Despite notable gains in loan interest and investment returns, Addis International (Addis Bank) executives have struggled with a substantial reduction in foreign exchange income, which cast a long shadow over the Bank's profitability. In a turn of events aberration to the industry's trend, the outcome has left shareholders reeling after directors reported a precipitous decline in the Bank's annual performance, marking a significant departure from its previously robust growth course.

Addis Bank's net profit plummeted to 223.48 million Br in its operation of 2022/23, marking a 35.2pc decline from the previous year and positioning it behind peers such as Enat, Global, and Berhan banks, which reported profits in the upwards of half a billion Birr. The downturn was emphasised by a dramatic fall in Earnings per Share (EPS), which more than halved to 12.91pc, leaving Addis Bank trailing in the wake of its competitors. The average for 29 private commercial banks was 38pc during the year.

"This ought to have shocked shareholders," said Abdulmenan Mohammed (PhD), a financial analyst based in London, but a keen observer of the domestic financial sector.

The decline in profit should prompt concerns over the Bank's strategic direction and operational efficiency, according to industry analysts. Abdulmenan attributed Addis Bank's unexpected downturn to a significant drop in foreign exchange net gains and a notable rise in expenses.

Hailu Alemu, Addis Bank's president, pointed to high surrender amounts and lower interest on exporters' loans as contributing to his Bank's financial woes.

"We lost half a billion Birr from this," Hailu told Fortune, conceding the severe impact of these factors on the Addis Bank's profitability.

Hailu, who holds degrees in accounting and economics from Addis Abeba University, has been with Addis Bank since its incorporation in 2012, serving as its founding president. His background in finance and economics likely informs his strategic approach to responding to tough times the Bank faced. Under his managment, a notable increase in interest on loans and investments in central bank bonds was recorded, rising by 33.8pc to 1.1 billion Br.

The domestic banking industry, known for its fierce competition and rapid changes, has presented a formidable challenge to Addis Bank. With a shareholder base of 15,000 deeply rooted in savings and credit associations, traditional community-based financial institutions, and farmer unions, the Addis Bank's recent performance has been a wake-up call, bringing to the fore the volatile nature of banking during economic headwinds.

Despite these, Addis Bank recorded positive developments, including a 33.8pc increase in interest income from loans and investments, and a modest 8.8pc rise in service charges and commissions. However, these gains were overshadowed by a significant reduction in income from foreign exchange dealings, which plummeted to 79.9 million Br from a high of 203.62 million Br the previous year.

The Bank's ambitious expansion saw the opening of 20 new branches, bringing the total to 132, alongside the hiring of 116 new employees, increasing the total workforce to 1,170. They are among the over 135,000 people the banking industry employs, with a considerable number working within first—and second-generation private banks. Addis Bank is known to have a lean operational model that provides operational efficiencies.

Fasil Sirak is among the staff members who have been with Addis Bank since its foundation over a decade ago. Managing Addis Bank's branch in the Mekanisa neighbourhood, he acknowledged that deposit mobilisation and generating forex were demanding tasks during the year. He saw when interest incomes grow alongside deposit increases, as these funds are often disbursed as loans. He believes in the importance of digital banking services to enhance profitability, advocating for a potential shift in strategy to address the Bank's financial challenges.

Kassahun Bekele, the board chairman, disclosed to shareholders his frustration over the long-awaited plot of land to build the Bank's headquarters, which was pending due to bureaucratic procedures. According to him, acquiring warehouses and properties for branches in Addis Abeba, including condominium houses for branch offices in Bulbula and Bole Arabsa, was pending, while lease agreements around the Qera Ara area were pending.

However, the rate of increase in assets, loan advances, and deposits in 2023 was lower compared to the preceding year. Hailu attributed this to the expanded financial landscape and the entry of new competitors into the market, which has made it increasingly challenging for the Bank to achieve high growth levels.

"Macroeconomic changes play a role in affecting the growth trajectory," he told Fortune.

However, Addis Bank's operational costs have surged, with interest paid on deposits, wages, and general administration expenses all recording significant increases. Yet, compared to its peers, wage expenses remained relatively lower, with a more conservative approach to spending. Abdulmenan flagged the Bank's high expenditure on branch rentals, salaries, and interest on time deposits as areas of concern.

Hailue told shareholders that the competitive landscape for talent and customers, intensified by aggressive branch expansion, has put additional pressure on the Bank's financial health.

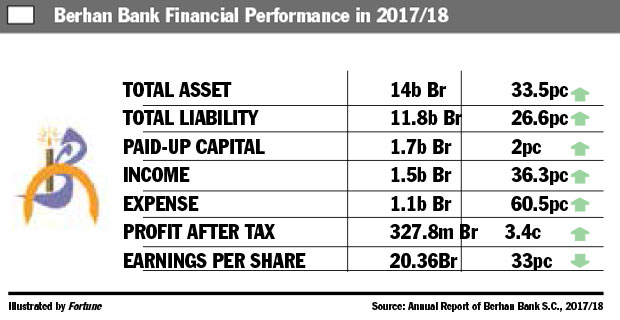

Addis Bank may have taken a more conservative approach in provisioning for potential loan impairments compared to its peers. There was a drop in the provision for impairment of loans and other assets, which declined to 14.55 million Br from 62.25 million Br. The amount is lower by more than double compared to Enat Bank's 149.3 million Br and significantly behind Berhan Bank's 311.15 million Br.

The loan-to-deposit ratio of Addis Bank increased to 82.7pc from 77.8pc, indicating increased lending activities. However, liquidity analysis reveals a decline in value and relative terms. Its cash and bank balances decreased by a substantial 3.1pc to 2.16 billion Br but lower than some of its peers. It is almost equal to Global Ethiopia's 2.1 billion Br, significantly lower than Enat's 4.1 billion Br and higher than Berhan Bank's 1.6 billion Br, suggesting that Addis International Bank's liquidity position falls in between.

Despite the setbacks on profitability and EPS fronts, Addis Bank's total assets grew by 16.8pc to 12.6 billion Br, with loans and advances totalling 7.47 billion Br. This demonstrated a significant effort to mobilise deposits, which grew by 16.5pc to 9.03 billion Br. However, the growth rate in assets, loan advances, and deposits was lower than the previous year, revealing the Bank's struggles in a rapidly expanding financial sector.

The Bank's liquidity position has become another area of concern, with declined cash and bank balances revealing a tighter financial situation. The ratio fell from 20.6pc to 17.1pc, indicating a decrease in the Bank's liquidity position relative to its total assets. Despite this, Abdulmenan commended Addis Bank for maintaining a reasonable level of liquidity under the circumstances.

Tamiru Tadesse, a shareholder, echoed this view, praising the Bank's executives for their liquidity management but suggested increasing paid-up capital through listing on the future capital market. He also believes considering a potential merger could be another option to boost the Bank's capital base and propel its growth. As Addis Bank struggles with meeting the regulatory minimum threshold of five billion Birr by 2026, Hailu disclosed plans to boost share sales, reflecting a strategic push to strengthen the Bank's capital base amidst economic upheaval. Shareholders have raised paid-up capital by 27.1pc to 1.83 billion Br, with 3.2 billion Br in shortfall.

Addis International Bank was incorporated by pooling 109.4 million Br in equity from 5,309 shareholders, contributing to its initial capitalisation. The diverse shareholder base reflects a broad community involvement in the formation and ownership of the Bank, with a sense of local ownership and support for its operations. The substantial increase in capital, alongside a significant decline in profit after tax, resulted in a notable decrease in share earnings. Despite this decline, Addis achieved a capital adequacy ratio (CAR) of 29.9pc, indicating that it is a highly capitalised bank.

"The management should use its capital efficiently to improve shareholders' returns," said Abdulmenan.

Addis Bank's story is a microcosm of the broader trends in the banking industry, where a blend of strategic expansion, aggressive lending, and customer service focus has defined the industry's competitiveness.

The industry's dynamics, with commercial banks holding a 50.5pc (but not overwhelming) share of 1.9 billion Br in deposits and assets, set the stage for intense competition among first—and second-generation private banks. These banks have taken a more aggressive position, disbursing loans and advances to 857 billion Br, representing 70.5pc of the industry's total. While Addis Bank may not have the sprawling branch network or the voluminous customer base of first and second-generation private banks, which dominate the landscape with over 55pc of the total customer base and 71pc of the branches, it appeared to have carved a niche that speaks to effective management and strategic foresight.

Smaller in scale compared to giants like Awash, Abyssinia, and Dashen banks, Addis Bank has demonstrated an operational foundation and efficiency that belies its size. However, what sets it apart is not the size of its ledger but the quality of its performance metrics. With a return on equity (RoE) of 9.4pc and a return on assets (RoA) of 1.9pc, Addis Bank illustrated a prowess in leveraging its equity and assets to generate profits that many larger banks could envy.

PUBLISHED ON

Mar 16,2024 [ VOL

24 , NO

1246]

Fortune News | Nov 27,2018

Fortune News | Oct 27,2024

News Analysis | Mar 23,2024

Fortune News | Feb 16,2019

Viewpoints | Aug 16,2025

Radar | Aug 17,2019

Viewpoints | Nov 05,2022

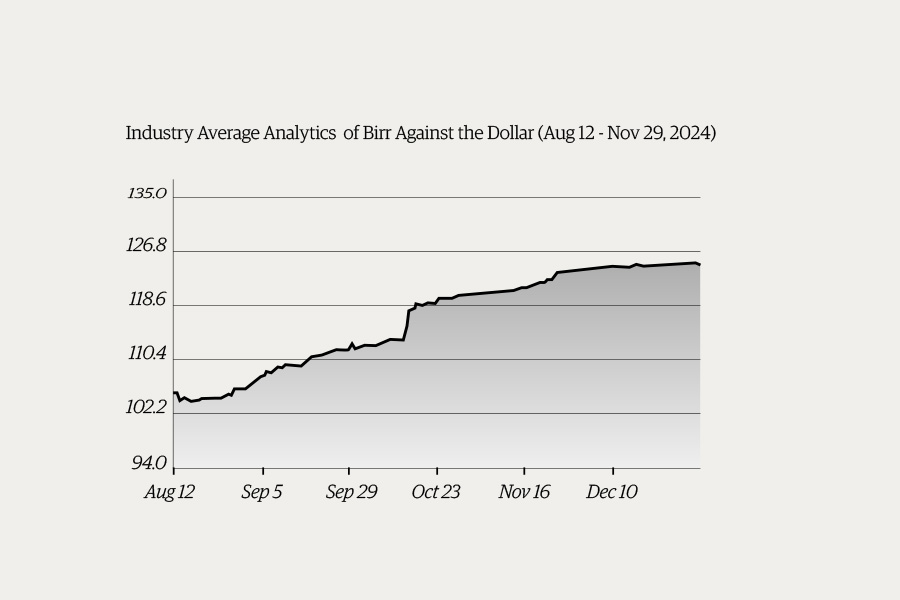

Money Market Watch | Jan 05,2025

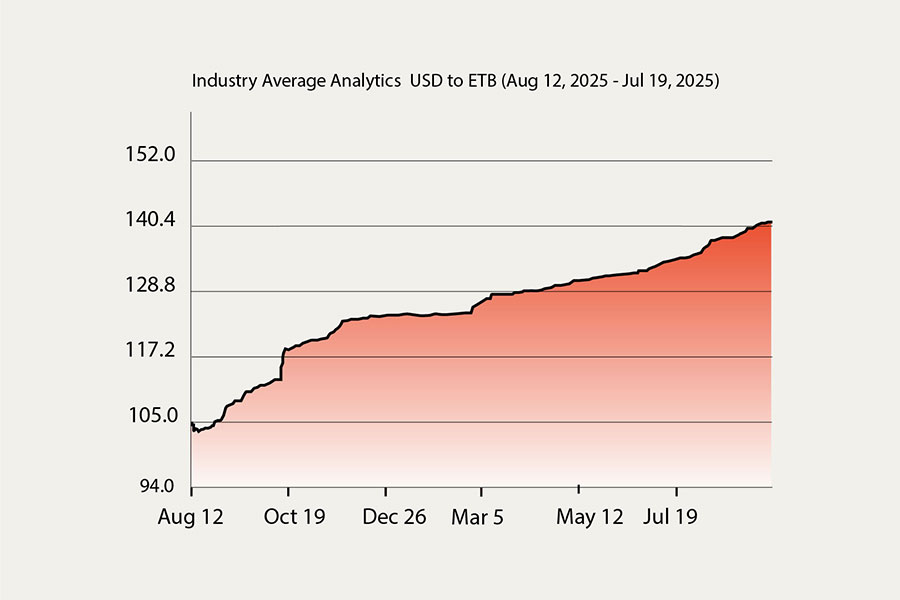

Money Market Watch | Sep 27,2025

My Opinion | Jul 18,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...