My Opinion | Nov 16,2019

Mar 1 , 2024

By Rabah Arezki

Rabah Arezki, a research director at the French National Center for Scientific Research (CNRS), is a senior fellow at the Foundation for Studies & Research on International Development (FERDI) and Harvard Kennedy School. This article is provided by Project Syndicate (PS).

Before the outbreak of COVID-19, Africa experienced 25 years of uninterrupted economic expansion, prompting analysts to proclaim that the continent’s growth momentum was no longer dependent on its extractive industries. As access to education and health care increased, so did life expectancy, nurturing an "Africa Rising" narrative. African countries turned to international capital markets, many of them for the first time, to finance their development needs.

A close examination of the data, however, reveals that Africa’s economic growth has not been broadly shared.

Per capita growth, in particular, has been far less impressive than it initially seemed. Poverty remains endemic across the continent, with roughly 431 million people in extreme poverty (living on less than 1.90 dollars per day). Without decisive action, the United Nations (UN) estimates that an additional 60 million will fall into extreme poverty by 2030. The inefficient delivery of public services like education and healthcare has led to widespread dissatisfaction.

The ambitions of the continent’s increasingly educated young people, in particular, seem to have outpaced actual material progress. Despite significant efforts to increase availability, half of Africa’s population still lacks access to electricity. Consequently, millions of Africans have migrated in recent decades for better opportunities. The economic shocks of the past few years, especially the pandemic and Russia’s invasion of Ukraine, have undermined the “Africa Rising” narrative by highlighting the continent’s heavy dependence on imported medicines, food, and fuel. Despite being home to 60pc of the world's uncultivated arable land, these crises have underscored Africa’s slow progress in capitalising on its vast land and subsoil resources to achieve food and energy security.

The situation in Africa today resembles the 1990s, a decade marked by wars, coups, and severe food and debt crises. The convergence of internal instability and external shocks has set in motion a vicious cycle of economic and financial distress, raising questions about the continent’s ability to shape its own destiny.

In the face of these challenges, however, African countries have become increasingly proactive in promoting their domestic and regional interests. This shift is reflected in their voting patterns at the UN General Assembly, particularly on issues like the war in Ukraine. African leaders have also been more prominent in international energy and climate discussions.

This newfound assertiveness is partly the result of a changing geopolitical landscape where rival global powers increasingly court African countries. Political leaders now have a unique opportunity to leverage their growing clout by accelerating the African Continental Free Trade Area (AfCFTA) implementation. The AfCFTA, which came into force in 2019, aims to boost cross-border trade by creating a unified market with rules of origin that provide preferential treatment to African-sourced goods. Establishing this trade bloc could stimulate industrialisation and strengthen Africa’s position in global negotiations.

While the AfCFTA represents a significant shift in Africa’s economic paradigm, unlocking its full potential will require a concerted effort. The continent’s population is projected to increase from 1.2 billion today to 2.5 billion by 2050. While some commentators view rapid population growth as a potential trigger for sociopolitical unrest and a drag on public finances, the economic benefits should not be underestimated. African countries could capitalise on this demographic dividend by boosting cross-border trade and streamlining their governance systems.

For decades, African policymaking has been dominated by an economic paradigm focused on meeting international market demand, akin to the export-led growth strategy underpinning East Asia’s “economic miracle” between the 1960s and 1990s. This approach was predicated on the belief that international competition would force governments to implement domestic reforms and boost productivity.

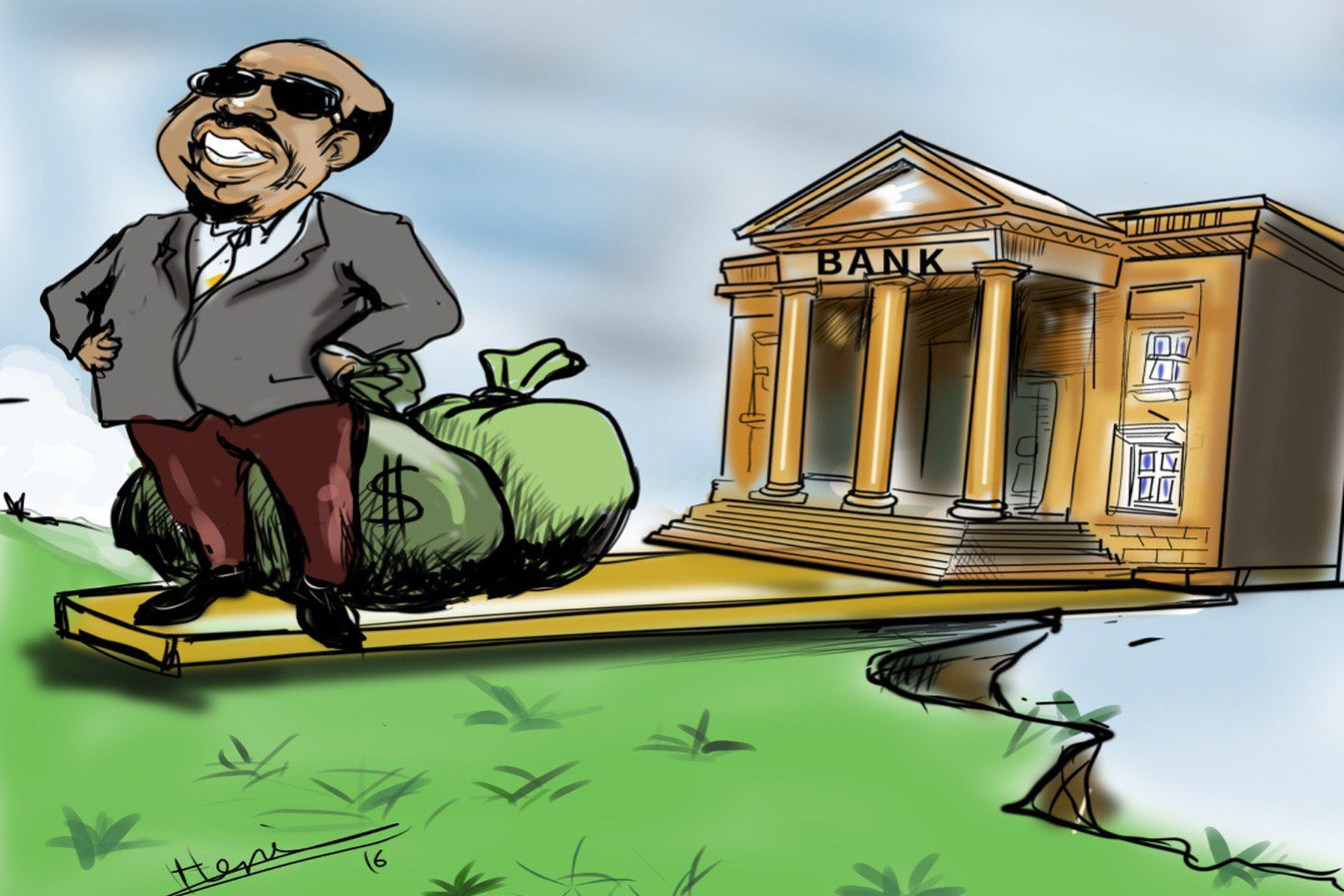

In reality, however, Africa continued to rely heavily on commodity exports. African economies have often struggled with high-interest rates and overvalued currencies. Consequently, the prevailing macroeconomic paradigm fostered an over-reliance on imports, with domestic financial systems catering to governments and import oligopolies rather than diversifying the continent’s economic base.

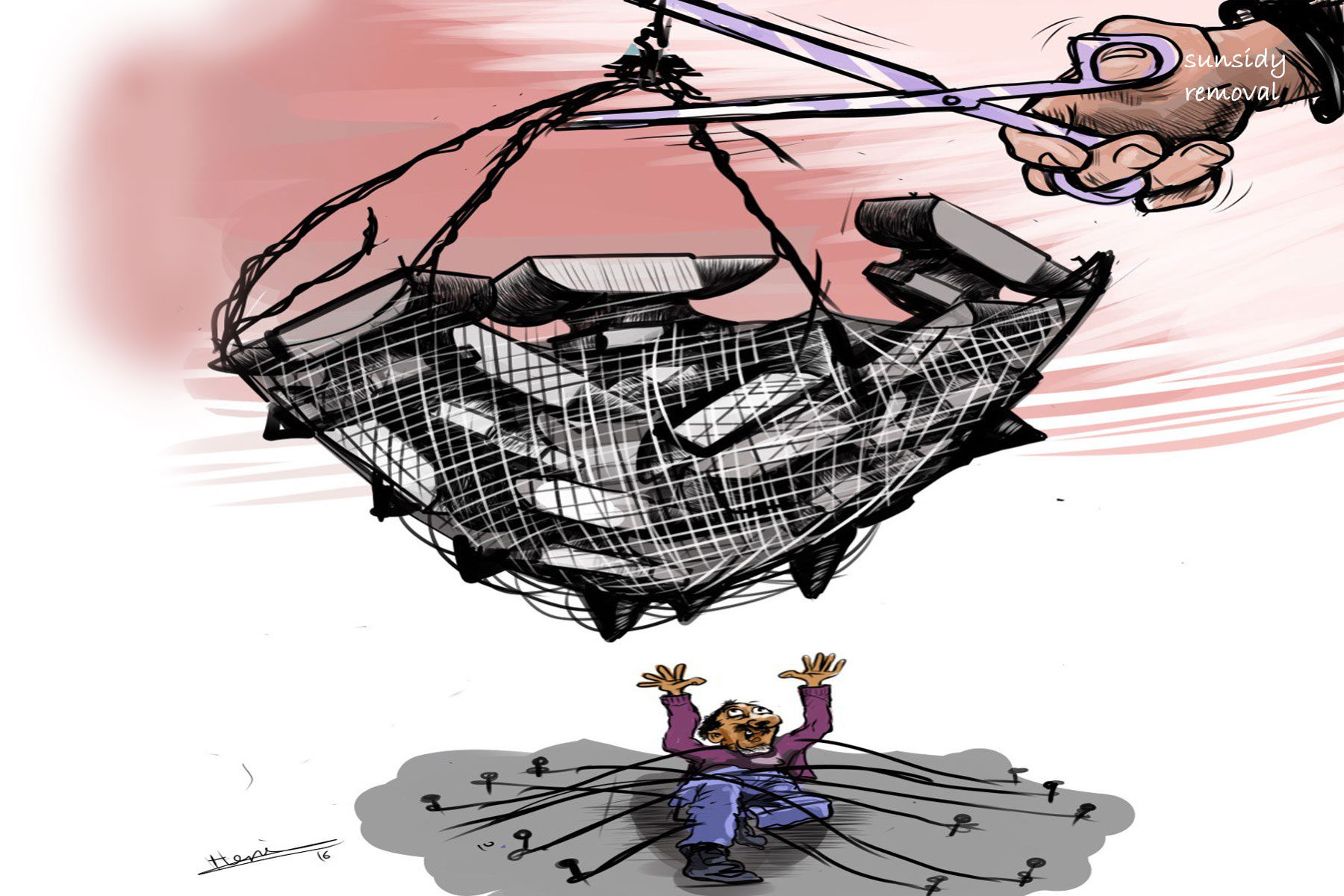

The new paradigm African countries must adopt relies on domestic demand-driven growth, capitalising on the continent’s fast-growing consumer base. To achieve this, policymakers must increase local production capacity by leveraging domestic demand. This is particularly relevant to sectors like agri-business, electricity, telecoms, and finance, where demand is rapidly rising, and the potential for regionalisation is enormous. For starters, African leaders should demonopolise the import sector by encouraging more competition in transportation and distribution. They should pursue competitive exchange rates while establishing adequate safety nets to mitigate potential adverse effects.

By combining exchange-rate adjustments with enhanced product-market competition, policymakers could redirect spending from imports to domestically manufactured goods and avoid devaluation-induced inflation. A renewed focus on industrialisation has the potential to integrate a large segment of the population currently working in the informal sector into the labour market, thereby providing workers with better employment opportunities.

While macro-structural adjustments are crucial to attracting domestic and foreign direct investment, African countries must also secure the necessary financing to meet their immense infrastructure needs, especially when eradicating energy poverty. To support their new economic strategy, many debt-distressed countries must first restructure their existing liabilities, which requires international partners' support.

African policymakers must focus on boosting energy production, in addition to shifting to renewables. Governance reforms, supported by regional integration, will be crucial to meeting the continent’s growing energy needs. De-risking strategies, such as guarantees offered by development banks, cannot enhance the attractiveness of energy projects. Countries could make their energy industries more investor-friendly by implementing bold, comprehensive reforms, particularly in the electricity, financial, and transportation sectors.

Success is far from guaranteed, partly because the interests of politicians and businesses in Africa are often aligned, breeding corruption and deepening public distrust. While the continent’s emerging economic paradigm promises greater self-reliance, particularly in key sectors like food and energy, its potential cannot be fully realised without the rule of law. African leaders must use this opportunity to reaffirm their commitment to upholding it.

PUBLISHED ON

Mar 01,2024 [ VOL

24 , NO

1244]

My Opinion | Nov 16,2019

Editorial | Dec 09,2023

Viewpoints | Jan 15,2022

Viewpoints | Jul 29,2023

Viewpoints | Sep 17,2022

News Analysis | Apr 20,2024

Commentaries | Dec 14,2019

Viewpoints | Jul 09,2022

Fortune News | Sep 14,2019

My Opinion | Jul 17,2022

Photo Gallery | 97511 Views | May 06,2019

Photo Gallery | 89744 Views | Apr 26,2019

My Opinion | 67424 Views | Aug 14,2021

Commentaries | 65849 Views | Oct 02,2021

Editorial | May 02,2024

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

May 2 , 2024

For successive generations of Ethiopia's tax authorities, the chore of tax collection...

Apr 27 , 2024

The Prosperity Party (PP) - Prosperitians - is charting a course through treacherous...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 28 , 2024

A dire situation unfolds across public universities, where students face the harsh re...

Apr 28 , 2024 . By MUNIR SHEMSU

A European business lobby in Ethiopia issued a scathing review of the tax system last...

Apr 28 , 2024

The Federal Supreme Court has recently ruled in the prolonged commercial dispute surr...

Apr 28 , 2024 . By MUNIR SHEMSU

Transport authorities placed blame on driving schools and vehicle inspection centres...