Viewpoints | Apr 19,2025

Jan 11 , 2025

By Dani Rodrik

While tariffs may boost various sectors, their effects may not translate into substantial investments in new technologies or job creation. Profitable corporations might choose to distribute the increased earnings among their managers and shareholders rather than expand productive capacity. Dani Rodrik, a professor of International Political Economy at Harvard Kennedy School, argued in this commentary provided by Project Syndicate (PS), that the economic pains caused by such protectionist policies will predominantly impact countries, further reinforcing the need for a measured approach to tariff imposition.

The world economy awaits with dread the arrival of Donald Trump's trade tariffs. Trump clearly loves import duties and has promised to raise them for goods from China, Europe, Mexico, and even Canada. How much havoc this will wreak depends not just on the tariffs' scope and magnitude, but also on the purpose to which they are put.

Economists dislike tariffs for a variety of reasons. Like all barriers to market exchanges, they create inefficiency. They prevent selling something of value more than they have, leaving buyers and sellers worse off in principle. Economic theory does recognise that this inefficiency can be offset by gains elsewhere. For example, tariffs can do some good in the presence of infant industries, knowledge spillovers, monopoly power, or national security concerns.

Even then, economists will argue that tariffs are a very blunt instrument. After all, an import tariff is a specific combination of two different policies: a tax on the consumption of the imported good and a production subsidy for its domestic supply, at equal rates. Any economic or non-economic objective can be met more effectively by deploying these policies separately and at customised rates, targeting them at desired outcomes more directly. To economists, tariffs are a pistol aimed at one's own foot.

Trump's view could not be more different. In his imagination, tariffs are like a Swiss Army knife, a tool that can simultaneously fix America's trade deficit, enhance its competitiveness, foster domestic investment and innovation, shore up the middle class, and create jobs at home.

This view is almost certainly fanciful. Tariffs will have highly uneven effects on US manufacturing, benefiting some while hurting those that depend on imported inputs or foreign markets. Even where they boost profits, there is no guarantee this will lead to more investment in new technologies or job creation. Corporations that get richer can choose to distribute the proceeds to their managers and shareholders instead of increasing productive capacity.

If Trump insists on his view, the good news, for the rest of the world at least, is that the economic costs will be borne mainly by Americans. That is another key insight from economics: just as the benefits of opening up to international trade accrue mostly at home, so do the costs inflicted by protectionism. Hence it would be a tragic mistake for other countries to overreact and retaliate with their own tariffs. There is no reason for them to replicate Trump's error and raise the risk of an escalating trade war.

Trump could, of course, adopt a more limited approach. He has often made a narrower case for tariffs, as a weapon to extract concessions from trade partners. Importantly, this implicit rejection of across-the-board tariffs also seems to reflect the view of his nominee for Treasury Secretary, Scott Bessent. Before the election, for example, Trump threatened Mexico and Canada with 25pc tariffs if they failed to "secure their borders." In principle, such threats do not need to be carried out if other countries comply with Trump's demands.

But, it is unclear whether using such threats to change others' behaviour will be effective.

China, India, and other large countries are unlikely to be swayed by them, given the risks of appearing weak. In any case, tariffs are a poor threat regardless of whether one views them as a faulty pistol or a Swiss Army knife. In the conventional view, because tariffs are harmful to the domestic economy, they lack credibility as punishment for others. On the alternative Trumpian view, tariffs are inherently desirable, which means they are likely to be used regardless of what trade partners do.

A fourth, more realistic conception of tariffs has been effective in some key instances. Advocates of this perspective view tariffs as a shield behind which other, mainly domestic policies, can work more effectively. Traditionally, trade laws have allowed countries to use tariffs to protect vulnerable sectors or regions under specific conditions, effectively supplementing domestic social policy.

An even more significant example is infant-industry protection, which has worked best when it exists alongside other instruments to incentivise domestic firms to innovate and upgrade. Some notable cases include the late-19th-century United States, post-1960s South Korea and Taiwan, and post-1990s China. In each of these cases, industrial policies went far beyond trade protection, and it is unlikely that tariff barriers on their own would have produced the gains each of these economies experienced.

Similarly, green policies often require some trade barriers to make them economically and politically viable, as in the case of the European Union's (EU) carbon tariffs and the local-content requirements of the US Inflation Reduction Act. In all these cases, tariffs play a supporting role for other policies that serve a broader purpose, and can be a small price to pay for the larger benefit.

Unfortunately, Trump has not offered a domestic agenda of renewal and economic reconstruction in any of these areas, and his tariffs will likely stand – and fail – on their own. When tariffs are moderate and are used to complement a domestic investment agenda, they need not cause much harm; they can even be useful. When they are indiscriminate and are not supported by purposeful policies at home, they do considerable damage, and more so at home than for trade partners.

PUBLISHED ON

Jan 11,2025 [ VOL

25 , NO

1289]

Viewpoints | Apr 19,2025

Viewpoints | Apr 19,2025

Photo Gallery | 154370 Views | May 06,2019

Photo Gallery | 144619 Views | Apr 26,2019

My Opinion | 134979 Views | Aug 14,2021

Photo Gallery | 132949 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 13 , 2025 . By AMANUEL BEKELE

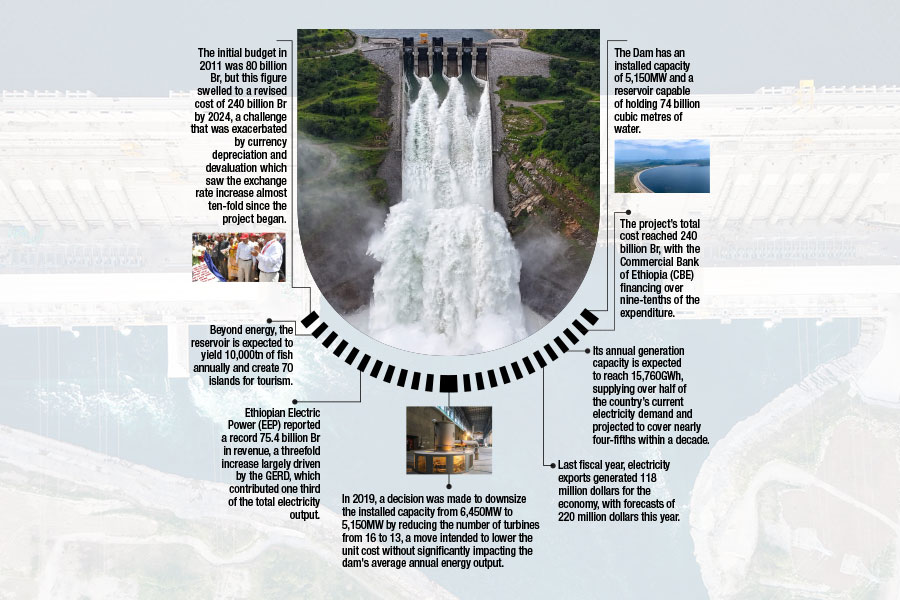

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025 . By BEZAWIT HULUAGER

Banks are facing growing pressure to make sustainability central to their operations...

Sep 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious se...

Sep 13 , 2025 . By BEZAWIT HULUAGER

Washington Health Care (WHC), a private healthcare provider founded by U.S.-trained p...