Editorial | Oct 14,2023

Apr 22 , 2022

By Ngaire Woods

Interrelated economic and political crises in poorer countries are putting millions of lives at risk, but mitigation is possible. Leading economies must refrain from beggar-thy-neighbour policies and use their combined resources in the IMF and the World Bank to act quickly and unconditionally to avert disaster, writes Ngaire Woods, dean of the Blavatnik School of Government at the University of Oxford.

Through no fault of their own, developing countries face a perfect storm of famine, political upheaval, and debt crises. Russia’s invasion of Ukraine and the Western-led sanctions it triggered are partly to blame, as are COVID-19 lockdowns in advanced economies, which deprived poor countries of vital tourism and export revenue.

Millions of lives are now at risk, but mitigation is possible. It should start at this month’s spring meetings of the International Monetary Fund (IMF) and the World Bank.

Policymakers have much to address – starting with spiralling food prices. The Russia-Ukraine conflict, involving countries that between them supply 29pc of the world’s wheat, has contributed to a 67pc increase in wheat prices since the beginning of this year. Export bans imposed by other wheat producers are also fueling price increases, as is a fertiliser shortage because of reduced supplies from Belarus and Russia.

Unsurprisingly, famine is spreading. The first countries to be hit are those that were in desperate straits prior to Russia’s invasion, including Afghanistan, the Democratic Republic of the Congo, Ethiopia, Nigeria, Pakistan, Sudan, South Sudan, Syria, Venezuela, and Yemen. Rapidly joining them are countries that rely on imported grain and were already facing acute food insecurity, such as Djibouti, Lesotho, Mozambique, Burundi, Madagascar, El Salvador, Lebanon, Honduras, Eswatini, Guatemala, and Namibia.

United Nations World Food Programme Executive Director David Beasley recently issued a stark warning: “If you think we’ve got hell on earth now, you just get ready. If we neglect northern Africa, northern Africa’s coming to Europe. If we neglect the Middle East, [the] Middle East is coming to Europe.”

Rising food prices and hunger will make riots and political upheaval more likely. Even before the Ukraine war began, people had been plunged into crisis in Afghanistan, Ethiopia, Somalia, Yemen, Myanmar and the Syrian refugee camps. In March, large-scale protests erupted in countries including Cameroon, India, Pakistan, Sri Lanka, and Spain.

Governments that can take preventive action are already doing so. Egypt, for example, which imports around 80pc of its wheat from Russia and Ukraine, recently introduced a price cap to counter the soaring price of unsubsidised bread (the government already subsidises bread for most of the population). The government also announced an economic aid package totalling 130 million Egyptian pounds (seven million dollars). These measures were made possible by assistance from the IMF and Saudi Arabia. But many countries have yet to receive such help.

Failure to cooperate is driving famine and conflict. Astonishingly, global stocks of rice, wheat, and maize, the world’s three major staples, are apparently at historic highs. Even stocks of wheat, the commodity most affected by the Ukraine war, are “well above levels during the 2007-08 food-price crisis,” while estimates suggest that about three-quarters of Russian and Ukrainian wheat exports had already been delivered before the invasion.

A serious debt crisis is also developing as many low-income countries, stretched to their limit by COVID-19, are hit by higher food and fuel prices, lower tourism revenues, reduced access to international capital markets, trade and supply-chain disruptions, depressed remittances, and a historic surge in refugee flows. Developing-country debt has soared to a 50-year high, at about 250pc of government revenues. About 60pc of countries that were eligible for the pandemic-related G20 Debt Service Suspension Initiative (DSSI) are experiencing or at high risk of debt distress.

Moreover, slower global growth and rising inflation, together with tighter financial conditions in richer countries, are spurring capital outflows from developing economies, forcing them to devalue their currencies and increase interest rates. As World Bank President David Malpass recently noted, “never have so many countries experienced a recession at once.” Malpass added that advanced economies’ stimulus policies have helped to make matters worse by fueling price rises and increasing inequality around the world.

Finding a genuinely global solution to these problems is now vital. In past debt crises, rich countries have used the IMF and World Bank to push the adjustment burden onto developing economies, arguing that they must undertake reforms before receiving assistance. But the most potent forces buffeting indebted low-income economies today are global and beyond their control – and IMF and World Bank member countries must pool resources and cooperate to address them.

The good news is that powerful shareholders in these institutions have proven capable of collective action. Last August, for example, they agreed to a new 650 billion dollar allocation of special drawing rights (SDRs, the IMF’s reserve asset).

But, because SDRs are distributed according to countries’ IMF quotas, most of the allocation went to the largest economies. Worse still, major IMF and World Bank shareholders have failed to channel resources to where they are most needed. Instead, to limit their possible exposure to any losses, they keep insisting on conditions that prevent rapid deployment. This approach also threatens to hinder the IMF’s new Resilience & Sustainability Trust and the World Bank Group’s emergency financing.

A far bolder collective approach is now required. The United States, China, Japan, the European Union, and the United Kingdom depend on global security and prosperity. They must work together to prevent famine, conflict, and a developing-country debt crisis that will tip the world into recession. They can prevent famine by acting in concert to calm global wheat and other grain markets and take measures to keep exports flowing. They can reduce the risk of conflict by not hobbling emergency IMF and World Bank assistance with conditionality. And they can build on the DSSI by creating a debt-restructuring mechanism in which they all participate.

Two core elements are crucial to managing today’s developing-country crisis. Powerful countries must refrain from beggar-thy-neighbour trade, fiscal, and monetary policies that wreak havoc on developing economies. And they must use their combined resources in the IMF and the World Bank to act quickly and unconditionally to avert disaster.

The challenges facing poorer countries are unprecedented. And that means the cooperative response from richer economies must be, too.

PUBLISHED ON

Apr 22,2022 [ VOL

23 , NO

1147]

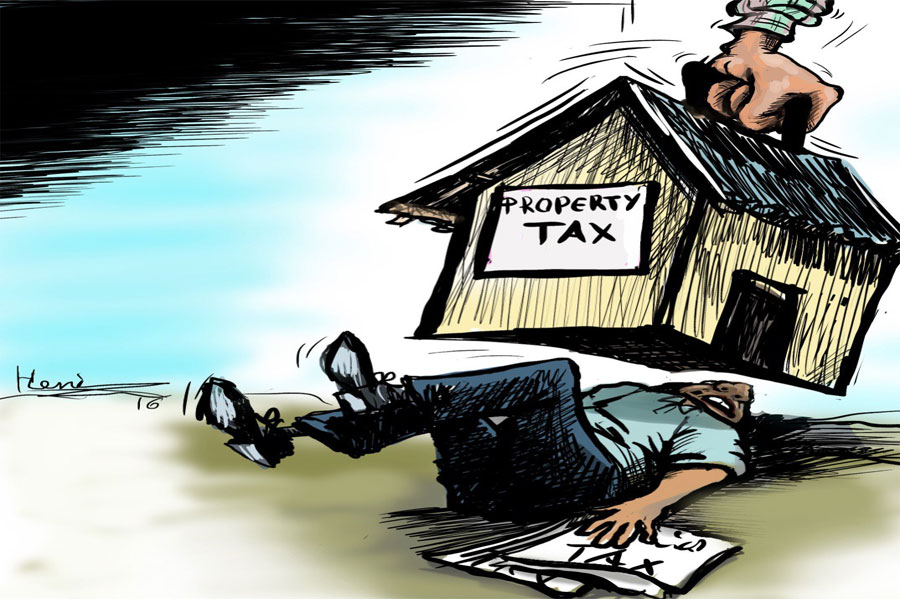

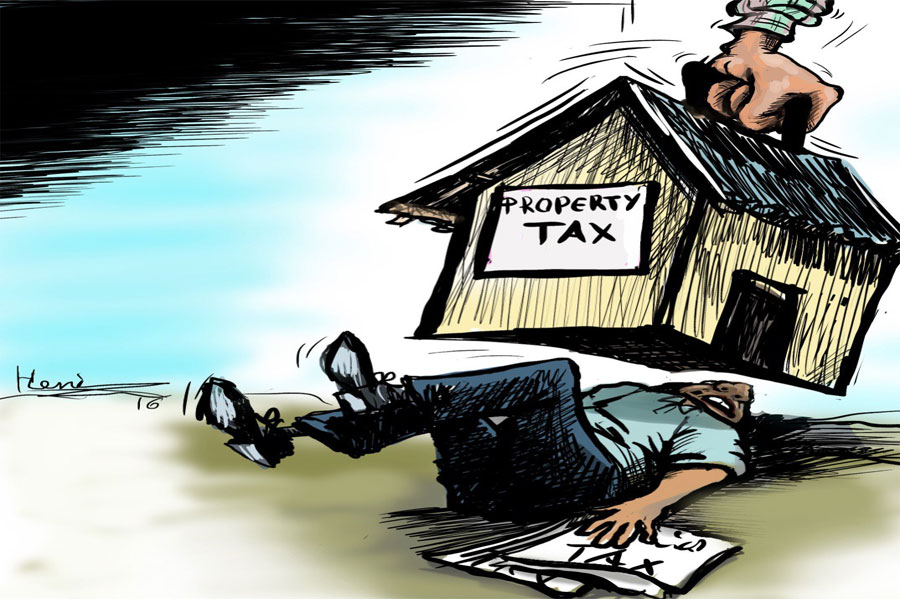

Editorial | Oct 14,2023

Viewpoints | Jun 12,2021

Commentaries | Sep 08,2024

Fortune News | Jan 03,2025

Commentaries | Apr 28,2024

Fortune News | Feb 22,2019

Covid-19 | Jun 11,2021

Commentaries | Apr 20,2024

Commentaries | Apr 10,2023

Viewpoints | Mar 23,2024

My Opinion | 131499 Views | Aug 14,2021

My Opinion | 127855 Views | Aug 21,2021

My Opinion | 125833 Views | Sep 10,2021

My Opinion | 123463 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...