethiopia (NBE) announced yesterday that it sold the dollars to commercial banks to assist the Ethiopian Petroleum Supply Enterprise (EPSE), the state-owned company responsible for importing fuel and petroleum products. The funds, to be disbursed in phases over the coming months, cover outstanding fuel import bills and ensure a consistent fuel supply nationwide.

The authorities see this as part of their broader strategy to stabilise the foreign exchange market, where the gap between official and parallel exchange rates had previously soared above 100pc before recent policy shifts narrowed the spread. The Central Bank's intervention follows a series of regulatory reforms liberalising the forex market and addressing persistent liquidity challenges.

“Ethiopia’s foreign exchange reform has shown a very positive start in just a short period of two months, with a significant drop in the parallel market premium,” said Governor Mamo Mihretu.

According to the Governor, the foreign exchange reserves at the central bank and commercial banks have reached record highs, boosted by increased remittances and export revenues. He has declined to disclose the amount of the reserve, though.

The Central Bank's action, the second since August this year, uncovers the urgency of the forex predicament, particularly for fuel imports suffering from erratic forex availability at a time of global price hikes. By allocating dollars specifically to EPSE, the Central Bank seeks to prevent fuel shortages marked by long lines of motorists before gas stations in the capital.

Analysts view the injection as a necessary but temporary measure, cautioning that lasting stability requires structural adjustments, including boosting productivity in forex-earning sectors like agriculture and manufacturing.

The forex injection this week may also help ease public discontent as businesses and households continue to face tight liquidity and import delays. Throughout the year, businesses have pressed for more forex allocations, forcing the government to balance the need to prioritise essential imports with the necessity of maintaining reserves.

The NBE indicated it might conduct additional dollar sales periodically based on evolving market conditions, signalling a flexible, data-driven approach to monetary policy.

Commentaries | Sep 27,2025

Fortune News | Aug 12,2023

Editorial | Dec 07,2024

Radar | Feb 05,2022

Featured | Jul 20,2025

Photo Gallery | 173563 Views | May 06,2019

Photo Gallery | 163784 Views | Apr 26,2019

Photo Gallery | 153788 Views | Oct 06,2021

My Opinion | 136533 Views | Aug 14,2021

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...