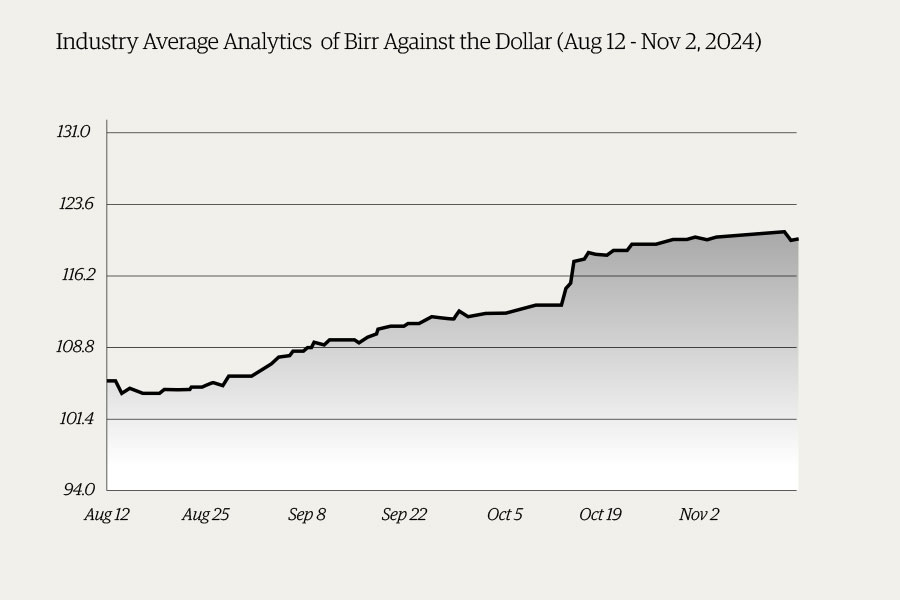

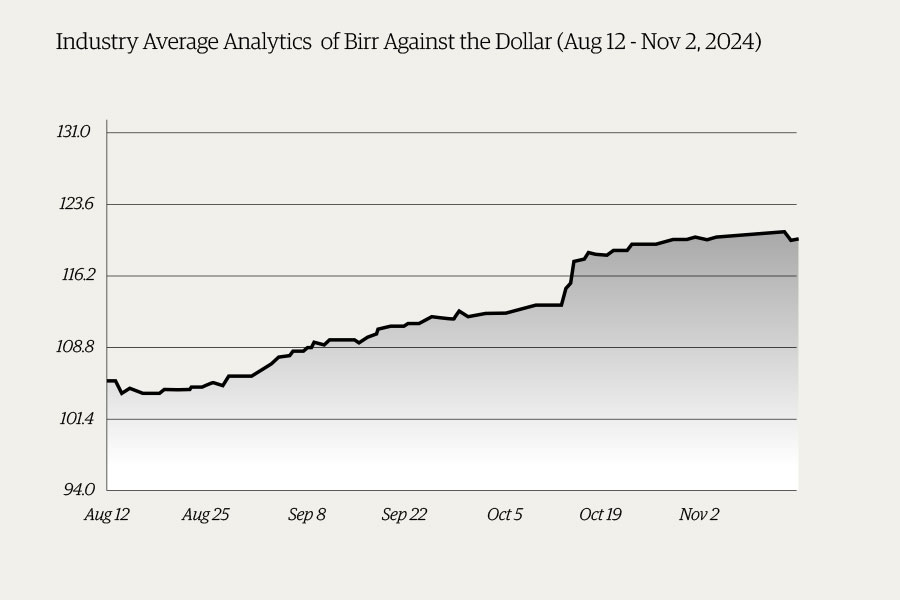

Money Market Watch | Nov 16,2024

Apr 27 , 2024.

The Prosperity Party (PP) - Prosperitians - is charting a course through treacherous waters. The party, which emerged from a fragmented political order, touts a liberal economic agenda in contrast to its conservative social policies and a seemingly disoriented political posture. Despite an ideological vacuum, it has initiated substantial reforms, most notably in its economic strategy, by phasing out subsidies on essential commodities such as electricity, fuel, and college fees.

These policies are designed to target a balanced and healthy macroeconomic environment through a moderate budget deficit, aiming at long-term benefits.

However, these measures come at a delicate time, fraught with social, economic, and political volatility.

Economic policies that include austerity measures, such as cutting subsidies, tax increases, or tightening the budget, are often deemed necessary for long-term financial health. However, they demand short-term sacrifices that many citizens, especially in economically vulnerable sectors, are either unwilling or unable to make. Prosperitians believe they have a mandate to rule, having secured electoral victory in the national elections of 2021.

Nevertheless, the legitimacy of this mandate is widely contested. International observers, including the United States and the European Union, criticised the electoral process as unfair and its outcome as not credible. The failure to hold votes in tens of constituencies, including the entire Tigray Regional State, has left gaps in the federal parliament.

This political backdrop casts a shadow over Prosperitians' economic policy decisions, whether devaluing the Birr as the ongoing negotiations with the International Monetary Fund (IMF) require or removing long-held subsidies targeting low-income groups. An incumbent party with a tenuous hold on legitimacy faces profound challenges and resistance when implementing policies that are unpopular yet deemed economically necessary.

The timing of such policies could hardly be worse in a society deeply polarised, where the political elite's grasp on power is vigorously contested, including through violent rebellions. By the very admission of the statement issued last week by the National Security Council, several of the regional states remain battlegrounds for vertical and horizontal violent conflicts. The country is not out of the woods, not even in Tigray, where the federal government signed an accord with the TPLF in Pretoria, South Africa, to ensure a durable hold on hostilities.

Economic liberalisation measures, including the phasing out fuel subsidies, which have been implemented gradually over the past few years, illustrate the Prosperitians' policy approach. Despite efforts by Governor Mamo Mehiretu to reorient the central bank to target inflation and price stability, the impacts on inflation have been moderate. But his move suggests that a measured approach can mitigate some of the immediate economic shocks. Monthly inflation dropped by two percentage points in March to 26pc, from an average of 33pc in the same period last year.

Yet, the broader economic context remains dire. The increase in spending has stretched the national budget. The country faces a towering budget deficit of about 284 billion Br, compelling Prime Minister Abiy Ahmed's (PhD) administration to make tough decisions on public spending.

The federal government expenditures surged, driven by significant investments in social and economic services, alongside substantial regional transfers, leading to a pronounced budget deficit, inching to four percent of the GDP. The period saw social services, which include health and education, receiving a hefty 19.5 billion Br for the fourth quarter of last year, marking a notable increase from the previous fiscal year. Economic services, encompassing agricultural support, received two billion Birr, while regional transfers, intended to bolster local governments in their service delivery, stood at an impressive 64.9 billion Br. These figures reflect a government strategy deeply invested in subsidising sectors vital for growth.

The year-on-year total government spending shows a 13.1pc surge, showing growing budgetary pressures, possibly exacerbated by the rising costs of subsidised services, if not ballooning military spending. Despite a 19pc increase in revenue over the same period, it was insufficient to keep pace with the expenditure, further deepening the fiscal imbalance. The persistent deficit and heavy reliance on borrowing to finance it should pose serious questions about long-term fiscal sustainability.

With considerable funds flowing into subsidised sectors, particularly commodities such as fuel, fertiliser, and seeds, the efficiency and targeting of these subsidies demand a careful reassessment. No less is the IMF pushing for fiscal consolidation as one of the stringent conditions before agreeing to a three-billion dollar bailout to ensure a more sustainable fiscal pathway.

James Vreeland (PhD) of Princeton University, a scholar in international political economy, points out that governments often use international financial institutions like the IMF as scapegoats to deflect domestic discontent over harsh economic policies. Known for insisting on strict fiscal controls, the IMF has, in recent years, faced criticism for advocating austerity measures during periods of political and economic instability. Recognising the potential for such policies to exacerbate rather than lessen crises, the IMF has sometimes urged countries to slow the pace of austerity measures, such as subsidising essential goods.

Subsidies are commonly viewed as market distortions but provide substantial relief and economic stability to tens of millions. Countries globally, including market giants like the United States and China, inject substantial funds into their economies through subsidies ranging from fossil fuels to electric vehicle production. The debate over subsidies often centres on their long-term economic distortions against short-term social benefits.

In Ethiopia's case, the gradual removal of these financial supports occurs against a backdrop of widespread political, economic and social crises, including an acute foreign currency shortage sufficient for only three weeks of imports, 4.6 million internally displaced citizens, and 21 million people in need of emergency humanitarian aid.

Prosperitians' economic strategy is fraught with risk. Implementing unpopular policies under a contested mandate could ignite political instability and protests, potentially undermining their already shaky legitimacy. Public trust may erode further with each new economic policy measure, particularly as adversarial groups could seize the opportunity to fuel public discontent and challenge their authority more vigorously. The international implications are no less considerable; failed economic policies could lead to reduced financial aid and cooler diplomatic engagements, further isolating the country on the global stage.

As subsidies on electricity are set to be slashed again next year and budgetary support for universities has already been cut, the socioeconomic impacts are likely to be severe. While Prosperitians contend with these manifold troubles, the economic environment continues to be dominated by state-owned enterprises in key sectors such as finance, telecommunications, services, and logistics. The removal of subsidies, therefore, does little to promote market dynamics that could be characterised as

competitive or undistorted. The savings they crave from slashing subsidies might shift the burden to the already strained population segment in the fixed-income category.

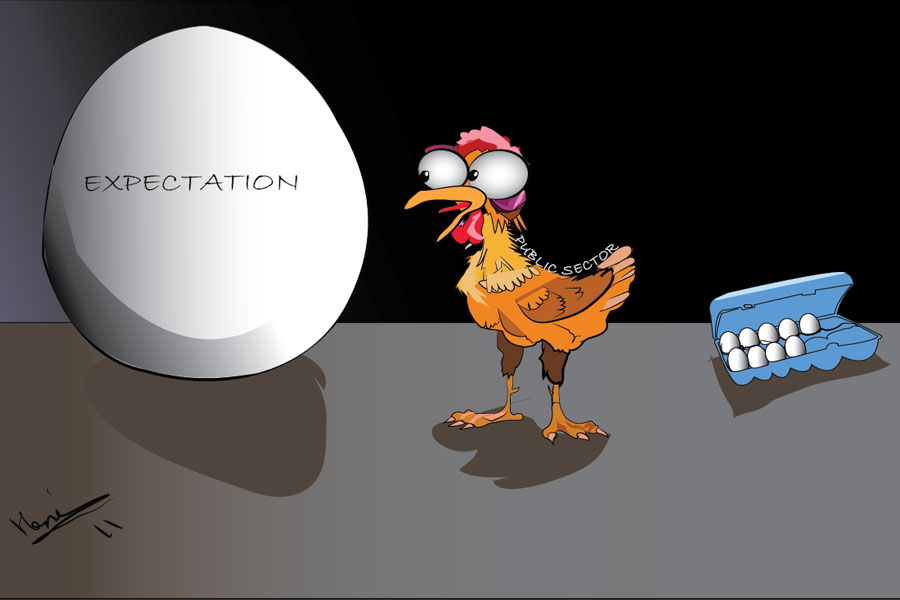

Vreeland suggests that a deep understanding of political dynamics and public sentiment is the path forward. Effective communication about the necessity, expected outcomes, and duration of economic policies could help manage public expectations and mitigate backlash. However, seeking broader consensus through negotiated political settlements could diffuse tensions and promote a more inclusive political system. Sadly, the two-track policy Prosperitians manoeuvre - and the diplomatic community in Addis Abeba conveniently dance with - have little leverage to help bring such consensus. Whether national dialogue or transitional justice, these are platforms with hardly any credibility in the eyes of the adversaries to help bring negotiated settlements through grand bargains.

Ultimately, the intersection of contested political mandates and the implementation of unpopular economic policies presents troubled waters for any ruling party. The stakes are invariably high, with political stability and the economic future hanging in the balance. Foresight and delicate touch will be essential as Prosperitians steer through the storm, balancing the imperative of economic reform with the political and social realities of the population they govern. Gradually phasing in policies could also allow the public time to adjust, potentially softening the immediate shock and reducing backlash.

PUBLISHED ON

Apr 27,2024 [ VOL

25 , NO

1252]

Money Market Watch | Nov 16,2024

Agenda | Feb 17,2024

Editorial | Dec 19,2018

Fortune News | Sep 06,2020

Viewpoints | Feb 03,2024

Agenda | Jan 18,2020

Fortune News | Aug 18,2024

Fortune News | Apr 03,2023

Viewpoints | Feb 03,2024

Fortune News | Jul 13,2024

Photo Gallery | 156491 Views | May 06,2019

Photo Gallery | 146778 Views | Apr 26,2019

Photo Gallery | 135309 Views | Oct 06,2021

My Opinion | 135246 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

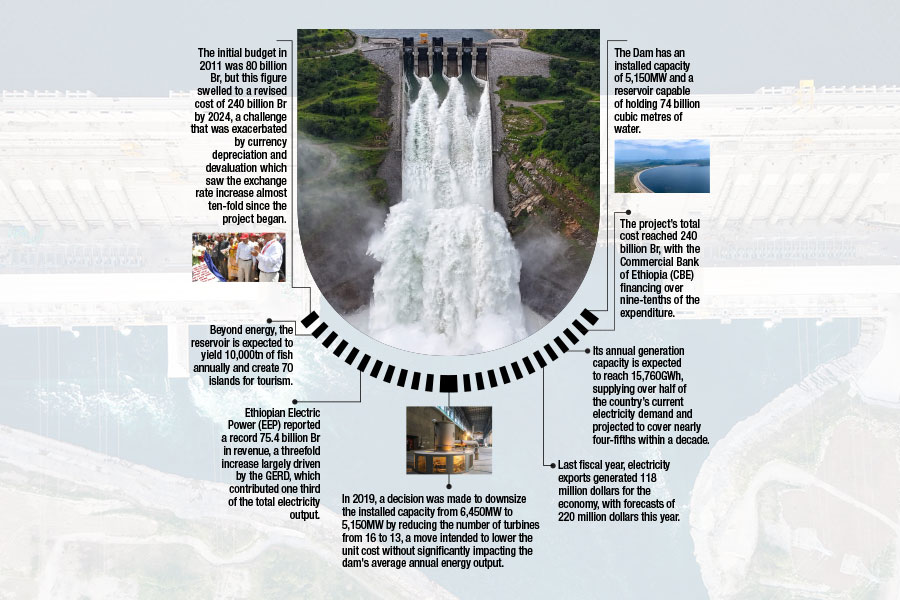

Sep 15 , 2025 . By AMANUEL BEKELE

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...