Radar | Jun 21,2025

Aug 10 , 2024

By Geremew Milkias

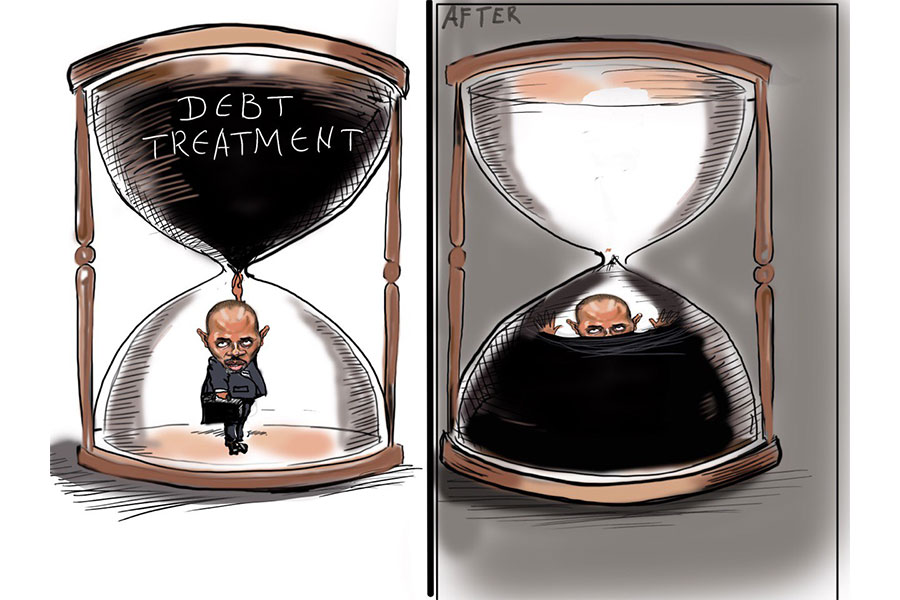

For decades, the financial sector has pondered the rocky ideas of market liberalisation and floating exchange rates. The recent upheaval triggered by the unpegging of the Birr has laid this struggle bare. When the government opted to restructure its debts and revalue the Birr — an essential step dictated by international lenders — the banking industry found itself in turmoil, revealing how unprepared it has been for such a seismic shift.

The disarray during that first week of floating the Birr was telling, demonstrating the disparity between the official exchange rate and the parallel market. The varying forex rates from commercial banks leading up to the National Bank of Ethiopia's (NBE) special auction revealed an inconsistent demand for foreign currencies. Questions arose about the prudence of private banks choosing not to buy from the state-owned Commercial Bank of Ethiopia (CBE) in the interbank market, a decision that resulted in opportunity loss for those banks.

Interestingly, the following week brought an unexpected calm, denoting a positive response from most private banks, with only a few stragglers. CBE, a frontrunner in setting the exchange rate, managed to weather the storm by keeping its rate stable, only to increase its spread to about 10pc from the previous five percent by week’s end. The special foreign exchange auction must have played a crucial role in stabilising the market.

As we advance into the digital age, the robustness of the banking infrastructure's cybersecurity is being put to the test. A recent glitch at CBE has brought to attention the urgent need to enhance security, especially as the economy becomes increasingly digital. The potential havoc a cyberattack could unleash — especially in the foreign exchange markets — is a threat the authorities should take seriously.

The floating exchange rate amplifies systemic risks within the banking industry and the larger economy. The shift has intensified the fiscal burdens on customers, who, despite having settled their letters of credit (LC), should now contend with inflated bills due to Birr losing its ground. The anticipated arrival of foreign banks would add another layer of uncertainty. Caught off guard, domestic banks are struggling to adapt to this new market reality.

These new entrants, supposedly equipped with substantial capital, technology and competitive advantages, would pose a formidable challenge to local banks, many of which have seen their total assets and paid-up capital nearly halved due to the exchange rate volatility. Yet, amidst these uncertainties, the Central Bank has begun to assert its regulatory influence on the market. However, the demand for regular updates on global forex standards and swift transaction reporting indicates a pressing need for even closer monitoring of market movements.

The evolution of foreign exchange markets has opened the floodgates to new risks for businesses and financial institutions. The economic risks posed by currency fluctuations, particularly given the country’s political climate and systemic vulnerabilities, are real threats. Interestingly, the recent deposit pledges of 2.5 billion dollars from multilateral financial institutions could have positively impacted liquidity and slightly boosted the Birr.

However, these positive trends exist alongside concerns about how the financial sector will respond to the influx of foreign banks and investors, as well as the looming threat of speculative attacks on the currency. The need for preparedness and adaptability has never been more crucial.

PUBLISHED ON

Aug 10,2024 [ VOL

25 , NO

1267]

Radar | Jun 21,2025

Viewpoints | Oct 05,2024

Fortune News | Jul 13,2025

View From Arada | Sep 03,2022

Fortune News | Aug 16,2020

Fortune News | May 24,2025

Agenda | Jul 28,2024

Obituary | Mar 16,2024

Editorial | Jul 17,2022

Radar | Apr 30,2024

Photo Gallery | 180314 Views | May 06,2019

Photo Gallery | 170511 Views | Apr 26,2019

Photo Gallery | 161543 Views | Oct 06,2021

My Opinion | 137274 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...