Fortune News | Dec 25,2021

Jul 3 , 2025

Ethiopia’s push for economic reform won a cautious vote of confidence from the International Monetary Fund (IMF) yesterday, as the Fund approved a fresh 262.3 million dollars disbursement under its 48-month Extended Credit Facility, bringing total support to about 1.87 billion dollars.

In a statement from Washington, IMF staff praised Addis Abeba’s success in taming inflation, boosting gold exports and building foreign-exchange reserves. However, they warned that unless authorities take “decisive steps” on key structural reforms, recent gains could quickly unravel.

Since the Birr was floated last year, the spread between the official and parallel-market exchange rates has narrowed and dollar liquidity has improved. Still, the IMF’s Deputy Managing Director, Nigel Clarke, said that “removing the remaining FX restrictions and enhancing market transparency is essential to lock in competitiveness gains.” The Fund criticised lingering controls on current-account transactions and opaque pricing mechanisms, arguing that these restraints continue to choke supply.

On the revenue front, Ethiopia’s tax-to-GDP ratio remains among the lowest in sub-Saharan Africa. It climbed only marginally to an estimated 8.5pc in 2024/25. According to the IMF, phasing out fuel subsidies and overhauling income, excise and property taxes will be necessary if Addis Abeba hopes to narrow a projected fiscal deficit of 1.5pc of GDP this year without cutting social-welfare spending.

External debt has surged to nearly 30pc of GDP after the Birr’s sharp depreciation, prompting the authorities to seek debt relief under the G20 Common Framework. While an agreement in principle has been reached with official creditors, the IMF urged parallel negotiations with commercial lenders “to secure comparable terms," and cautioned against resorting to fresh non-concessional borrowing outside of the Koysha hydropower project.

Despite forecasts of roughly seven percent annual GDP growth through 2028/29, the IMF flagged several lingering risks, including regional security tensions, climate-related shocks and the possibility of waning donor support.

“Maintaining tight monetary and financial conditions, alongside prudent fiscal management, is vital to navigate these headwinds,” said the Fund.

Fortune News | Dec 25,2021

Radar | Jul 06,2025

Fortune News | Jun 21,2025

Fortune News | May 02,2020

Agenda | Mar 28,2020

Radar | Aug 27,2022

Editorial | Mar 27,2021

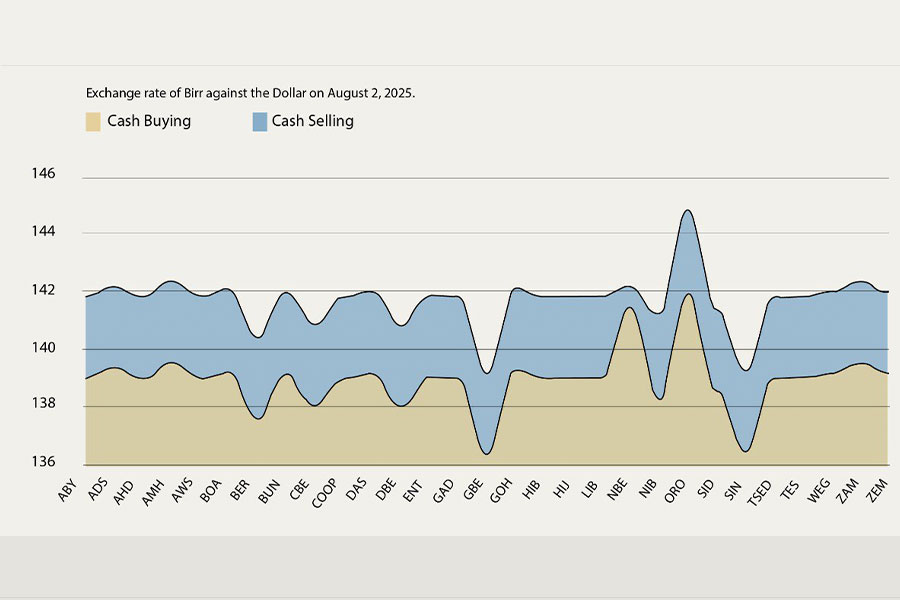

Money Market Watch | Aug 30,2025

Radar | Dec 08,2024

Photo Gallery | 172740 Views | May 06,2019

Photo Gallery | 162966 Views | Apr 26,2019

Photo Gallery | 152800 Views | Oct 06,2021

My Opinion | 136399 Views | Aug 14,2021

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...