Aug 5 , 2023

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Commercial banks across the country and the National ID Project Office have joined forces to register residents in two years using digital identification systems. A consortium of 21 banks, led by the Ethiopian Bankers Association, is gearing up for this ambitious initiative that aims to consolidate multiple accounts under one unique digital ID.

The federal government covers the lion's share of the project cost, footing 95pc of the bill, while commercial banks bear the remaining five per cent. The commercial banks would shoulder funding to procure registration kits, including laptops, iris scanners, and fingerprint recognition devices. However, the banks are putting up more than just money. They are tasked with the registration process, acting as registration centres to implement this high-profile digital transformation initiative.

The financial implications of this initiative are significant. The registration kits, priced up to 3,500 dollars each, are equivalent to approximately 21 million dollars, pushing the total bill to over a billion Birr. The consortium has plans to procure nearly 6,000 kits, Demesew Kassahun, the Association's secretary general, disclosed. A new bank account will be opened by the Association to manage the funds, with the state-owned Commercial Bank of Ethiopia (CBE) contributing the largest portion, according to the Secretary-General.

Solomon Desta, the vice governor of the central bank, has asked Abie Sano, president of the CBE, to contribute a whopping 330 million Br to buy the registration kits. This contribution underscores the commitment of the central bank towards the digitisation drive, according to Frezer Ayalew, central bank's director of banking supervision. He has been actively engaging with bank executives. The contribution each bank makes towards this initiative is not arbitrary; it is determined based on their respective number of branches, customer base, and deposit mobilisation data, according to Frezer.

"We set the amount for each based on these criteria," he told Fortune.

In the project's pilot phase, eight leading Ethiopian banks, including the CBE, the Cooperative Bank of Oromia (COOP), Awash, Dashen, Abyssinia, and Oromia International banks, were brought onboard with nearly 400 kits being deployed to these banks.

In partnership with different government institutions these banks registering 1.5 million individuals, is an impressive start that signals promising potential for the project.

Gelila Atnafu, a coordinator at the ID Project Office, disclosed a strategy to extend the project's reach beyond financial institutions. Schools, industrial parks, and telecom centres will join the initiative to ensure broader registration coverage.

"Banks are close to society," Gelila said, implying that they are well-positioned to kick-start this project its planners believe will be transformative.

However, there is no ignoring the significant pressure this puts on the banks. Apart from funding the procurement of registration kits, the banks are also grappling with mandatory bond purchases, depositors' premium contributions, and tax duties.

Yehualashet Zewedu works for Wegagen Bank as a chief finance officer (CFO). He recognises the benefits of having citizens digitally registered. He sees promises of the potential, pointing out that it would be instrumental in verifying customers in line with the "Know Your Customer" directive issued by the regulatory authority.

"It prevents fraudulent activities," said Yehulaeshet.

However, he also acknowledges the challenges banks could face.

"We're trying to manage our costs," he said, reflecting the concerns shared by many banking executives.

Despite the challenges, Ethiopia's national ID project is undeniably ambitious. It marks a significant step towards digital transformation, reflecting a broader global trend. The success of the project, however, will depend on how well it manages the balancing act of pushing digital registration while ensuring data security and managing costs. But if successfully implemented, experts see its potential in revolutionising Ethiopia's banking system.

Run by the former principal technical advisor to the Prime Minister, Yodahe Araya, the Project Office registered 100,000 citizens in its six-month trial phase partnering with institutions. Following the trial's end, parliament legislated the Digital ID Proclamation with a majority vote at the end of March. The project is expected to register 90 million residents by 2025.

Oromia International Bank has been registering up to 50 individuals a day. The Bank plans to expand its lending portfolio to include small loans disbursed without collateral once its customers are registered under the KYC.

Not every branch will qualify to register, as wide spaces and lit rooms are criteria for collecting biometrics. Meanwhile, residents are slowly but surely making their way to register. Despite the looming financial pressures, citizens are gradually embracing this new system.

A truck driver, Yenus Abas moved to the capital 10 years ago from Gonder, a town in Amhara Regional State. Often using his driver's licence as an ID, he was asked to show a resident ID upon attempts to get a passport at the immigration office. He decided to register for a digital ID instead of waiting for a clearance letter from his hometown. Yenus was excited about his successful registration at Awash Bank's headquarters on Ras Abebe Aregay Road which took him less than half an hour. He was told to wait for a text number, which would be used as identification.

"It's so much easier," he told Fortune.

While there are many proponents of the project, some banking veterans remain puzzled about the decision to involve banks in the procurements. Eshetu Fantaye, the former president of Ahadu Bank, raised questions even as he applauded the move towards digital identification.

Digital financial expert Endeshaw Tesfaye offers a different perspective. While acknowledging the initial financial burden on newly established banks, he believes that the returns, in the long run, are worth the investment.

Abdi Hundi, partnership division head at the Bank, told Fortune that customers have started to make their way looking to register. But he also observed a reluctance to register mainly due to data security concerns.

An essential component of the National ID project, under the Prime Minister's Office, is data protection, which Ethiopia is yet to legislate. It remains the industry's significant concern that needs to be addressed, as echoed by Endeshaw, who mentioned Kenya's experience where digital ID registration was suspended due to the absence of a data protection law. Experts at the Ministry of Innovation & Technology (MoIT) are formulating a data protection bill that aims to reassure citizens about the safety of their personal information.

The bill has been tabled before the Council of Ministers, disclosed Ayaleneh Lema, the Ministry's legal directorate head.

PUBLISHED ON

Aug 05,2023 [ VOL

24 , NO

1214]

Editorial | Apr 10,2021

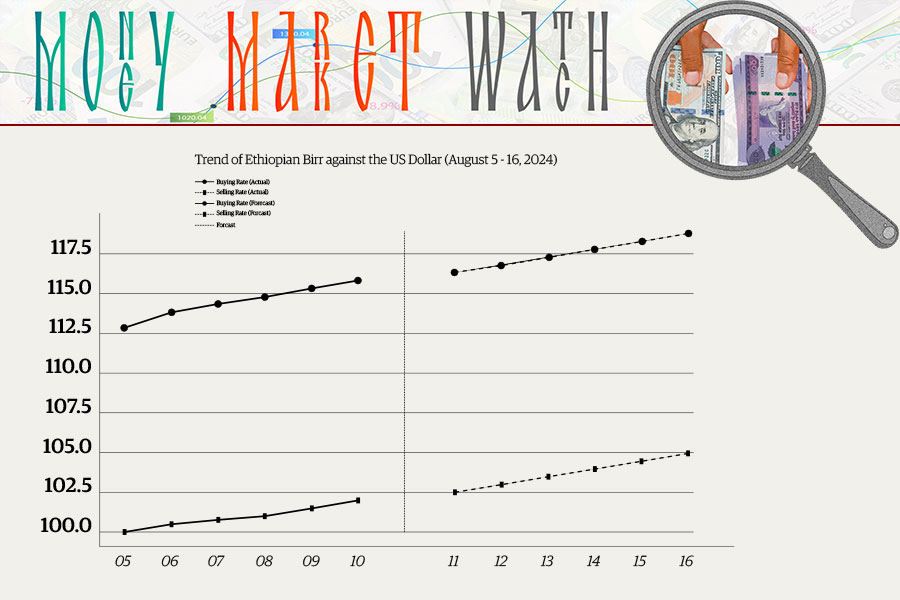

Money Market Watch | Aug 11,2024

Radar | Aug 20,2022

Radar | Mar 11,2023

Fortune News | Aug 07,2021

Radar | Sep 18,2021

Radar | Mar 27,2021

Editorial | Nov 25,2023

Fortune News | Jul 21,2024

Fortune News | Jun 04,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...