Editorial | Nov 25,2023

Financial institutions are scrambling to get a hold of account holders' personal information in the wake of a directive from the National Bank of Ethiopia (NBE) requiring them to compile data before the deadline comes to pass in February next year.

The directive, issued last August, commits commercial banks, microfinance institutions, and payment instrument issuers to include a tax identification number (TIN), average monthly income, and occupation under all client account information. The requirements also apply when opening new accounts. Banks and microfinance institutions have been given a six-month window to set up a Know Your Customer (KYC) unit at their headquarters, to update customer information and set up a system to monitor transactions deemed "suspicious."

Commercial banks have been instructed to strengthen fraud monitoring activities and submit daily reports to the central bank. These reports were previously reviewed quarterly.

The central bank has also compelled banks to review and authorise all new accounts at these units within five days of receiving clients' requests. Deposits made before authorisation are to be kept in a temporary account. However, banks are not required to demand supporting documents from their customers for verification. If customers are unwilling or the banks cannot update depositor information within six months, the account will be deactivated until the data is completed.

Banks have started contacting their clients by phone to gather details and create a comprehensive customer database. Among them is Zemen Bank, which serves 180,000 account holders.

"It's hard to comply with this in the Ethiopian context," said a senior manager at Zemen. "But it's a relatively easy task for banks with a small customer base."

Compliance with the "know your customer" rule will challenge industry giants such as the state-owned Commercial Bank of Ethiopia (CBE), with over 30 million accounts active. The CBE has not been calling clients to gather information, choosing instead to compile existing documents and request additional details when clients visit one of the nearly 1,800 branches it operates.

"It's impossible to finalise the process in the time left," said an executive at the CBE. "The central bank should give us an extension."

Regulators at the central bank are willing to consider such requests. The six-month transition was provided for the financial institutions to implement certain systems, according to Solomon Desta, vice governor of financial institutions at the NBE. Other requirements have to be fulfilled immediately, he told Fortune.

"If there are indeed issues that require more than six months to finalise and we find them reasonable, we'll extend the deadline," said the Vice Governor.

The directive requires banks to assign unique identification numbers (ID) to their clients and list all accounts by the client under the designated ID. In the absence of a national digital ID system, compliance has been a daunting task for the banks.

The absence of a national ID system and biometric data make it challenging to identify duplicates, according to Melaku Kebede, president of Hibret Bank.

Hibret Bank uses a core banking system from Oracle, which creates a unique ID for account holders. However, clients do not use the ID when opening additional accounts, leading to multiple IDs assigned to a client. The Bank operates a tool to filter and aggregate accounts under the same name. Despite the inconvenience, Melaku finds that the information gathered in the process is vital to determine the size of the unbanked segment of the population.

"The data can be used to study banking and spending patterns,” he said.

Regulators at the central bank argue the directive is key to monitoring transactions. Financial institutions have been advised to look out for clients who provide false information and make frequent transactions that do not match their income.

However, bank employees encounter most clients unwilling to share personal information such as income.

"We're having a difficult time filling in the information," said a sales officer at one of the commercial banks.

At the end of last month, the central bank issued a circular that introduced adjustments to the directive. Signed by Vice Governor Solomon, it allows banks to accommodate and include low-income and undocumented nationals who do not possess identification documents, instead using biometric data (photographs and fingerprints). However, these accounts cannot be opened through a proxy while maximum deposits are limited to 300,000 Br. Neither can such accounts be used to make any incoming or outgoing transfers.

PUBLISHED ON

Nov 27,2021 [ VOL

22 , NO

1126]

Fortune News | Sep 14,2020

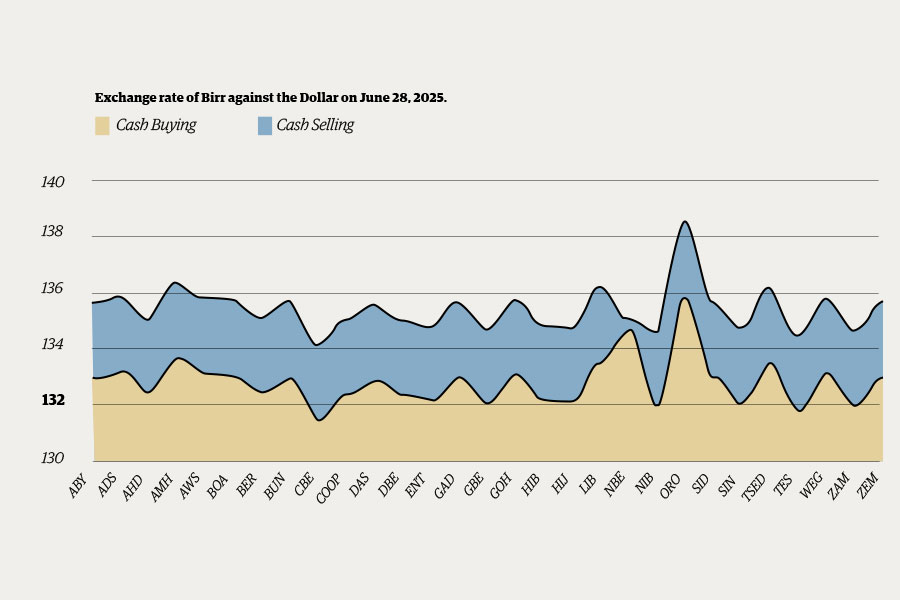

Money Market Watch | Jun 29,2025

Viewpoints | Nov 05,2022

Radar | Mar 14,2020

Commentaries | Dec 07,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...