Fortune News | Dec 27,2018

Apr 10 , 2021

By KIDUS DAWIT ( FORTUNE STAFF WRITER )

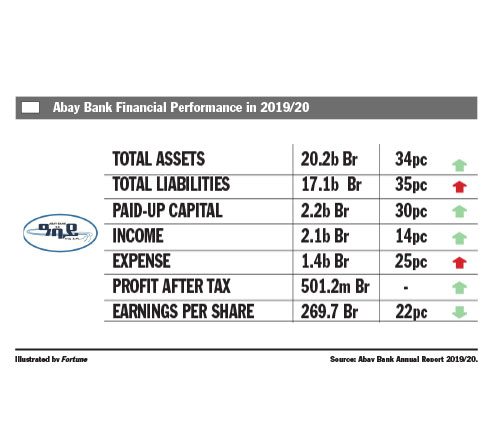

Earnings per share (EPS) went down by 21.5pc to 269.66 Br.

Earnings per share (EPS) went down by 21.5pc to 269.66 Br. It was not a gratifying year for the shareholders of Abay Bank, which fell short of repeating the impressive performances it had been exhibiting for the better part of its decade in operation. Abay’s net profit for the last fiscal year remained stagnant, in stark contrast to the average industry growth rate of 33pc recorded in the year 2018/19.

Earnings per share (EPS) went down by 21.5pc to 269.66 Br. The main culprits behind such slack figures are stagnant profit at a little over half a billion Birr, coupled with the injection of fresh capital.

This must have been a disappointment to the shareholders, said Abdulmenan Mohammed, a financial statement analyst based in London.

It was a grim reality captured by Ethiopia Tadesse, board chairperson of Abay Bank.

"The year under review was marked by significant global and domestic developments which impacted our business in several ways," reads her statement published in the Bank's annual report.

Yehuala Gessesse, president of the Bank, attributes the challenging year to the pandemic, shortages in foreign currency, and surging inflation last year.

However, the Bank did attend decent growth in income, only to see it nullified by a spike in expenses, leading to the static performance. Interest on loans, advances and bonds bought from the central bank increased by 36.5pc to just over 1.5 billion Br, while income from service charges and commissions went down by 19pc to 418.54 million Br; a development that Abdulmenan characterised as "shocking."

Interest expenses increased by over a fifth to 567.5 million Br; other operating expenses increased by a similar amount to 341.82 million Br; while salaries and benefits jumped up to 451.9 million Br.

Much like others in the industry, Abay's gains on foreign exchange dealings plummeted over the last fiscal year. It saw a sharp drop of 62.6pc to 47.88 million Br.

It is time for the management of the Bank to thoroughly examine its competitive position in these areas of business and come up with a strategy to reverse such free fall, according to Abdulmenan. He did, however, recognise Abay for having a good credit management system, which he advises the Bank to capitalise on.

The Bank's provision for securing sick loans and other assets went down by almost half to 28 million Br, while total assets increased considerably to 20.2 billion Br. Abay disbursed loans and advances of 11.61 billion Br, an increase of 53pc, and mobilised deposits of 16.1 billion Br, a growth of 38.8pc. Its loan-to-deposit ratio increased to 72.1pc from 65.5pc, a "remarkable" figure, according to Abdulmenan.

Abay invested 2.71 billion Br in the central bank's five-year bonds, which account for 13.4pc of the Bank's total assets and 16.8pc of its total deposits.

The Bank also opened 31 new branches over the reporting period, bringing its total branch network up to 223.

Abay's liquidity level improved both in relative and value terms. Its cash and bank balances increased to 4.76 billion Br (including Treasury Bills and time deposits). The ratio of liquid assets to total assets also increased to 28.5pc from 22.2pc, and the ratio of liquid assets to total deposits grew slightly to 29.6pc from 29pc.

Abay increased its paid-up capital by 30pc to 2.17 billion Br. It has a capital adequacy (CAR) ratio of 23.9pc, which is about the same ratio for the banking industry at large.

"Abay has strong capital and huge liquid resources; it should use these to earn more income," said Abdulmenan.

The Bank's returns have been unsatisfactory to Bereket Haile, who acquired shares for 60,000 Br two years ago, becoming one of the over 4,000 shareholders. He believes it is better to invest than to hold on to money, in light of the country's growing inflation, hovering at 20pc of an annual moving average. He is confident that Abay can make a comeback.

"I increased my shares recently," he told Fortune. "I know the stagnation in performance is temporary."

PUBLISHED ON

Apr 10,2021 [ VOL

22 , NO

1093]

Fortune News | Dec 27,2018

Radar | Sep 19,2020

Fortune News | Apr 10,2023

Fortune News | Jan 28,2023

Radar | Oct 09,2021

Radar | Jan 14,2023

Fortune News | Apr 02,2022

Radar | Jul 15,2023

Fortune News | Aug 18,2024

Radar | Sep 06,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...