Oct 19 , 2019.

One of the criticisms that was expressed about the administration of Prime Minister Abiy Ahmed (PhD) early on was the concern that there did not seem to be a well thought out comprehensive economic policy governing the management of the national economy. The recent announcement and introduction of the Homegrown Economic Reform Agenda that the government has put forward as the road map for the management of the economy for the next three years has gone some way to respond to these concerns.

Whether one agrees with the direction the government is going or not, at least it is good to know that it is not directionless. The reform agenda rightfully starts from an acknowledgement of the progress made in the last decade. But it also resolves to confront the macroeconomic imbalances the country finds itself in currently head-on. It proposes to do that by introducing macroeconomic, structural and sectoral reforms.

Tightening the fiscal belt, controlling public sector finances, shedding debts and increasing domestic resources mobilisation by focusing on financial discipline and sound economic management are some of the stated policy objectives. No less is the room created for the private sector to play its rightful role in the economy.

However, this needs the harmonisation and coordination of policies in the fiscal, monetary and exchange rate policies.

Now the concern is whether the policy objectives set to address different problems will result in conflicting policy outcomes. Whether the practical decisions being made daily are synchronised to complement each other.

Or do measures taken to put out a fire in one area start one in another?

One of the stated goals is to rein in public sector spending and belt-tightening. At the same time, job creation is also a priority with an ambitious desire to create two million jobs a year. Compare that with 1.8 million formal jobs the country has created in both the private and public sectors.

With high employment being one of the biggest headaches the economy is facing, ambitious planning is understandable. In a country where 70pc of the total population - well over 100 million - is under the age of 29, nothing should deprive policymakers of their sleep more.

But with an unemployment rate approaching the 20pc range and the private sector still not in a position to create a significant number of jobs, it is hard to see how the two policy prescriptions can work together seamlessly. Creating jobs naturally requires investment spending. It requires an expansive fiscal position to finance public investment in a Keynesian way.

Until the private sector gets to a position where it can generate jobs so much that the size for formal employment becomes a game changer, the government may have no choice but to step in.

Even when the country succeeds in creating a high number of jobs required to curb unemployment, it might disturb the economy by creating inflationary pressure. No doubt the newly employed will be spending close to 60pc of their income on food items.

Since there is no domestic agricultural production that can meet this demand, it will force the country to import basic commodities. It is a factor that will exacerbate the foreign exchange reserve.

The prevailing foreign exchange regime is not working. The parallel market is galloping unchecked with a well over 20pc market exchange rate premium. With the country still spending 1.4 billion dollars annually to import basic commodities, it is a problem that is not going away anytime soon.

It is not clear if any significant steps are taken to correct this, other than rationing the meagre foreign exchange reserves. This is where policymakers appear to be helpless and clueless and are instead shooting themselves in the foot.

There have indeed been some efforts by the administration of Prime Minister Abiy Ahmed (PhD) to improve the ease of doing business and loosen up bureaucratic and regulatory procedures. There have been some steps taken to reduce bottlenecks related to business registration and licensing. No doubt these will help and encourage the private sector.

However, considering the major obstacle it is facing - finance - it is hard to see bold moves effective enough to spur its activity to make the private sector become a job creation engine.

Access to finance has long been the Achilles' heel of the private sector in Ethiopia. If it is to become a more active player in the country’s development agenda in the future, this conundrum has to be addressed. With banks charging as high as 18pc interest, business loans are expensive. And with mostly short payback periods, they are not very attractive.

With a government focused on reining in spending, how the private sector’s access to finance will be addressed is not clear.

The other economic headache in Ethiopia is inflation. Fighting inflation is rightly a stated policy goal. However, with a still expanding money supply, it is not at all clear how that goal is going to be achieved. Although considering the inflation rate, the budget might not be exactly expansionary, it is hardly a belt-tightening one either.

None of these problems and challenges is new and shocking to policymakers. There are even proposed solutions and some activities to address them individually. The question is how or whether the prescriptions work together to bring in the desired economic development.

The ultimate success of policy objectives is not dependent on just having the seemingly right solutions for individual problems. It is rather in coming up with answers that not only address compartmentalised problems that put out fires in different silos. It is also in coming up with policy prescriptions that complement each other and can be applied in a synchronised manner.

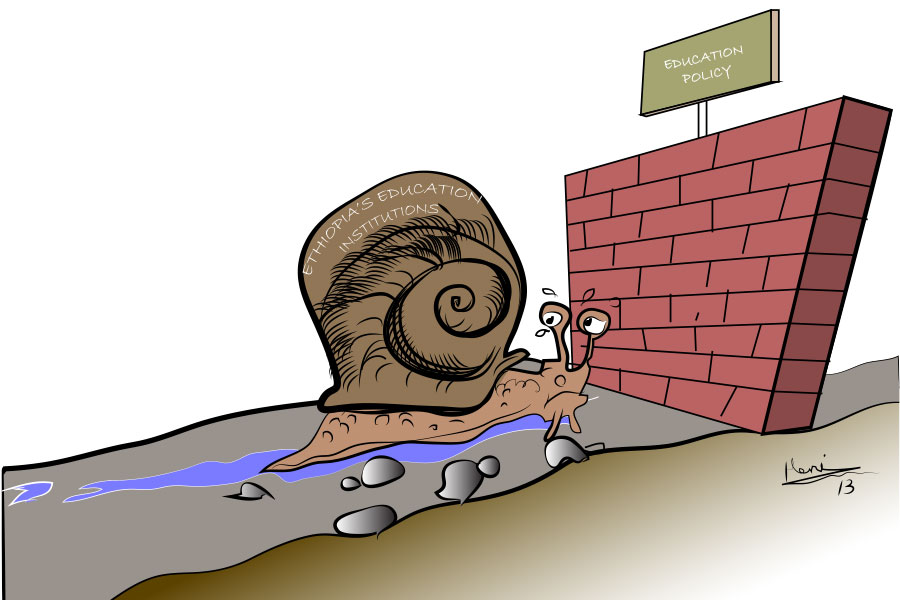

Considering the Ethiopian economic governance on this count, all that can be said is that the jury is still out. Ethiopia's fiscal, monetary and exchange rate policies are the reflections of the institutional leaders tasked to execute them. They do not go in tandem with a shared destination.

PUBLISHED ON

Oct 19,2019 [ VOL

20 , NO

1016]

Editorial | Oct 03,2020

Fortune News | Apr 19,2025

Radar | Aug 21,2023

My Opinion | Nov 16,2019

Life Matters | Nov 14,2020

My Opinion | 132804 Views | Aug 14,2021

My Opinion | 129269 Views | Aug 21,2021

My Opinion | 127128 Views | Sep 10,2021

My Opinion | 124701 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 27 , 2025

The Bank of Abyssinia has gone all-in on paperless banking, betting that biometric log-ins and touch-free kiosks will save it hundreds of mi...

Jul 27 , 2025 . By RUTH BERHANU

As Addis Abeba ushers in this year's rainy season, city officials have committed to planting 4.2 million...

Jul 27 , 2025 . By BEZAWIT HULUAGER

Ethio telecom's latest annual performance review painted a picture of rapid infrastructural expansion and...

Jul 27 , 2025 . By BEZAWIT HULUAGER

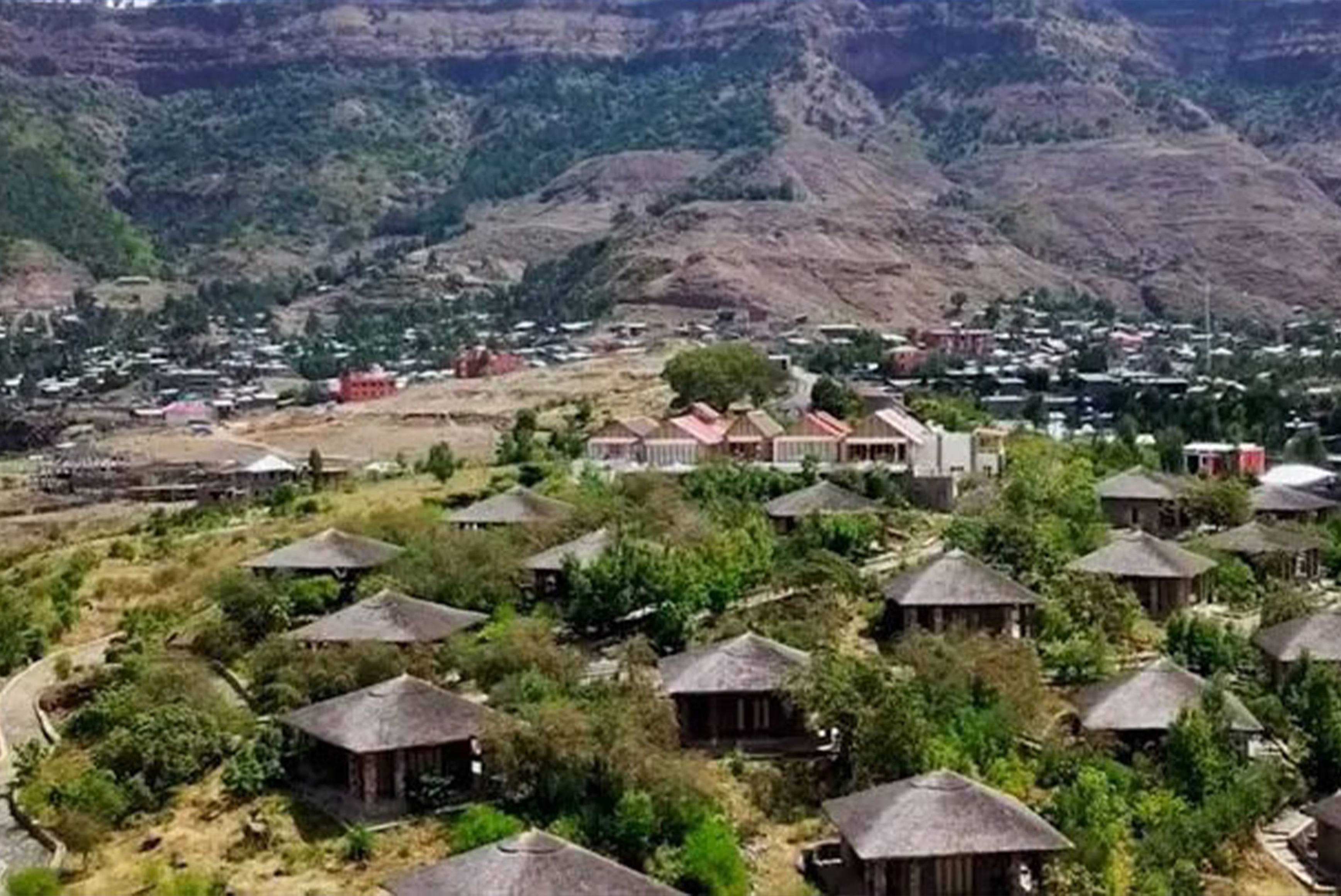

Once a crown jewel of the country's tourism circuit and a beacon for international pilgrims, Lalibela now...