Fortune News | Dec 25,2021

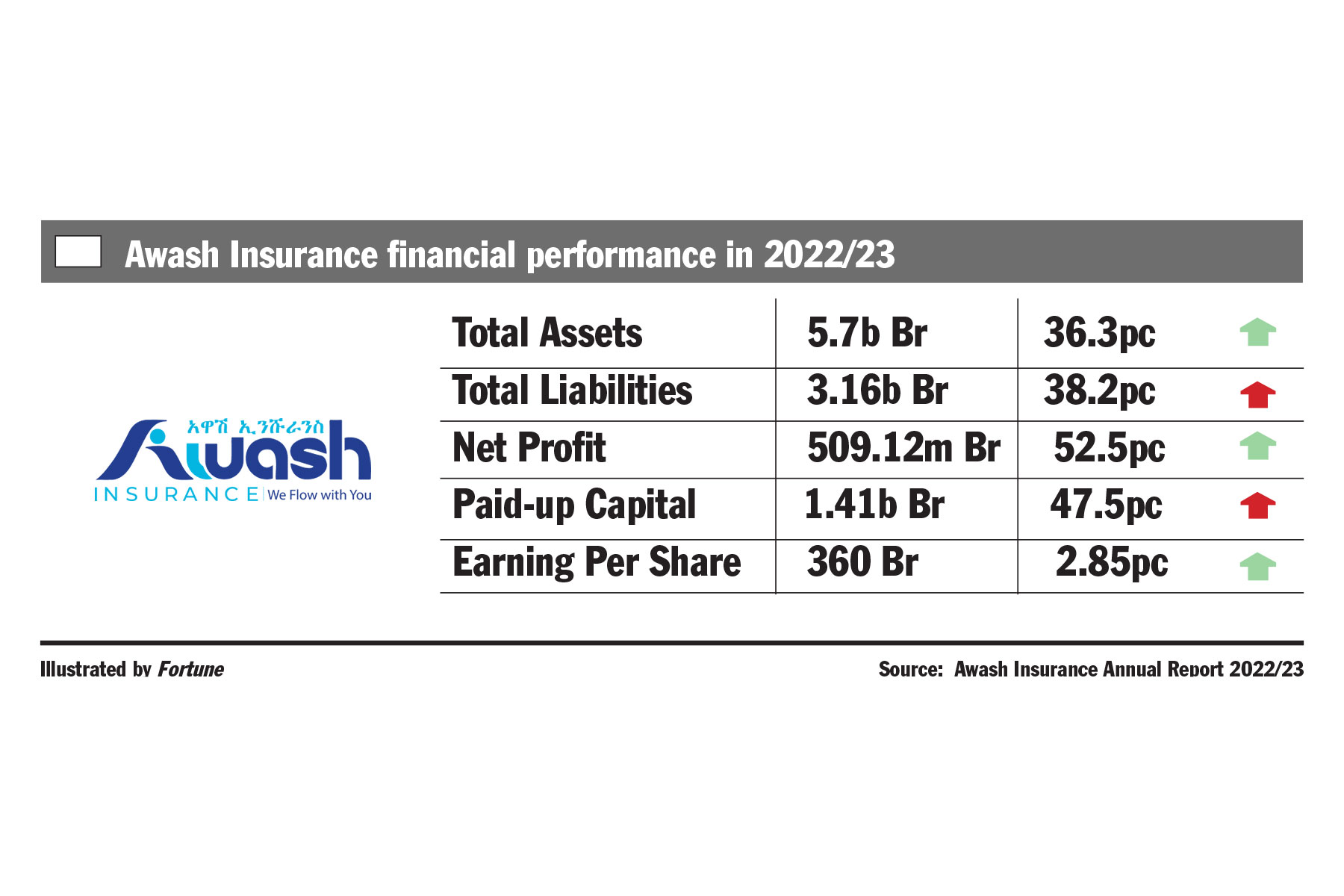

Awash Insurance consolidated its lead in the private insurance sector last year, registering vigorous profit growth that eclipsed its competitors — United Insurance, Nyala, and Oromia. Despite a challenging economic backdrop, Awash Insurance outperformed with a profit of 509.12 million Br, a 52.5pc increase from the previous year, outstripping United Insurance’s 327.02 million Br, Nyala’s 273.3 million Br, and Oromia’s 333.9 million Br in net profits.

Although its earnings per share (EPS) grew modestly by 10 Br to 360, this growth was less pronounced than its contenders during the same period. Its EPS lagged behind Oromia’s 430 Br and United’s 479 Br, though slightly higher than Nyala’s 354 Br.

Awash’s acting CEO Jibat Faji, attributed the dampening EPS growth to its aggressive capitalisation strategy. The company raised its paid-up capital by 47.5pc to 1.41 billion Br, nearly threefold the half-billion regulatory minimum set by the National Bank of Ethiopia (NBE) and almost double Nyala’s 830 million Br, United’s 840.5 million, and Oromia’s 870 million Br.

Abdulmenan Mohammed (PhD), a London-based financial analyst, noted that the substantial capital increase has impacted the company’s EPS. He urged the directors to consider a capitalisation policy beneficial to shareholders.

The Acting CEO, Jibat Faji, echoed this sentiment, citing the company’s strategy of bolstering its capital to align with profit growth. At the shareholders’ meeting, he stated: “We still have one of the highest EPS in the industry.”

However, at 36pc return, Awash posted an EPS four percentage points lower than United Insurance in the 2022/23 operation year.

The company’s profit surge was driven primarily by a substantial 64.1pc increase in investment returns, totalling 484.1 million Br, and a 35.4pc jump in underwriting profit to 548.88 million Br. This was supported by a 36.4pc increase in gross written premiums, which reached 2.4 billion Br. A 6.4pc drop in the amount ceded to reinsurers enhanced the company’s retention rate.

Abdulmenan praised Awash’s management for its adept handling of investments during this period.

Awash Insurance not only retained its lead among private insurers but also commands a 22.3pc market share in the life insurance segment, with nearly 60pc of its revenues stemming from motor insurance. Despite the insurance industry contributing less than one percent to the national GDP, it saw a collective net profit increase of 29pc from the previous year, reaching 3.6 billion Br.

Continuing its aggressive growth course despite losing its respected executive, Gudissa Legesse, Awash Insurance has rewarded its shareholders with returns almost 50pc higher than the banking industry offers. According to Board chairman Tadesse Gemeda, who addressed a shareholders’ assembly held at the Addis Ababa Hilton Hotel on Menelik II Avenue in October last year, the firm has maintained its strategic dominance in the general insurance market.

Awash Insurance’s gross written premium was nearly twice that of its closest competitors, with United at 1.5 billion Br, Oromia recording around 1.2 billion Br and Nyala slightly more at 1.3 billion Br. The insurance industry reported a 38pc increase in gross written premium to 22.9 billion Br, with general insurance accounting for 94pc of the premium income and life insurance generating the balance. The industry recorded a loss ratio of 59pc as net earned premiums reached 12.8 billion Br against substantial net claims of 7.5 billion Br.

Tsegaye Kemsi, one of the 456 founding shareholders, praised the company’s performance. Awash Insurance was incorporated in 1994 with a 4.9 million Br paid-up capital and appointed Tsegaye as its founding CEO before he was replaced by the late Gudina five years ago. He believes the company should focus on underwriting services in fire and life insurance, for they yield higher returns with modest risks. He argued that several motor insurance claims are either fraudulent or exaggerated.

The acting CEO disclosed that motor insurance claims constituted most of the total claims; consistent with industry-wide figures, this segment contributed around 52pc of the premium income at a loss ratio of 69pc.

Tsegaye called for updated risk assessment procedures and management practices to strengthen Awash’s industry leadership.

After working at the branch for a decade, where he increased its performance by 33pc this year, Binyam Binyam Gebremehdin, manager of the Gofa Branch, recognised motor insurance as the most resilient and sought-after insurance segment. Over the past year, he has observed a dip in appetite for performance guarantee bonds from new construction projects and marine insurance.

“Both construction and international trade have dipped,” he told Fortune. “But, we’re on a strong growth trajectory.”

The financial performance was also reflected in the company’s earnings from the commission, which rose by 23.2pc to 164.99 million Br, although the commission paid out to agents grew by 67pc to 102.67 million Br. However, the surge in gross written premiums and retention rates led to a notable increase in claim expenses and other provisions by 36.6pc to 836.3 million Br.

“It should ring a bell for better risk management practices,” said Abdulmenan.

According to Jibat, the rise in claim expenses was due to increasing costs for automobile spare parts for motor insurance and higher payouts for political violence and terrorism insurance.

Despite rising operational costs, which saw a 40pc increase in wages, benefits, and administration expenses to 541.64 million Br, Jibat defended these expenses, citing the company’s extensive portfolio and nationwide presence with 60 branches and 717 employees.

“It’s small compared to our size,” he argued.

Awash Insurance’s total assets saw an upturn by 36.3pc to 5.7 billion Br, primarily held in short-term and fixed-time deposit accounts worth 1.99 billion Br, 860.41 million in shares, 60 million Br in government bonds, and 366.22 million in property investments. With its capital and non-distributable reserves representing 28.6pc of its asset base and a rise in its ratio of cash and bank balances to total assets by 1.13pc to six percent, Abdulmenan observed that the firm remains a well-capitalised enterprise, substantially ahead of its peers.

Awash Insurance’s asset base is considerably higher than its peers, edging United by 2.4 billion Br, Oromia by two billion Br, and Nyala’s asset base by 1.9 billion Br.

The acting CEO disclosed plans to expand Awash’s asset base further by constructing a 32-story building in the heart of the capital’s financial district around Mexico Square, consolidating the firm’s ambitious expansion strategies.

“Our investments are still below the regulatory cap,” Jibat told Fortune.

PUBLISHED ON

Apr 20,2024 [ VOL

25 , NO

1251]

Fortune News | Dec 25,2021

News Analysis | May 04,2024

Fortune News | Dec 24,2022

Radar | May 24,2025

Editorial | Jul 10,2021

Fortune News | Oct 18,2025

Viewpoints | Jan 26,2019

Radar | Aug 21,2021

My Opinion | Nov 16,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...