Jun 24 , 2023

By Yehualashet Tamiru Tegegn

Ethiopia, often lauded as an African economic tiger, now faces severe financial difficulties, with a looming threat of default and potential economic and social collapse. The government's primary strategy has been attracting foreign investment to restore its diminishing foreign currency reserves, writes Yehalashet T. Tegegn (yehuala5779@gmail.com), an adjunct lecturer of law at Addis Abeba Univerity.

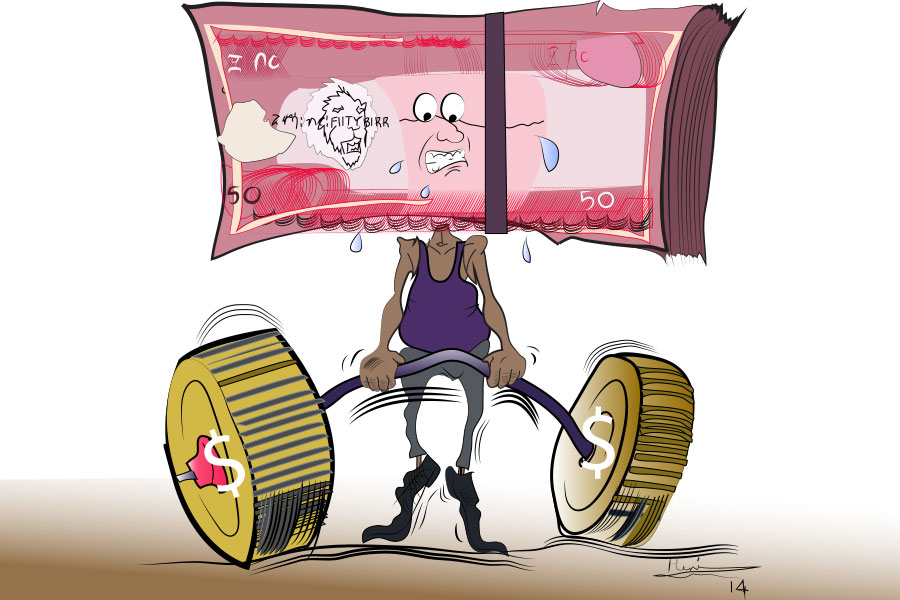

Under the shadow of Africa's second-highest peak, Ethiopia is teetering on a precipice. Often hailed as an African economic tiger, the country is now beleaguered by a cascade of financial troubles that present not only a threat of default but also of a broader social and economic breakdown. This raises questions about the judiciousness of betting on foreign investment as the primary panacea.

The Ethiopian government is currently trying to court its creditors into an agreeable debt restructuring plan, yet tangible progress remains elusive. The country's coffers are strained, and bankruptcy looms ominously on the horizon. Default is now a question of when - not if - unless a credible debt restructuring strategy is implemented. The authorities are toying with all available fiscal levers in a desperate bid to buoy the sinking ship.

Tax rates are being tweaked, and public expenditure is pruned. Notably, a concerted effort to woo foreign investment is being pursued. The latter is seen as a lifeline to replenish the evaporating foreign currency reserves. However, in pursuing short-term gains, the government risks making long-term mistakes. Its endeavour to privatise public enterprises, and concessions to foreign investors, may come at the expense of domestic interests. The allure of foreign currency is strong, yet it should not lead the government into overpromising or overstretching protections for investors.

Each policy action invariably births winners and losers. An aggressive pursuit of foreign investment can tip the scales unfavourably for domestic stakeholders.

Take, for instance, the government's attempts to expand its revenue base by increasing the tax base or tax rates. While this may put more money into the national purse, the average Ethiopian employee or consumer bears the brunt of these changes. Conversely, reducing taxes may make for happier consumers but drains the state's resources.

This tug-of-war between domestic and international interests also extends to investor protection. While respecting investment treaties can reassure investors, it may come at a high cost for the country. Protection measures may imply giving up a degree of control over national resources and sacrificing larger economic objectives. The economic guarantees offered by Ethiopia should not be perceived as an absolute entitlement for investors, overriding the country’s broader interests. Economic crises can have far-reaching impacts on social and human rights, and no investor’s rights, usually property rights, should overrule the fundamental human rights of the citizens.

Investors naturally desire protection from risk, but the scales must be balanced. The same investors who benefit from a prosperous economy should also bear some of the burdens when public policy measures are required in response to economic downturns. Investing involves risk, and it is unrealistic for investors to expect protection from all eventualities.

While offering protections and incentives to investors may address Ethiopia's short-term problems, it risks creating a time bomb for the future. The government should retain the right to adjust its policies as needed, and these rights should be clearly stated in investment agreements. Failing to do so could see Ethiopia repeating the missteps of Argentina in the early 2000s.

In that instance, in the grip of a severe economic crisis, Argentina attempted to stabilize its economy through structural reforms, fiscal discipline, and a sweeping privatisation of state-owned entities. Despite its desperate situation, the government retained the right to regulate investors' fee schedules, indicating an attempt to retain control even amidst chaos.

In 2002, Argentina took a bold step. It unpegged its currency from the US Dollar, a move known as "pesification," which affected all contracts and payments in Argentina. This was a gamble aimed at controlling hyperinflation and stimulating growth. However, the decision was challenged by foreign investors who took their cases to international arbitration tribunals, alleging a breach of the Bilateral Investment Treaties (BITs). The tribunals ruled in favour of the investors, a chilling precedent for countries like Ethiopia looking to walk a similar path.

The analogy is important in the Ethiopian context, not only to illustrate the risks of overcommitment to investors but also to remind us of the social and human rights ramifications of an economic collapse. As Argentina's economy imploded, fundamental rights such as security and health were undermined. Similarly, Ethiopia's present economic struggle is not just a financial crisis; it has profound implications for its people's quality of life and human rights.

The lessons from Argentina should caution Ethiopia against over-promising in its bid to attract foreign investment. Overreaching to secure foreign currency could plunge it into more profound economic and social turmoil. While international investment may offer a short-term solution, the government must retain control over its economy to protect long-term stability.

It would be remiss to overlook the role of multinational corporations and foreign investors in modern economies. Their influence in shaping economic landscapes, creating job opportunities, and bolstering foreign currency reserves is indisputable. For developing countries like Ethiopia, these factors are particularly salient.

However, hunting for foreign currency and investment should not override the duty to protect citizens' welfare. The government must balance protecting investors and preserving its ability to regulate the economy in the public's interest. This includes retaining the right to amend public policies and ensure investment agreements incorporate such provisions.

Ethiopia's predicament underscores a critical lesson for other economies teetering on the brink of a similar crisis. There is a fine line between attracting foreign investment and sacrificing long-term national interests for short-term gains. As countries navigate these treacherous waters, the priority should always be to protect their economic sovereignty and the welfare of their citizens.

By avoiding the temptation to overpromise, by staying firm on protecting the rights of its citizens and by retaining its ability to change its public policies as and when needed, Ethiopia might still be able to navigate through this storm, emerging more assertive and resilient in the other side. It is a journey fraught with challenges, but with thoughtful navigation, the promise of a brighter future remains alive.

PUBLISHED ON

Jun 24,2023 [ VOL

24 , NO

1208]

Viewpoints | Nov 02,2024

Fortune News | May 14,2022

Fortune News | Oct 30,2021

Fortune News | Jan 15,2022

Editorial | Dec 30,2023

Fortune News | Jan 26,2019

Editorial | Jan 29,2022

Radar | Oct 20,2024

Radar | Jul 21,2024

Radar | Apr 01,2024

My Opinion | 131673 Views | Aug 14,2021

My Opinion | 128039 Views | Aug 21,2021

My Opinion | 126001 Views | Sep 10,2021

My Opinion | 123622 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...